ARES FOREX Review 2

This so-called broker said I could earn a lot. But this is a complete scam.

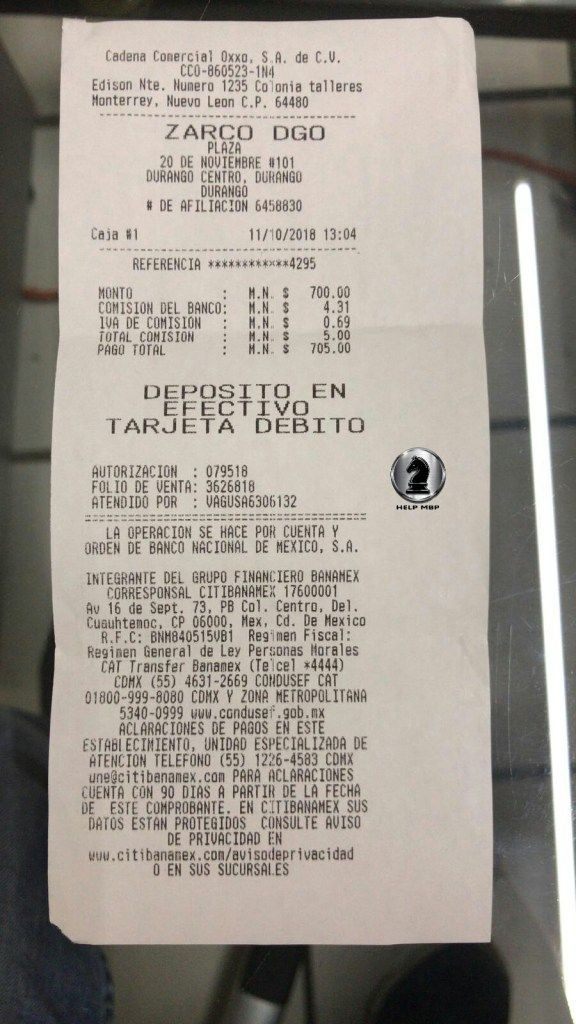

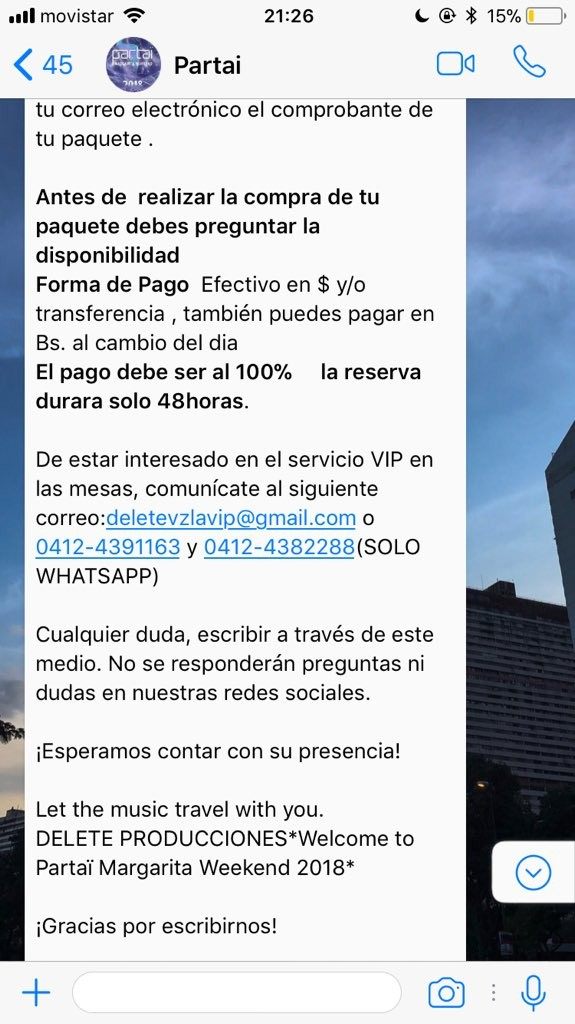

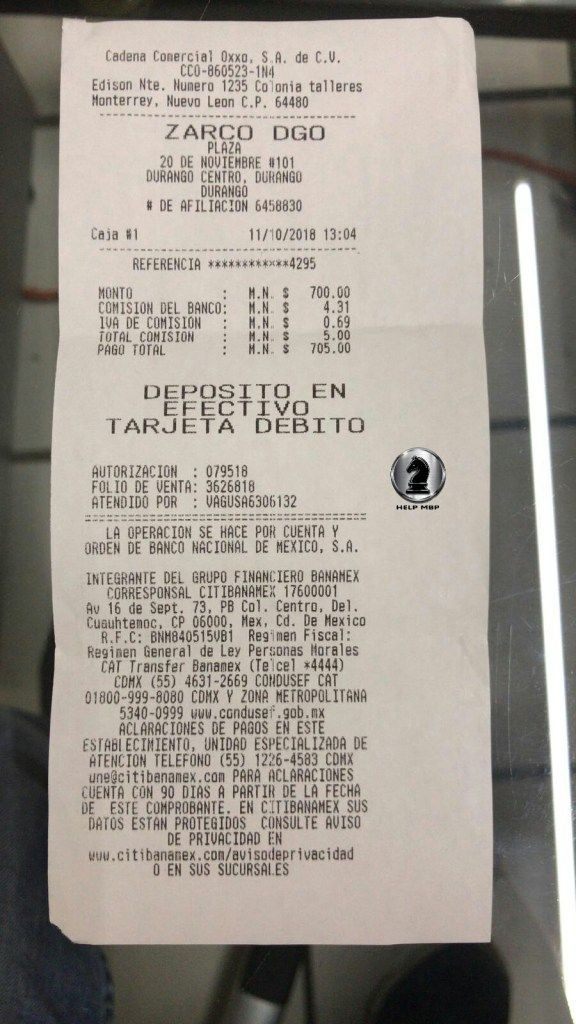

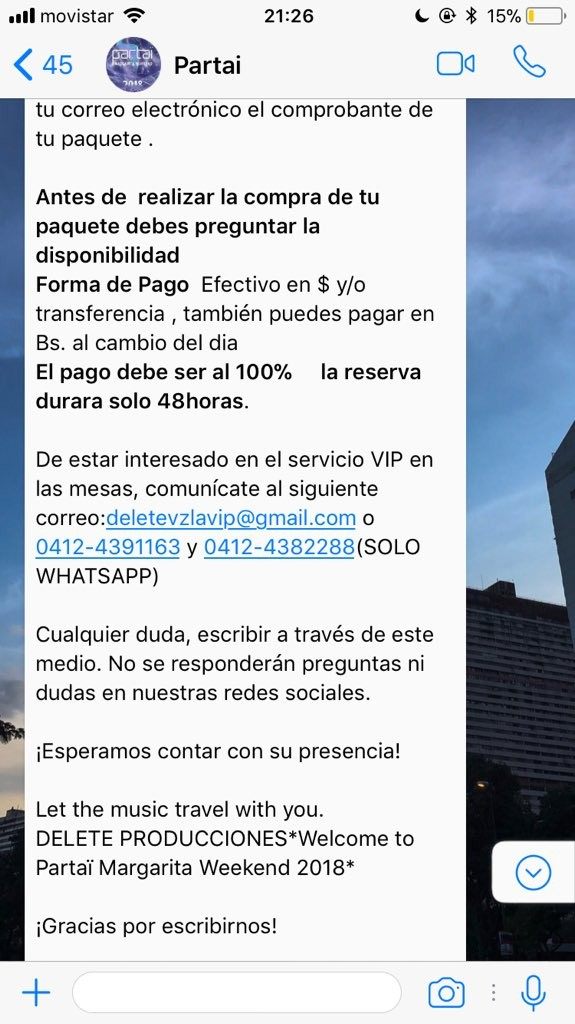

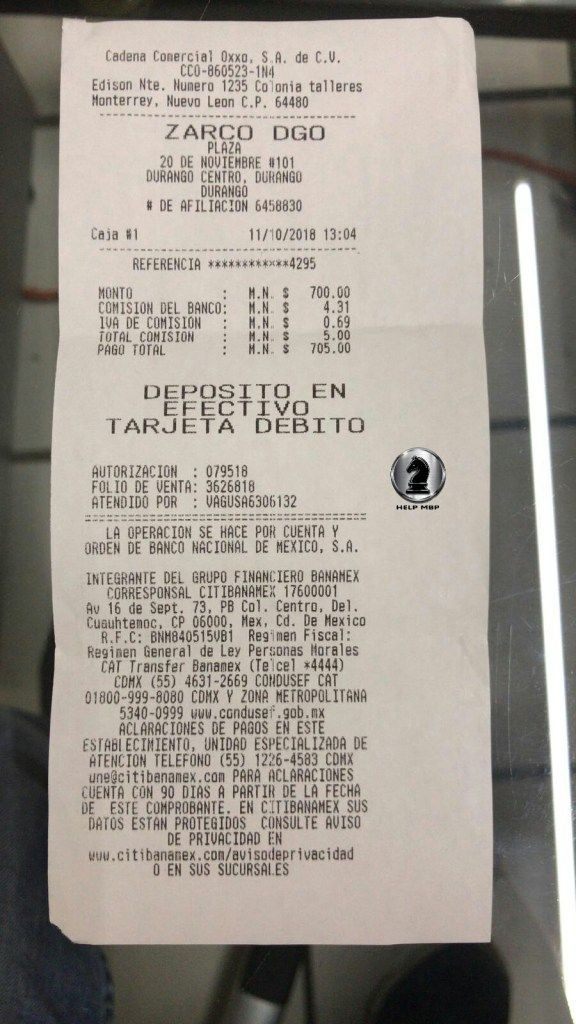

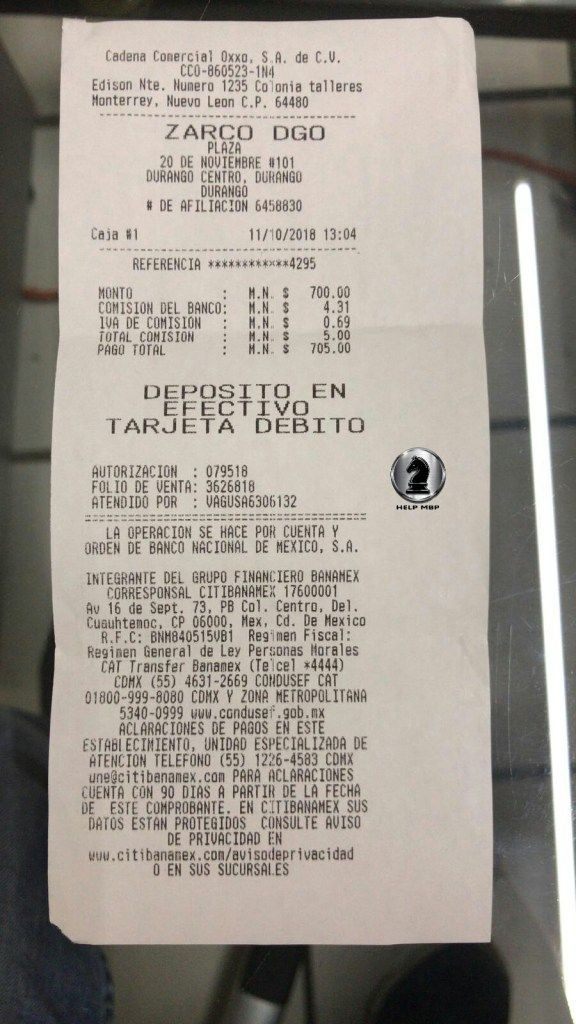

This company promised a high profit to me. So I dpeosited $700.

ARES FOREX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

This so-called broker said I could earn a lot. But this is a complete scam.

This company promised a high profit to me. So I dpeosited $700.

This comprehensive ares forex review presents a balanced assessment of a UAE-registered online forex and CFD broker that has garnered mixed feedback from the trading community. Ares Forex positions itself as a provider of competitive trading conditions. The broker offers spreads as low as 0 pips and leverage up to 1:2000, which appeals to traders seeking aggressive trading parameters. It caters primarily to forex and CFD traders, particularly those pursuing high-leverage opportunities across multiple asset classes including currencies, stocks, indices, commodities, and cryptocurrencies.

