Regarding the legitimacy of AUGS forex brokers, it provides VFSC, ASIC and WikiBit, (also has a graphic survey regarding security).

Is AUGS safe?

Business

License

Is AUGS markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

AUGS Markets Limited

Effective Date:

2020-06-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

AUGS MARKETS PTY LTD

Effective Date:

2011-08-09Email Address of Licensed Institution:

shii@innoinvest.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit 1101, 309 Pitt Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

0292470022Licensed Institution Certified Documents:

Is AUGS Safe or Scam?

Introduction

AUGS, or AUGS Markets, is a forex broker that has positioned itself within the global trading market, offering a range of financial instruments including forex, commodities, and indices. Traders often seek brokers like AUGS for their trading needs, but it is crucial for them to conduct thorough evaluations before committing funds. The forex market is rife with both legitimate brokers and scams, making it imperative for traders to assess the safety and reliability of their chosen broker. In this article, we will investigate whether AUGS is safe or potentially a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a significant indicator of its legitimacy. AUGS claims to be regulated by multiple authorities, but the reality is more complex. Below is a summary of AUGS's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan Financial Services Authority (LFSA) | MB/21/0060 | Labuan, Malaysia | Licensed |

| Vanuatu Financial Services Commission (VFSC) | 700371 | Vanuatu | Revoked |

| Australian Securities and Investments Commission (ASIC) | 374686 | Australia | Suspicious Clone |

AUGS is licensed by the Labuan Financial Services Authority (LFSA), which is a relatively less stringent regulatory body compared to others like ASIC or FCA. The VFSC license has been revoked, raising concerns about the broker's operational legitimacy. Additionally, the ASIC license is flagged as a suspicious clone, indicating that there may be other entities misusing this regulatory claim. This raises red flags regarding the overall quality of regulation and compliance history, suggesting that AUGS may not be as secure as it claims.

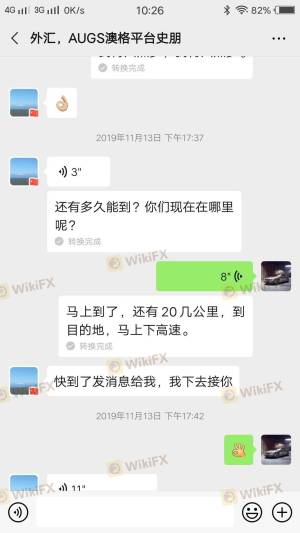

Company Background Investigation

AUGS Markets was founded in 2011, with its headquarters reportedly located in Sydney, Australia. However, the lack of transparency regarding its ownership structure and management team raises questions about its credibility. The company does not provide detailed information about its founders or key personnel, which is a common practice among legitimate brokers. This lack of transparency can be a significant warning sign.

Moreover, the company's operational history reveals a pattern of regulatory issues, particularly with its licenses in Vanuatu and Australia. The absence of detailed information about the management team and their professional backgrounds further complicates the assessment of AUGS. A trustworthy broker typically provides clear details about its leadership and operational strategies, which AUGS fails to do.

Trading Conditions Analysis

AUGS offers a variety of trading conditions, but traders should be cautious about the overall fee structure and any unusual policies that may arise. The broker claims to provide competitive spreads and leverage options, but the actual costs can vary significantly.

| Fee Type | AUGS Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-1.3 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 3-5% | 1-3% |

While AUGS markets itself as a competitive option, its spreads are higher than the industry average, which could impact profitability for traders. Additionally, the absence of a clear commission model can lead to confusion regarding hidden fees. Traders should be aware of these potential pitfalls and conduct due diligence before trading with AUGS.

Client Fund Security

The security of client funds is a critical aspect of evaluating whether AUGS is safe. The broker claims to maintain segregated accounts for client funds, which is a standard practice meant to protect traders' investments. However, the effectiveness of these measures is questionable given the broker's regulatory history.

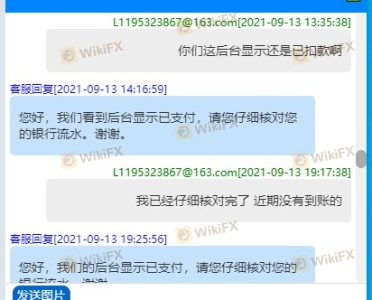

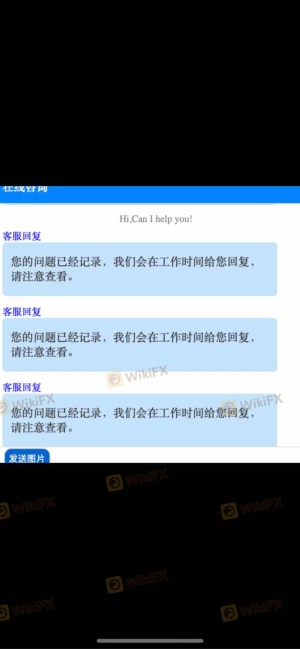

AUGS does not provide information regarding investor protection schemes, which are essential for safeguarding client funds in the event of insolvency. Moreover, the lack of a clear negative balance protection policy raises concerns about the potential for clients to lose more than their initial deposits. Historical incidents involving fund security issues, including withdrawal delays and unresponsive customer service, further exacerbate these concerns.

Customer Experience and Complaints

AUGS has garnered mixed reviews from clients, with many expressing dissatisfaction regarding their experiences. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

For instance, several traders have reported being unable to access their funds after making withdrawal requests, with customer service failing to provide adequate support. Such patterns of complaints are alarming and indicate that AUGS may not be a reliable trading partner.

Platform and Trade Execution

AUGS utilizes the popular MetaTrader 4 (MT4) platform for trading, which is known for its user-friendly interface and robust features. However, the performance of the platform has been called into question, with reports of instability and execution issues.

Traders have reported experiencing slippage and rejected orders, which can significantly affect trading outcomes. The absence of clear policies regarding order execution and slippage further complicates the trustworthiness of the trading platform. If traders encounter manipulation or technical issues, it could lead to substantial financial losses.

Risk Assessment

Using AUGS as a forex broker entails various risks that potential traders should consider. Below is a summary of key risk categories associated with trading through AUGS:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Uncertain regulatory status |

| Fund Security Risk | High | Lack of investor protection mechanisms |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

| Platform Stability Risk | High | Reports of execution issues |

To mitigate these risks, traders should approach AUGS with caution, consider starting with a minimal investment, and continuously monitor their trading activities.

Conclusion and Recommendations

In conclusion, the investigation into AUGS Markets raises several concerns regarding its safety and legitimacy. The combination of questionable regulatory status, lack of transparency, high trading costs, and negative customer experiences suggests that traders should exercise caution when considering this broker. While there are no definitive signs of fraud, the potential red flags warrant serious consideration.

For traders seeking reliable alternatives, it is advisable to explore brokers that are well-regulated by reputable authorities like the FCA or ASIC, have transparent operations, and demonstrate a solid track record of customer service. Notable alternatives may include brokers like IG, OANDA, or Saxo Bank, which have established reputations for safety and reliability in the forex market.

Ultimately, traders must be diligent in their research and select brokers that prioritize their security and provide a trustworthy trading environment.

Is AUGS a scam, or is it legit?

The latest exposure and evaluation content of AUGS brokers.

AUGS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AUGS latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.