AUGS 2025 Review: Everything You Need to Know

Executive Summary

AUGS Markets is a regulated forex broker. It has gained significant attention in the trading community and earned an impressive user rating of 5 out of 5 stars. This augs review shows a broker that has been operating since 2011. The company offers traders access to multiple financial markets with competitive conditions. It holds an Australian Financial Services License, which demonstrates its commitment to regulatory compliance and trader protection.

Two key features make AUGS Markets different from its competitors. The broker provides leverage up to 500:1 and requires a minimum deposit of just $200. These conditions make the platform attractive to traders who want high leverage opportunities. They don't need substantial initial capital requirements. The broker offers currencies, indices, precious metals, and commodities. This variety caters to different trading strategies and preferences.

AUGS Markets targets traders who want to use high leverage ratios. The broker also maintains relatively low startup costs. The combination of regulatory oversight, competitive trading conditions, and comprehensive asset coverage makes this broker a viable option. Both novice and experienced traders can find a reliable trading environment here.

Important Notice

Potential traders should know that AUGS Markets operates across different jurisdictions. The broker may face varying regulatory requirements depending on the region. Investors must carefully consider the legal and regulatory framework in their specific location before using the broker's services. Regulatory compliance requirements may differ significantly between countries. This affects the available services and trading conditions.

This evaluation uses publicly available information and user feedback from various sources. The assessment aims to provide an objective analysis of AUGS Markets' offerings. However, traders should conduct their own research before making investment decisions. Market conditions and broker policies may change. This review reflects the current available information as of 2025.

Rating Framework

Broker Overview

AUGS Markets Pty Ltd emerged in the forex trading landscape in 2011. The company established itself as an international professional broker headquartered in Australia. It has dedicated over a decade to enhancing customer trading experiences while expanding its global reach. Through continuous improvements in financial services standards and professional qualifications, AUGS has evolved into a multinational financial trading company. The broker maintains financial licenses across several countries. Its commitment to legal compliance demonstrates its dedication to providing services that follow international regulatory standards.

The company's business model centers on providing customizable solutions across diverse financial markets. This augs review indicates that the broker offers access to currencies, indices, precious metals, commodities, and additional trading products. AUGS Markets operates under the principle of delivering comprehensive financial services. The broker maintains strict adherence to regulatory requirements in each jurisdiction where it operates. Its focus on professional qualification enhancement and service standard improvement reflects its long-term commitment to trader satisfaction and market credibility.

Regulatory Jurisdiction: AUGS Markets operates under the supervision of Australian financial regulators. The broker holds an Australian Financial Services License that ensures compliance with local financial services legislation and provides trader protection measures.