However, our analysis reveals significant concerns regarding regulatory oversight. Specific regulatory authority information remains unclear despite the company's UAE registration. User feedback presents a dichotomy of experiences, with some traders appreciating the competitive trading conditions while others express concerns about withdrawal processes and customer service responsiveness. The broker operates exclusively through the MetaTrader 4 platform. It offers multiple account types to accommodate different trading styles and religious requirements.

Regional Entity Differences: Ares Forex operates as a UAE-registered entity, but specific regulatory authority oversight remains unclear in available documentation. This regulatory ambiguity presents potential risks that traders should carefully evaluate before engaging with the platform. Different jurisdictions may have varying levels of investor protection, and the absence of clear regulatory information raises important considerations about fund security and dispute resolution mechanisms.

Review Methodology: This ares forex review is based on comprehensive analysis of user feedback, available market data, and publicly accessible information about the broker's services and trading conditions. Due to limited official documentation, some assessments rely heavily on trader experiences and third-party evaluations.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 8/10 | Strong performance due to reasonable $100 minimum deposit and diverse account options including Islamic accounts |

| Tools and Resources | 7/10 | Solid offering with MT4 platform and multiple asset classes, though educational resources lack detailed documentation |

| Customer Service | 6/10 | Mixed reviews indicating response time issues and problem resolution challenges affecting overall satisfaction |

| Trading Experience | 7/10 | Competitive spreads and commission-free structure offset by user-reported slippage concerns during volatile periods |

| Trust and Security | 5/10 | Significant concerns due to unclear regulatory status and user safety apprehensions affecting confidence levels |

| User Experience | 6/10 | Balanced feedback with positive platform usability countered by withdrawal process difficulties and support issues |

Ares Forex operates as a UAE-based online trading platform specializing in forex and CFD services across global markets. The company has established itself within the competitive online brokerage space by focusing on providing access to multiple asset classes. These include major and minor currency pairs, stock CFDs, index derivatives, commodity contracts, and cryptocurrency instruments. While specific establishment dates remain unclear in available documentation, the broker has developed a presence among traders seeking high-leverage opportunities and competitive spreads.

The broker's business model centers on providing direct market access through the widely recognized MetaTrader 4 platform. This enables traders to execute positions across diverse financial instruments. Ares Forex positions itself as a comprehensive trading solution provider, offering multiple account types designed to accommodate various trading strategies, experience levels, and religious requirements through specialized Islamic accounts that comply with Sharia law principles.

The platform's core offering includes access to forex markets with major, minor, and exotic currency pairs. It also provides CFD trading opportunities in global stock markets, major indices, precious metals, energy commodities, and emerging cryptocurrency markets. However, specific regulatory authority oversight remains unclear despite the UAE registration. This represents a significant consideration for potential clients evaluating the broker's credibility and regulatory compliance standards.

Regulatory Jurisdiction: Ares Forex operates under UAE registration, though specific regulatory authority details are not clearly documented in available materials. This creates potential oversight concerns for prospective clients.

Deposit and Withdrawal Methods: Specific payment processing methods are not detailed in available documentation. The broker accepts a minimum deposit of $100 across account types.

Minimum Deposit Requirements: The platform maintains an accessible $100 minimum deposit threshold. This positions it competitively for entry-level traders and those testing the platform's services.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available documentation. This suggests limited or undisclosed incentive programs.

Available Trading Assets: The broker provides access to forex currency pairs, stock CFDs, major global indices, commodity contracts including precious metals and energy, and cryptocurrency trading instruments.

Cost Structure Analysis: Ares Forex advertises spreads starting from 0 pips with commission-free trading structures. Specific spread ranges and potential markup details vary by account type and market conditions.

Leverage Ratios: Maximum leverage reaches 1:2000, representing one of the higher leverage offerings in the retail trading space. This appeals to traders seeking amplified position sizes.

Platform Options: Trading exclusively occurs through MetaTrader 4. This provides access to standard charting tools, technical indicators, automated trading capabilities, and expert advisor functionality.

Geographic Restrictions: Specific country limitations and regulatory restrictions are not detailed in available documentation.

Customer Support Languages: Available language support options are not specified in accessible materials.

This ares forex review continues with detailed analysis of each evaluation criterion. It provides comprehensive insights into the broker's performance across critical areas affecting trader experience and satisfaction.

