Is XIANG RONG safe?

Business

License

Is Xiang Rong Safe or a Scam?

Introduction

Xiang Rong is a forex broker that claims to offer trading services in various financial markets, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers entering this space has surged, making it essential for traders to carefully evaluate the reliability and safety of these platforms. Choosing the wrong broker can lead to significant financial losses, which is why a detailed assessment of Xiang Rong's legitimacy is crucial. This article will investigate the broker's regulatory status, company background, trading conditions, and customer experiences to determine if Xiang Rong is safe or a scam.

Regulatory and Legality

Regulation is a critical factor when assessing any forex broker. A regulated broker is typically subject to strict oversight, providing a level of assurance regarding the safety of traders' funds and fair trading practices. Unfortunately, Xiang Rong appears to lack legitimate regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Xiang Rong claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Crimes Enforcement Network (FinCEN) in the U.S. However, upon investigation, no valid license or registration was found under either of these authorities. This absence of regulation raises significant concerns about the broker's operational legitimacy and the protection of client funds. The lack of regulatory oversight is a strong indicator that Xiang Rong is likely to be operating as a scam, as unregulated brokers often engage in risky practices and lack accountability.

Company Background Investigation

Xiang Rong's company history and ownership structure are also critical in assessing its credibility. The broker claims to operate in multiple regions, including Australia and Canada, but it lacks transparency regarding its actual corporate structure. There is minimal information available about the company's founders or management team, which makes it difficult to gauge their experience and qualifications in the financial industry.

The absence of a clear corporate address and lack of detailed information about its operations further exacerbate concerns. A reputable broker should provide transparent information about its history and management. The anonymity surrounding Xiang Rong's operations suggests a lack of accountability, making it imperative for traders to exercise caution. The overall opacity of the broker's information is a significant red flag, indicating that Xiang Rong may not be safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions offered are a vital aspect to consider. Xiang Rong claims to provide competitive trading conditions; however, several elements raise concerns. The broker's minimum deposit requirement is notably high, starting at $2,000, which is significantly above the industry average.

| Fee Type | Xiang Rong | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low |

The spread for major currency pairs is also uncompetitive, starting at 2.3 pips, compared to the industry average of around 1.0 pips. Such high trading costs can erode potential profits and make it difficult for traders to succeed. Additionally, Xiang Rong's claims of offering a commission-free model may not be entirely accurate, as hidden fees can often be applied, further complicating the cost structure. Overall, these unfavorable trading conditions raise questions about whether Xiang Rong is truly safe for traders.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Xiang Rong does not provide any clear information regarding the segregation of client funds or investor protection measures.

Many reputable brokers offer segregated accounts to ensure that client funds are kept separate from the company's operational funds. This practice protects traders in case of insolvency. However, Xiang Rong does not appear to have such safeguards in place, leaving clients vulnerable to potential losses. Furthermore, the broker lacks negative balance protection, which is a standard feature among regulated brokers that helps prevent traders from losing more than their initial deposits.

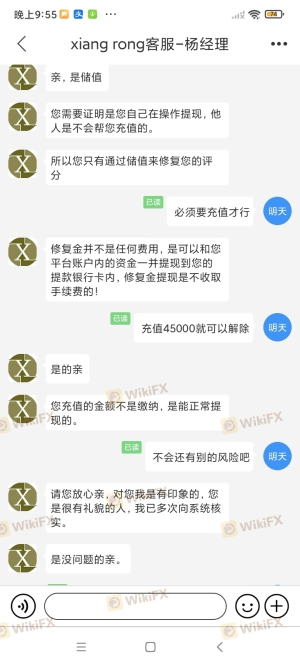

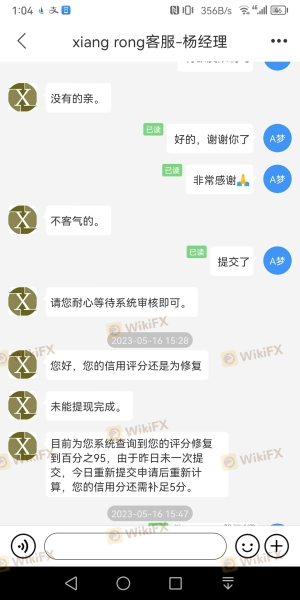

Historical issues regarding fund security have also been reported, with numerous complaints from users alleging difficulties in withdrawing funds. These issues further highlight the risks associated with trading with Xiang Rong, making it crucial for potential clients to consider the safety of their investments.

