Is ViniFx safe?

Business

License

Is Vinifx Safe or Scam?

Introduction

Vinifx is an online trading platform that has positioned itself within the forex and cryptocurrency markets, aiming to attract a global clientele. As the online trading space grows, so does the number of brokers, making it essential for traders to assess the credibility and safety of these platforms. The rise of scams in the financial sector has made it crucial for potential investors to conduct thorough research before committing any funds. This article investigates whether Vinifx is a safe trading option or a potential scam, employing various sources and methodologies to evaluate its legitimacy, regulatory status, and user experiences.

Regulation and Legitimacy

One of the primary factors in assessing the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards designed to protect client funds and maintain market integrity. However, Vinifx has been flagged as an unregulated broker, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | UK | Warning issued |

| Financial Services Authority (FSA) | N/A | St. Vincent and the Grenadines | Unverified |

The FCA has issued a warning against Vinifx, claiming that it operates without authorization in the UK, which is a serious red flag. Additionally, claims that Vinifx is registered with the FSA in St. Vincent and the Grenadines have not been substantiated. The absence of proper regulatory oversight means that traders have no recourse in the event of disputes or fund mismanagement, making it imperative to question is Vinifx safe for trading.

Company Background Investigation

Vinifx LLC, the entity behind Vinifx, has a somewhat murky history. Established in St. Vincent and the Grenadines, the company lacks transparency regarding its ownership structure and operational history. The absence of clear information about the management team further complicates matters, as potential investors cannot assess the experience or credibility of those running the platform. A reputable broker typically discloses information about its founders and management, which fosters trust among clients. The lack of such transparency raises concerns about the company's legitimacy and operational integrity.

Trading Conditions Analysis

Vinifx claims to offer competitive trading conditions, including leverage up to 1:500 and low spreads. However, the actual trading fees and conditions are critical in determining the overall cost-effectiveness of trading with this broker.

| Fee Type | Vinifx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None stated | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads may appear attractive at first glance, the lack of clarity on commission structures and overnight fees raises questions about hidden costs. Traders should be wary of any broker that does not clearly outline its fee structure, as this can lead to unexpected costs that diminish profitability. This ambiguity further prompts the question: is Vinifx safe for serious traders.

Client Funds Security

The safety of client funds is paramount when assessing a broker's trustworthiness. Vinifx has not demonstrated adequate measures to secure client funds. Reports suggest that the broker does not provide segregated accounts, which means that client funds may be co-mingled with the broker's operational funds, increasing the risk of loss in the event of insolvency. Additionally, there are no investor protection schemes in place, such as those offered by regulated brokers in the UK or EU. This lack of security measures leads to concerns about the safety of funds deposited with Vinifx and raises the question: is Vinifx safe for investment?

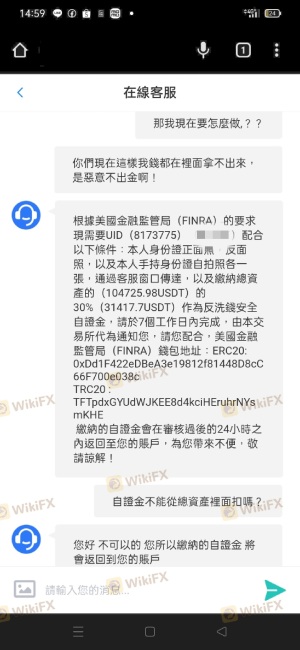

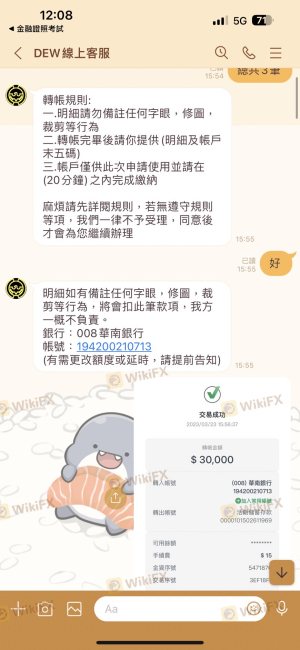

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of any trading platform. Reviews of Vinifx reveal a pattern of complaints regarding withdrawal issues, difficulty in contacting customer support, and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow response |

| Aggressive Sales Tactics | High | Ignored complaints |

Many users have reported that once they deposited funds, communication with the broker became increasingly difficult, and withdrawal requests were often met with unreasonable delays or outright denials. These patterns are alarming and suggest that Vinifx may not prioritize client satisfaction or transparency, further questioning is Vinifx safe for traders.

Platform and Trade Execution

The trading platform offered by Vinifx is another area of concern. Traders have reported issues with platform stability and execution quality. Instances of slippage and rejected orders have been noted, which can significantly impact trading outcomes. A reliable trading platform should provide seamless execution without unexpected interruptions. The lack of transparency regarding the platform's performance and any potential manipulation raises further doubts about the broker's integrity.

Risk Assessment

Using an unregulated broker like Vinifx carries inherent risks. The absence of oversight means that traders are exposed to various potential issues, including fund mismanagement, withdrawal difficulties, and lack of recourse in disputes.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation and warnings issued |

| Fund Security Risk | High | No segregation of funds |

| Platform Reliability Risk | Medium | Reports of execution issues |

To mitigate these risks, traders are advised to conduct thorough due diligence, avoid depositing large sums of money, and consider using regulated alternatives.

Conclusion and Recommendations

In conclusion, the evidence suggests that Vinifx poses significant risks for potential investors. The lack of regulation, transparency, and customer support, combined with a history of complaints, raises serious concerns about the platform's legitimacy. Therefore, it is reasonable to conclude that is Vinifx safe is a question that leans towards a negative answer.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternatives that are well-regulated and have a proven track record of client satisfaction. Brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC should be prioritized to ensure a safer trading experience. Always remember to invest wisely and stay informed to protect your financial interests.

Is ViniFx a scam, or is it legit?

The latest exposure and evaluation content of ViniFx brokers.

ViniFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ViniFx latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.