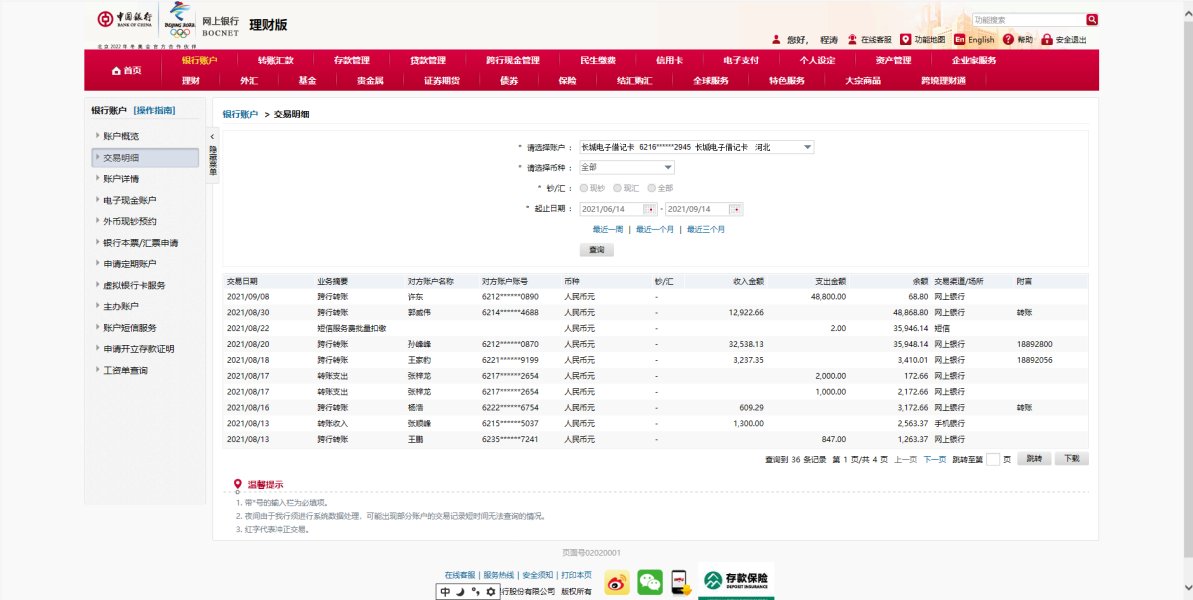

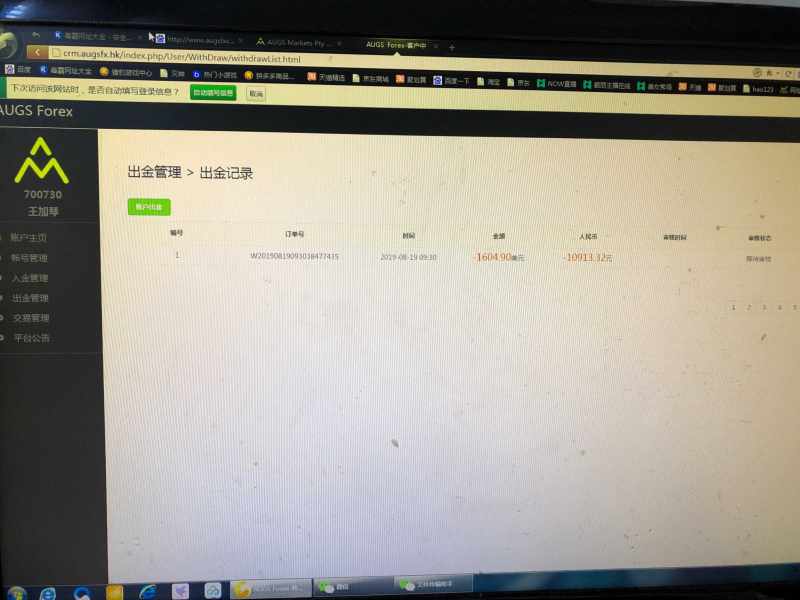

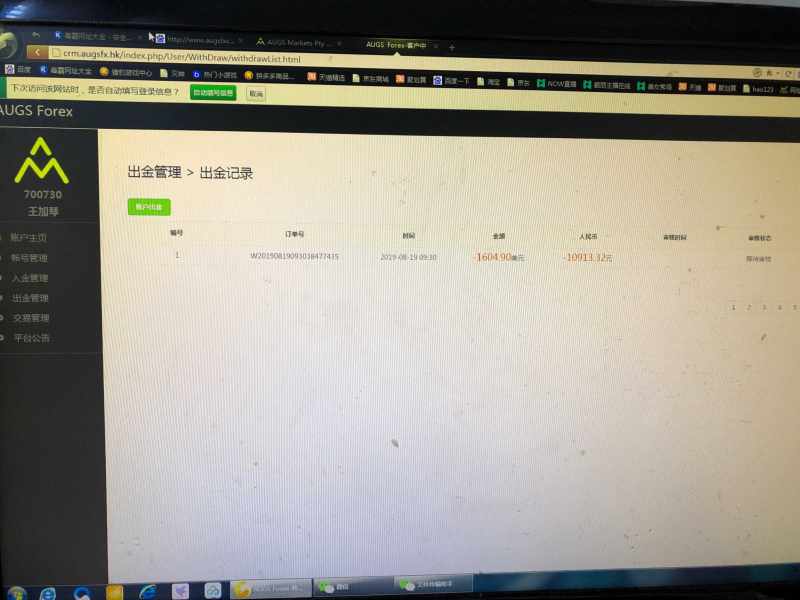

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources. Potential clients need to contact the broker directly for comprehensive payment processing information.

Minimum Deposit Requirement: The broker maintains an accessible entry point with a minimum deposit requirement of $200. This makes it suitable for traders with varying capital levels and investment capacities.

Bonus and Promotions: Current promotional offerings and bonus structures were not specified in available materials. Potential clients should inquire directly about any available incentive programs.

Tradeable Assets: AUGS Markets provides access to multiple asset classes including foreign exchange currencies, stock indices, precious metals such as gold and silver, and various commodity markets. This offers diverse trading opportunities.

Cost Structure: Detailed information about commission structures and spread configurations was not provided in available sources. This indicates the need for direct broker consultation to understand complete pricing models.

Leverage Ratios: The broker offers competitive leverage ratios reaching up to 500:1. This provides traders with significant market exposure potential relative to their account capital.

Platform Options: This augs review finds that specific trading platform information was not detailed in current sources. Further investigation is required for comprehensive platform analysis.

Regional Restrictions: Geographic limitations and regional availability restrictions were not specified in available materials.

Customer Service Languages: Supported customer service languages were not detailed in current sources.

Detailed Rating Analysis

Account Conditions Analysis

AUGS Markets demonstrates strong performance in account conditions. The broker earns a solid 8 out of 10 rating. Its $200 minimum deposit requirement positions it favorably for traders seeking accessible entry points into forex markets. This relatively low threshold removes barriers for novice traders while remaining reasonable for experienced investors. They can test the platform's capabilities without major risk.