Customer Experience and Complaints

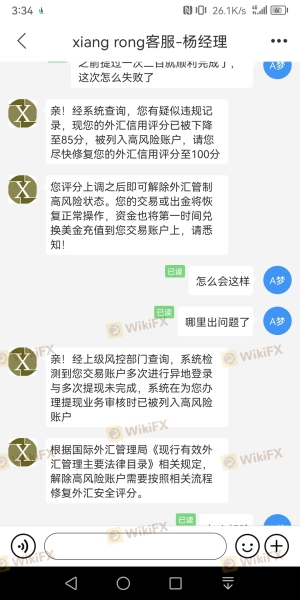

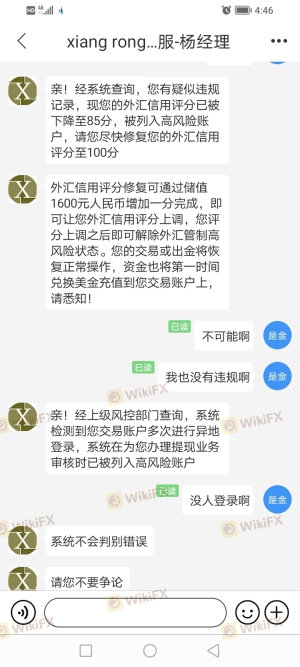

Customer feedback plays a significant role in understanding a brokers reliability. Xiang Rong has garnered numerous negative reviews, with traders frequently citing issues related to withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

Common complaints include difficulties in accessing funds, unexpected fees, and inadequate responses from customer service. The overall response from the company has been deemed unsatisfactory, with many users reporting that their concerns were ignored or inadequately addressed.

One notable case involved a trader who successfully made a profit but faced significant hurdles when attempting to withdraw their funds. After multiple attempts, they were met with vague responses and additional fees that were not initially disclosed. Such experiences raise serious concerns about whether Xiang Rong is safe for traders, as these patterns suggest a lack of accountability and transparency.

Platform and Trade Execution

The trading platform offered by Xiang Rong is another critical aspect to evaluate. The broker claims to provide access to popular trading platforms; however, reviews indicate that the platform may not function as advertised.

Traders have reported issues with order execution, including slippage and rejected orders, which can severely impact trading performance. Additionally, there are concerns regarding potential platform manipulation, as some users have reported suspicious price movements that seem to benefit the broker rather than the traders. These issues further question the integrity of Xiang Rong's trading environment and whether it is safe for users.

Risk Assessment

Engaging with Xiang Rong presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | High fees and withdrawal issues |

| Operational Risk | Medium | Platform reliability concerns |

The absence of regulation, combined with high trading costs and customer complaints, creates a high-risk environment for traders. To mitigate these risks, potential clients are advised to conduct thorough due diligence, consider starting with a small deposit, and ensure they fully understand the terms and conditions before committing significant funds.

Conclusion and Recommendations

In summary, Xiang Rong raises multiple red flags that suggest it may not be a safe trading option for forex traders. The lack of regulatory oversight, poor customer feedback, and questionable trading conditions all point toward the broker operating in a manner that may not prioritize the safety and interests of its clients.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of customer satisfaction. Options such as Forex.com, IG, or OANDA may provide safer trading environments with better protections for client funds. Ultimately, traders should remain vigilant and prioritize safety when selecting a forex broker, as the risks associated with Xiang Rong suggest it may not be worth the investment.

Is XIANG RONG a scam, or is it legit?

The latest exposure and evaluation content of XIANG RONG brokers.

XIANG RONG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XIANG RONG latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.