Is YHFX safe?

Business

License

Is YHFX Safe or a Scam?

Introduction

YHFX, a forex broker operating primarily out of China, has been gaining attention in the trading community. As with any broker, especially in the volatile forex market, it is crucial for traders to exercise due diligence before committing their funds. The forex market is rife with opportunities, but it also harbors risks, including the potential for scams. This article aims to provide a comprehensive evaluation of YHFX, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation is based on data gathered from various reputable financial websites, user reviews, and regulatory databases to ensure an objective assessment of whether YHFX is safe or a potential scam.

Regulation and Legitimacy

Regulation is a vital aspect of any forex broker's credibility. A regulated broker is subject to stringent oversight, which helps protect traders from fraud and malpractice. YHFX claims to operate under a full license, but its regulatory status raises several red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | Suspicious Clone | United Kingdom | Low Score, Warning |

The Financial Conduct Authority (FCA) has flagged YHFX as a suspicious clone, indicating that it may not be operating legitimately. This status is alarming, as it suggests that YHFX may not adhere to the rigorous standards set by credible regulatory bodies. The lack of robust regulation can expose traders to significant risks, including the possibility of losing their investments without recourse.

The quality of regulation is paramount; brokers regulated by top-tier authorities like the FCA or ASIC offer more protections compared to those under less stringent jurisdictions. YHFXs association with a suspicious regulatory status raises concerns about its operational integrity and compliance history. Therefore, it is essential for potential clients to consider these factors when evaluating if YHFX is safe.

Company Background Investigation

YHFX's company history and ownership structure also play a crucial role in assessing its legitimacy. Established approximately 5 to 10 years ago, the broker has primarily focused on the Chinese market. However, details about its ownership and management team are scarce, which diminishes transparency.

The management team's background is crucial for understanding the broker's operational ethos. A team with a solid track record in finance and trading can inspire confidence among traders. Unfortunately, YHFX does not provide sufficient information about its management, which could indicate a lack of accountability.

Moreover, the level of transparency in a brokers operations is a significant factor in determining its trustworthiness. YHFX's limited information disclosure raises concerns about its willingness to maintain open communication with clients and regulatory bodies. This opacity can be a warning sign for traders, as a trustworthy broker should be transparent about its operations, fees, and the risks associated with trading. Thus, the lack of information about YHFX's management and operational transparency contributes to the question of whether YHFX is safe.

Trading Conditions Analysis

When considering a broker, understanding the trading conditions is essential. YHFX offers a variety of trading instruments and claims to provide competitive spreads and leverage. However, it is crucial to dissect the fee structure to identify any hidden costs or unusual policies.

| Fee Type | YHFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | 0.5% | 0.5% |

While YHFX appears to offer competitive spreads, the slightly higher spread for major currency pairs compared to the industry average raises questions about its competitiveness. Additionally, the absence of a commission structure is appealing; however, it is essential to verify if the broker compensates for this through wider spreads or hidden fees.

A broker's fee structure should be clear and transparent. YHFX's lack of detailed information on its fees may lead to unexpected costs for traders. Moreover, any unusual fees or policies can significantly impact a traders profitability. Therefore, potential clients should carefully evaluate YHFX's trading conditions before deciding if YHFX is safe for their trading activities.

Customer Fund Safety

The safety of client funds is a paramount concern for any trader. YHFX claims to implement various security measures to protect customer deposits. However, a deeper analysis is required to evaluate the effectiveness of these measures.

YHFX does not clearly state its policies regarding fund segregation, investor protection, or negative balance protection. Segregation of client funds is crucial as it ensures that traders' deposits are kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency.

Furthermore, the absence of investor protection schemes raises concerns about the safety of funds deposited with YHFX. Historical incidents involving fund safety issues, such as withdrawal difficulties and potential fraud allegations, further exacerbate these concerns. Therefore, it is essential for traders to weigh these factors carefully and consider if YHFX is safe for their investments.

Customer Experience and Complaints

User feedback provides valuable insights into the reliability of a broker. Analyzing customer experiences with YHFX reveals a mixed bag of reviews, with several users reporting issues related to withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Support Issues | Medium | Inconsistent |

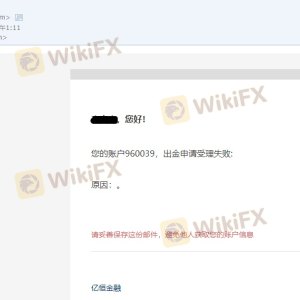

Common complaints include difficulties in withdrawing funds, with multiple users reporting that their withdrawal requests were either delayed or denied without clear reasons. Such issues can significantly impact traders' experiences and lead to a loss of trust in the broker. Moreover, YHFX's poor response to these complaints raises concerns about its commitment to customer service.

A few notable cases illustrate these issues. One user reported that their initial withdrawal request was rejected, and subsequent requests were met with vague responses from customer support. This lack of responsiveness can be a significant red flag for potential clients considering whether YHFX is safe.

Platform and Trade Execution

The performance of the trading platform is another crucial aspect to evaluate. YHFX claims to offer a robust trading platform, but its stability and execution quality need thorough examination.

User reviews suggest that while the platform is user-friendly, there are instances of slippage and rejected orders, which can hinder trading performance. Such issues can be particularly detrimental in the fast-paced forex market, where timely execution is critical. The absence of any reported platform manipulation is a positive aspect; however, the concerns regarding execution quality could deter potential traders.

Overall, the platform's reliability and execution performance are vital factors for traders to consider when assessing if YHFX is safe for their trading needs.

Risk Assessment

Engaging with any broker involves inherent risks. Evaluating YHFX's risk profile reveals several areas of concern that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Withdrawal Risk | High | Reports of withdrawal difficulties. |

| Transparency Risk | Medium | Limited information on operations. |

The high regulatory risk associated with YHFX is a significant concern, as unregulated brokers often lack the oversight necessary to protect traders. Additionally, the historical complaints regarding withdrawal issues further exacerbate the risks involved.

To mitigate these risks, traders should consider starting with a small investment, thoroughly researching the broker's reputation, and being cautious about the funds they deposit. Understanding the risks associated with trading through YHFX is crucial for making informed decisions about whether YHFX is safe.

Conclusion and Recommendations

In conclusion, the evaluation of YHFX reveals several concerning factors that potential traders should consider. The lack of robust regulation, coupled with historical complaints about withdrawal issues and limited transparency, raises significant red flags. While YHFX may offer some appealing trading conditions, the associated risks may outweigh the benefits.

For traders seeking a reliable and safe trading environment, it may be prudent to explore alternatives with established regulatory oversight and positive user feedback. Brokers such as IG, CMC Markets, and Pepperstone are examples of well-regulated platforms that offer competitive trading conditions and a commitment to customer safety.

Ultimately, traders must weigh the evidence presented in this analysis and make informed decisions based on their risk tolerance and trading objectives. The question of whether YHFX is safe remains contentious, and potential clients should proceed with caution.

Is YHFX a scam, or is it legit?

The latest exposure and evaluation content of YHFX brokers.

YHFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YHFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.