The standout feature in account conditions is the availability of leverage up to 500:1. This provides substantial trading power for position sizing and market exposure. However, available sources do not specify different account types or their respective features. This limits our ability to assess the full spectrum of account offerings. The absence of detailed information about account tiers, special features, or Islamic account availability represents a gap in publicly available information.

This augs review notes that while the basic account parameters appear competitive, the lack of comprehensive account structure details prevents a higher rating. Traders seeking specific account features should contact the broker directly. They need to understand the complete range of available options and their respective terms and conditions.

The tools and resources category receives a 7 out of 10 rating. This is based on the broker's multi-asset platform approach. AUGS Markets offers access to various trading products including currencies, indices, precious metals, and commodities. This provides traders with diversification opportunities across multiple market sectors. The range of available instruments supports different trading strategies and risk management approaches.

However, specific details about trading tools, technical analysis resources, research capabilities, and educational materials were not comprehensively covered in available sources. The absence of information about automated trading support, advanced charting tools, or market analysis resources limits our ability to provide a complete assessment. We cannot fully evaluate the broker's tool ecosystem.

The platform's emphasis on customizable solutions suggests flexibility in trading approaches. However, specific implementation details remain unclear. Educational resources, webinars, market commentary, and research reports are essential components for trader development. Their availability and quality could not be verified through current sources.

Customer Service and Support Analysis

Customer service evaluation cannot be completed due to insufficient information in available sources. Critical aspects such as customer service channels, response times, service quality metrics, and multilingual support capabilities were not detailed in current materials. The availability of 24/7 support, live chat options, telephone support, and email responsiveness remains unclear.

Professional customer service is crucial for forex brokers. This is particularly true during volatile market conditions or technical difficulties. Without specific information about support infrastructure, response protocols, or service level agreements, potential clients cannot adequately assess this important aspect. They cannot evaluate the broker's offering properly.

The absence of user feedback regarding customer service experiences in available sources further complicates the evaluation process. Traders considering AUGS Markets should directly test customer service responsiveness and quality. They should do this before committing significant capital.

Trading Experience Analysis

This augs review cannot provide a comprehensive trading experience assessment. This is due to limited platform-specific information in available sources. Critical elements such as platform stability, execution speed, order processing quality, and mobile trading capabilities were not detailed in current materials.

Trading experience includes platform functionality, user interface design, execution quality, and overall system reliability. Without specific performance metrics, user interface screenshots, or execution quality data, it is impossible to evaluate platform performance. We cannot assess how it performs during normal and high-volatility market conditions.

Mobile trading capabilities, advanced order types, one-click trading features, and platform customization options are increasingly important for modern traders. The absence of detailed platform information represents a significant gap. Available assessment materials lack this crucial information.

Trust Factor Analysis

AUGS Markets achieves a strong 9 out of 10 rating in trust factors. This is primarily based on its regulatory status. The broker holds an Australian Financial Services License, which requires compliance with stringent financial services regulations. It also provides important trader protections. Australian financial regulation is generally well-regarded internationally, which contributes to the broker's credibility.

The company's establishment in 2011 demonstrates operational longevity. This suggests stability and market acceptance over more than a decade. However, specific information about fund safety measures, segregated account policies, insurance coverage, or third-party auditing was not detailed in available sources.

Regulatory compliance represents the foundation of broker trustworthiness. AUGS Markets' licensed status provides essential credibility. The absence of reported negative incidents or regulatory actions in available sources further supports the positive trust assessment. However, comprehensive due diligence should include verification of current regulatory standing.

User Experience Analysis

User experience evaluation is limited by insufficient detailed information in available sources. While AUGS Markets reportedly receives a 5 out of 5-star user rating, specific aspects of user satisfaction, interface design quality, registration processes, and account management experiences were not comprehensively detailed.

The high user rating suggests positive overall satisfaction among traders who have used the platform. However, without detailed user feedback, interface screenshots, or specific user journey analysis, it is difficult to identify particular strengths. We also cannot identify areas for improvement in the user experience.

Account opening procedures, verification processes, fund management interfaces, and overall platform navigation remain unclear based on available information. The broker's target audience includes traders seeking high leverage with low minimum deposits. This suggests a focus on accessibility, though implementation details require further investigation.

Conclusion

AUGS Markets presents itself as a regulated forex broker with notable strengths in regulatory compliance and competitive trading conditions. The combination of Australian Financial Services License oversight, 500:1 leverage availability, and accessible $200 minimum deposit creates an attractive proposition. This appeals to traders seeking high leverage opportunities with regulatory protection.

The broker appears well-suited for traders who prioritize regulatory oversight while seeking significant leverage ratios and reasonable entry requirements. The multi-asset platform approach accommodates diverse trading strategies across currencies, indices, precious metals, and commodities.

However, this evaluation reveals significant information gaps in areas such as customer service quality, platform specifications, and detailed user experiences. While the available information suggests a legitimate and well-regulated broker, potential clients should conduct thorough research. They should also consult directly with the broker to address these information gaps before making investment decisions.