Ares Forex demonstrates strong performance in account condition offerings through its diverse range of account types designed to accommodate various trading preferences and requirements. The broker provides Standard accounts for general trading, VIP accounts for higher-volume traders, Professional accounts for experienced market participants, and Islamic accounts that comply with Sharia law principles by eliminating swap charges and interest-based transactions. This variety allows traders to select accounts aligned with their trading volume, experience level, and religious considerations.

The $100 minimum deposit requirement positions Ares Forex competitively within the retail brokerage space. It makes the platform accessible to beginning traders and those seeking to test services without significant capital commitment. This threshold compares favorably against many competitors requiring higher initial deposits, particularly for brokers offering similar leverage ratios and asset diversity. User feedback generally supports the accessibility of account opening processes, though specific verification procedures and documentation requirements lack detailed public information.

The availability of Islamic accounts represents a significant advantage for Muslim traders seeking Sharia-compliant trading opportunities. These accounts eliminate overnight swap charges and interest-based transactions, addressing religious requirements while maintaining access to the full range of trading instruments and platform features. However, specific terms, conditions, and potential modifications to trading costs for Islamic accounts are not clearly documented in available materials.

Account management features and funding flexibility appear standard based on user experiences. Detailed information about account upgrade procedures, minimum activity requirements, and potential account maintenance fees remains limited in public documentation.

The trading infrastructure at Ares Forex centers on MetaTrader 4, providing users with access to comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors and trading signals. The MT4 platform offers standard features including multiple timeframe analysis, extensive technical indicator libraries, custom indicator development capabilities, and one-click trading execution across all available instruments.

Asset diversity represents a key strength, with the broker offering forex trading across major, minor, and exotic currency pairs. It also provides CFD access to global stock markets, major indices from developed and emerging economies, commodity contracts including precious metals and energy products, and cryptocurrency trading opportunities. This range allows traders to diversify portfolios and capitalize on various market conditions across different asset classes.

However, educational resources and market analysis tools lack comprehensive documentation in available materials. User feedback suggests limited availability of educational content, market research, and trading tutorials that many competitors provide as standard offerings. This gap particularly affects beginning traders who rely on broker-provided educational materials to develop trading skills and market understanding.

Automated trading support through MT4's Expert Advisor functionality and signal services provides experienced traders with algorithmic trading opportunities. Specific signal provider partnerships and automated strategy performance data are not detailed in accessible documentation.

Customer service performance represents a significant concern area based on available user feedback and experiences. Multiple trader reports indicate extended response times for support inquiries, with some users experiencing delays in receiving assistance for account-related questions, technical issues, and withdrawal requests. The lack of detailed customer service channel information in public documentation compounds these concerns by limiting transparency about available support options.

Response time issues appear particularly problematic during peak trading hours and volatile market conditions when traders most require immediate assistance. User experiences suggest that while basic inquiries may receive responses within reasonable timeframes, complex issues involving account verification, withdrawal processing, and technical platform problems often experience significant delays that impact trading activities and user satisfaction.

Service quality concerns extend beyond response times to include reports of insufficient technical expertise among support staff when addressing platform-related issues and trading problems. Some users report receiving generic responses that fail to address specific concerns, requiring multiple follow-up communications to achieve resolution.

The absence of clearly documented customer service hours, available communication channels, and escalation procedures in public materials creates additional uncertainty for traders evaluating the broker's support capabilities. Multi-language support availability remains unclear, potentially limiting accessibility for non-English speaking traders in the broker's target markets.

The trading experience at Ares Forex delivers mixed results based on user feedback and platform performance reports. MetaTrader 4 stability generally receives positive assessments from users, with the platform maintaining consistent performance during standard market conditions and providing reliable access to charting tools, technical analysis features, and order execution capabilities.

Competitive spreads starting from 0 pips and commission-free trading structures create attractive cost conditions for active traders. This particularly benefits those executing high-frequency strategies or trading major currency pairs during peak liquidity periods. Users generally acknowledge the cost advantages compared to many competitors, though specific spread consistency during volatile market conditions receives mixed feedback.

