Is YACglobal safe?

Business

License

Is YACGlobal Safe or Scam?

Introduction

YACGlobal is a forex broker that has emerged in the trading landscape, aiming to provide a platform for retail traders looking to engage in currency trading. As the forex market continues to grow, the influx of brokers can be overwhelming, making it imperative for traders to conduct thorough due diligence before committing their funds. Understanding whether YACGlobal is a safe trading option or a potential scam is crucial for anyone considering this broker. This article will investigate YACGlobal's regulatory status, company background, trading conditions, customer experiences, and overall safety measures, utilizing various online resources and user feedback.

Regulation and Legitimacy

The regulation of forex brokers is a critical factor in determining their legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, YACGlobal does not appear to hold any licenses from major regulatory bodies, raising concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight means that YACGlobal operates in a high-risk environment, where traders may have limited recourse in the event of disputes or financial mishaps. Regulatory bodies, such as the FCA in the UK or the ASIC in Australia, provide a layer of security for traders, ensuring that brokers adhere to strict financial practices. The lack of such oversight for YACGlobal is a significant red flag and raises questions about its commitment to transparency and accountability.

Company Background Investigation

YACGlobal Fintech Limited, the parent company behind YACGlobal, is reportedly registered in China. The company has been in operation for approximately 2-5 years, but detailed information about its history, ownership structure, and management team remains sparse. This lack of transparency can be concerning for potential clients, as understanding the people behind a broker can provide insight into its operational integrity.

The management team's background and professional experience are crucial for establishing trust. However, there is little available information regarding the qualifications or reputations of YACGlobal's executives. This obscurity can lead to skepticism regarding the company's motives and operational practices. The absence of clear and accessible information about the company's history and management is a significant factor in assessing whether YACGlobal is safe or a potential scam.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. YACGlobal's fee structure includes a minimum deposit requirement ranging from $5 to $100,000, with a maximum leverage of 1:888 and minimum spreads starting at 1 pip. While these numbers may seem attractive, they must be weighed against industry standards to determine their competitiveness and fairness.

| Fee Type | YACGlobal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread offered by YACGlobal is within the typical range for forex trading, but the lack of a clear commission structure raises questions. Traders should be cautious of brokers that do not provide transparent information about their fee models, as hidden costs can significantly impact profitability.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. YACGlobal's policies regarding fund security are not well-documented, making it difficult to ascertain how they protect client deposits. Key factors to consider include whether funds are held in segregated accounts, the existence of investor protection schemes, and whether negative balance protection is offered.

In the absence of regulatory oversight, the security measures implemented by YACGlobal become even more crucial. Traders must be wary of brokers that do not clearly outline their fund protection policies, as this can lead to significant risks of loss.

Customer Experience and Complaints

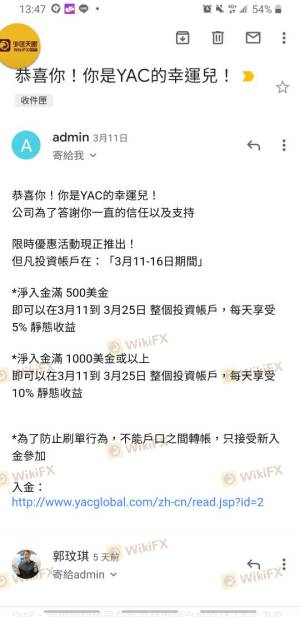

Customer feedback is an invaluable resource when assessing the reliability of a broker. Reviews and testimonials from current and former clients can provide insight into common issues and the overall quality of service provided by YACGlobal.

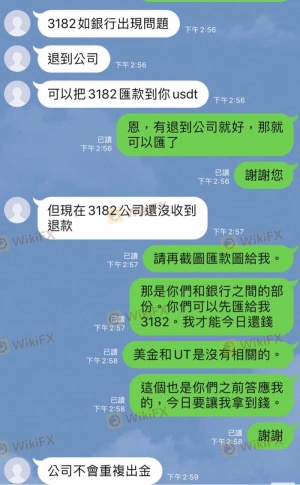

Common complaints associated with YACGlobal include difficulties in withdrawing funds, lack of customer support responsiveness, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Fair |

| Trade Execution Problems | High | Poor |

Typical case studies reveal that some traders have reported significant delays in processing withdrawals, which raises concerns about the broker's liquidity and operational efficiency. The lack of timely responses from customer support further exacerbates the situation, leading to frustration among users.

Platform and Trade Execution

The performance of the trading platform is another critical aspect of a broker's reliability. A stable and efficient platform is essential for successful trading. YACGlobal's platform has received mixed reviews regarding its stability and user experience.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. The presence of such issues may indicate a lack of technological investment or potential manipulation, further questioning whether YACGlobal is a safe broker.

Risk Assessment

Using YACGlobal comes with inherent risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Lack of transparency in fees |

| Operational Risk | High | Issues with withdrawals and support |

To mitigate these risks, traders should consider starting with a small investment, conduct thorough research on the broker's practices, and explore alternative options that offer better regulatory protection and transparency.

Conclusion and Recommendations

In conclusion, the investigation into YACGlobal raises several red flags that suggest it may not be a safe trading option. The lack of regulatory oversight, insufficient transparency regarding company operations, and numerous customer complaints indicate potential risks that traders should carefully consider.

For those looking for a reliable forex broker, it may be wise to explore alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Always prioritize safety and transparency when selecting a trading partner, as this can significantly impact your trading experience and financial security.

In summary, is YACGlobal safe? The evidence suggests that traders should proceed with caution, as the broker's practices and customer feedback indicate potential risks that could lead to significant financial loss.

Is YACglobal a scam, or is it legit?

The latest exposure and evaluation content of YACglobal brokers.

YACglobal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YACglobal latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.