Is Tradingweb safe?

Business

License

Is Tradingweb Safe or Scam?

Introduction

Tradingweb is a relatively new player in the forex market, claiming to offer a range of trading services to investors. However, the lack of transparency surrounding this broker raises significant concerns among potential traders. In an industry notorious for scams, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of forex brokers before entrusting them with their funds. This article aims to provide a comprehensive assessment of Tradingweb, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a thorough review of available online resources, user feedback, and industry reports.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any forex broker. A well-regulated broker is typically seen as more trustworthy since it is subject to oversight by financial authorities that enforce compliance with industry standards. Unfortunately, Tradingweb operates without any valid regulatory license, which raises significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory framework means that Tradingweb does not adhere to the stringent requirements that licensed brokers must follow, such as maintaining segregated accounts for client funds or providing investor protection mechanisms. This lack of oversight is alarming, as it leaves traders vulnerable to potential fraud and mismanagement of their funds. Historical compliance records of regulated brokers indicate a commitment to ethical practices, whereas Tradingweb's unregulated status suggests a higher risk of fraudulent activities.

Company Background Investigation

A thorough investigation into Tradingweb's company background reveals a concerning lack of information. The broker's website provides minimal details about its ownership structure, management team, or operational history. This opacity is a common trait among scam brokers, as legitimate companies typically provide comprehensive information about their leadership and corporate governance.

Moreover, the absence of a physical address or contact information further complicates the situation. Traders are often left wondering who they are dealing with and whether they can trust the broker with their investments. The lack of transparency regarding the company's history and operations is a significant concern, leading many to question whether Tradingweb is indeed a legitimate trading platform or simply a facade for fraudulent activities.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall safety and reliability. However, Tradingweb's website lacks detailed information about its trading fees, spreads, and commissions, which raises further suspicion.

| Fee Type | Tradingweb | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.5% |

The absence of clear information regarding trading costs is a significant red flag. Legitimate brokers typically provide detailed information about their fee structures to allow traders to make informed decisions. Tradingweb's lack of transparency in this area suggests that it may impose hidden fees or unfavorable trading conditions, which could ultimately lead to losses for traders.

Customer Funds Security

The security of customer funds is paramount when choosing a forex broker. Regulated brokers are required to implement strict measures to protect client funds, including segregating client accounts and providing negative balance protection. Unfortunately, Tradingweb does not offer any such assurances, leaving traders at risk of losing their entire investments.

Reports of withdrawal issues further exacerbate concerns about the safety of funds with Tradingweb. Users have claimed that their withdrawal requests have been ignored or delayed indefinitely, a common tactic used by scam brokers to retain client funds. Without proper security measures in place, traders are left vulnerable to potential fraud and financial loss.

Customer Experience and Complaints

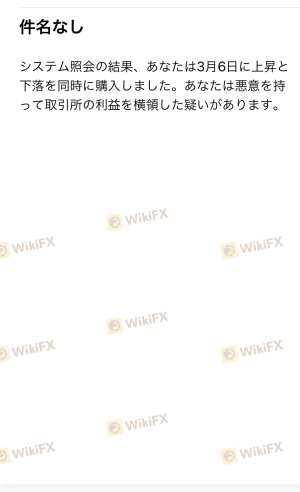

Evaluating customer feedback is crucial in determining the reliability of a broker. In the case of Tradingweb, numerous negative reviews and complaints have been reported. Many users express frustration over their inability to withdraw funds and the lack of responsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Ignored |

| Poor Customer Support | Medium | Unresponsive |

| Misleading Information | High | None Provided |

Typical cases include users who have reported being unable to access their funds after making deposits, leading to significant financial distress. The lack of a reliable support system further compounds these issues, as traders often find themselves without assistance when facing problems.

Platform and Execution

The performance and reliability of a trading platform significantly impact the trading experience. However, Tradingweb's platform appears to lack the necessary features and stability expected from a reputable broker. Users have reported issues with order execution, including slippage and rejected orders, which can severely affect trading outcomes.

Without a robust trading platform, traders may find it challenging to execute their strategies effectively. This raises concerns about the overall trading environment provided by Tradingweb and whether it can be trusted to facilitate fair and transparent trading.

Risk Assessment

Using Tradingweb carries inherent risks that potential traders should be aware of. The absence of regulation, coupled with numerous negative reviews and complaints, paints a concerning picture of this broker's operations.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with platform reliability |

To mitigate these risks, traders are advised to conduct thorough research before investing with any broker. Seeking out regulated alternatives with positive reviews and a proven track record can help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Tradingweb is not a safe broker for traders. The lack of regulation, transparency, and numerous negative user experiences indicate a high risk of fraudulent activity. Potential investors should exercise extreme caution and consider avoiding Tradingweb altogether.

For traders seeking reliable alternatives, it is advisable to choose brokers that are regulated by reputable authorities and have demonstrated a commitment to customer service and transparency. Some recommended alternatives include well-established brokers with solid regulatory frameworks and positive user feedback.

In summary, is Tradingweb safe? Based on the available evidence, it appears to be a scam, and traders should be wary of engaging with this broker.

Is Tradingweb a scam, or is it legit?

The latest exposure and evaluation content of Tradingweb brokers.

Tradingweb Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradingweb latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.