Order execution quality presents concerns based on user reports of slippage during high-volatility periods and news events. Some traders report experiencing price slippage that exceeds expected levels, particularly when trading minor currency pairs and exotic instruments during low liquidity periods. These execution issues can significantly impact trading profitability, especially for scalping and short-term trading strategies.

Platform functionality through MT4 provides comprehensive chart analysis capabilities, extensive technical indicator access, and automated trading support through Expert Advisors. The familiar MT4 interface appeals to experienced traders comfortable with the platform's features, though the lack of additional platform options may limit appeal for traders preferring alternative trading environments.

Mobile trading experience details remain limited in available documentation. MT4's standard mobile application presumably provides basic trading functionality for users requiring on-the-go market access.

Trust and security represent the most significant concerns in this ares forex review, primarily due to unclear regulatory oversight and limited transparency about fund protection measures. While the broker operates under UAE registration, specific regulatory authority oversight, compliance standards, and investor protection mechanisms are not clearly documented in available materials. This regulatory ambiguity creates substantial uncertainty about the safety of client funds and the availability of dispute resolution procedures.

The absence of detailed information about segregated client accounts, deposit insurance coverage, and regulatory compliance measures raises important questions about fund security protocols. Many regulated brokers provide clear documentation about client fund segregation, insurance coverage, and regulatory oversight, but such information remains unclear for Ares Forex based on available documentation.

Company transparency concerns extend beyond regulatory status to include limited public information about management structure, financial reporting, and operational procedures. The lack of detailed company background, leadership profiles, and financial stability indicators makes it difficult for traders to assess the broker's long-term viability and operational integrity.

User feedback includes specific concerns about withdrawal difficulties and fund safety, with some traders reporting challenges in accessing their accounts and processing withdrawal requests. These reports, combined with unclear regulatory status, significantly impact the broker's trustworthiness assessment and raise important considerations for potential clients evaluating platform safety.

Third-party verification and industry recognition information are not available in accessible documentation. This limits external validation of the broker's claims and performance standards.

Overall user satisfaction with Ares Forex presents a mixed picture reflecting both positive trading condition experiences and significant concerns about operational reliability. User feedback indicates appreciation for competitive spreads, high leverage availability, and the familiar MT4 platform interface, particularly among traders prioritizing cost-effective trading conditions and platform functionality.

Interface design receives generally positive feedback through MT4's established user experience, providing intuitive navigation, comprehensive charting capabilities, and efficient order management tools. Experienced MT4 users typically adapt quickly to the platform's features, while beginning traders benefit from the extensive online resources and tutorials available for the MetaTrader platform.

However, significant user experience challenges emerge in areas of customer service interaction and withdrawal processing. Multiple user reports indicate frustration with extended support response times, complicated withdrawal procedures, and lack of transparency in problem resolution processes. These operational issues significantly impact overall satisfaction despite competitive trading conditions.

Account registration and verification processes receive limited detailed feedback in available materials. User experiences suggest standard industry procedures with typical documentation requirements for account activation and verification completion.

Common user complaints focus primarily on withdrawal processing delays, customer service responsiveness, and lack of educational resources compared to competitors. These concerns particularly affect traders requiring reliable fund access and ongoing support for trading activities. Improvement recommendations from user feedback emphasize the need for enhanced customer service training, streamlined withdrawal procedures, and increased transparency in operational processes.

This ares forex review reveals a broker offering attractive trading conditions including competitive spreads, high leverage options, and diverse asset access. Substantial concerns about regulatory oversight and operational reliability significantly impact its overall assessment. The platform appeals primarily to experienced traders comfortable with regulatory uncertainty who prioritize trading cost advantages and high leverage availability over comprehensive regulatory protection and customer service excellence.

Ares Forex suits traders seeking aggressive leverage ratios up to 1:2000 and cost-effective trading through zero-pip spreads and commission-free structures. The MetaTrader 4 platform provides familiar functionality for experienced users, while multiple account types accommodate various trading preferences including Islamic accounts for Sharia-compliant trading.

However, the significant disadvantages include unclear regulatory status raising fund safety concerns, user reports of withdrawal difficulties and customer service issues, and limited educational resources compared to established competitors. These factors make Ares Forex unsuitable for beginning traders or those prioritizing regulatory protection and comprehensive customer support over competitive trading conditions.

FX Broker Capital Trading Markets Review