Is Scotia International safe?

Business

License

Is Scotia International A Scam?

Introduction

Scotia International has emerged as a noteworthy player in the foreign exchange market, catering to a diverse clientele interested in trading various financial instruments. As a part of the larger Scotiabank family, Scotia International offers a range of services aimed at both novice and experienced traders. However, with the proliferation of online trading platforms, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy and safety of their chosen brokers.

In the volatile world of forex trading, the stakes are high, and the potential for loss can be significant. Traders must be aware of various factors, including regulatory compliance, trading conditions, and customer experiences, before committing their funds. This article employs a comprehensive investigative approach, utilizing data from regulatory bodies, customer reviews, and industry analysis to assess whether Scotia International is a safe and legitimate trading platform or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is one of the most critical factors in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client funds. Scotia International claims to be regulated by several authorities, but it is essential to verify this information to ensure compliance and safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IIROC (Investment Industry Regulatory Organization of Canada) | N/A | Canada | Verified |

| CIPF (Canadian Investor Protection Fund) | N/A | Canada | Verified |

Scotia International is regulated by the IIROC, which is a recognized regulatory body in Canada. This regulatory oversight is crucial as it ensures that the broker adheres to strict guidelines regarding capital adequacy, operational integrity, and client fund protection. Additionally, being a member of the CIPF provides an extra layer of security, as it protects clients' investments up to a certain limit in the event of the broker's insolvency. The historical compliance of Scotia International with regulatory standards further enhances its credibility.

However, it is important to note that while regulation is a positive indicator, it does not guarantee complete safety. Traders should remain vigilant and conduct their due diligence before engaging with any broker.

Company Background Investigation

Scotia International has a rich history that is intertwined with Scotiabank, one of Canadas largest and most reputable banks. Established in 2008, Scotia International has positioned itself as a reliable broker offering a wide range of financial services, including forex trading, commodities, and equities. The ownership structure is clear, with Scotiabank being the parent company, which adds a layer of trust due to the bank's long-standing reputation.

The management team at Scotia International comprises experienced professionals with extensive backgrounds in finance and technology. This expertise is vital for maintaining operational integrity and ensuring that the trading platform meets the needs of its users. Transparency in operations and information disclosure is another area where Scotia International excels. The broker provides clear information about its services, fees, and regulatory status, which is essential for building trust with clients.

Trading Conditions Analysis

Understanding the trading conditions offered by Scotia International is crucial for potential clients. The broker's fee structure and trading policies can significantly impact a trader's profitability. Scotia International employs a competitive pricing model, but it is essential to analyze whether these costs align with industry standards.

| Fee Type | Scotia International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | $9.99 per trade | $4.95 - $9.95 |

| Overnight Interest Range | Varies by account type | Varies by broker |

Scotia International's spread for major currency pairs tends to be on the higher side compared to industry averages. Additionally, the commission structure, which charges $9.99 per trade, may deter casual traders who are looking for more cost-effective options. The lack of a clear tiered commission structure for high-volume traders also raises concerns about the overall competitiveness of its trading costs.

Client Funds Safety

The safety of client funds is paramount when evaluating any trading platform. Scotia International claims to implement stringent measures to ensure the security of client capital. The broker segregates client funds from its operational funds, which is a standard practice among reputable brokers. This segregation ensures that, even in the event of financial difficulties, client funds are protected.

Moreover, Scotia International participates in investor protection schemes, which offer additional security for clients' investments. However, it is essential to investigate any historical issues related to fund security or disputes that may have arisen in the past. Transparency regarding these matters can significantly influence a trader's decision to engage with the broker.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the overall service quality of Scotia International. Reviews from users reveal a mixed bag of experiences, with some praising the platform's functionality and others expressing frustration over customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Platform Stability | Medium | Addressed |

| High Fees | Low | Acknowledged |

Common complaints include difficulties with withdrawals, slow response times from customer support, and issues related to the stability of the trading platform. Some users have reported significant delays in resolving these issues, which can be detrimental for traders needing prompt assistance.

For instance, one user highlighted a frustrating experience while attempting to withdraw funds, citing a lack of communication from the support team. While Scotia International has mechanisms in place to address these complaints, the effectiveness of their resolution process is a crucial area for improvement.

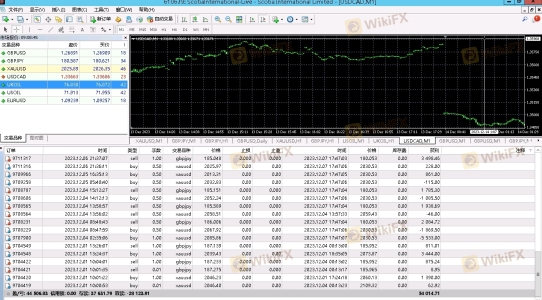

Platform and Trade Execution

The performance of a trading platform is vital for a seamless trading experience. Scotia International offers a proprietary trading platform that is designed to accommodate various trading styles. However, user reviews indicate that the platform may experience stability issues, particularly during peak trading hours.

Order execution quality is another critical aspect to consider. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. While Scotia International strives to provide a reliable trading environment, any signs of manipulation or systemic issues should be carefully scrutinized.

Risk Assessment

Engaging with Scotia International carries inherent risks, as with any trading platform. A comprehensive risk assessment can help potential clients understand the potential pitfalls associated with using this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Well-regulated by IIROC |

| Customer Service Reliability | Medium | Mixed reviews on responsiveness |

| Platform Stability | High | Reports of frequent outages |

To mitigate risks, traders should consider starting with a demo account to familiarize themselves with the platform before committing real funds. Additionally, maintaining a diversified portfolio and employing risk management strategies can help safeguard investments.

Conclusion and Recommendations

In conclusion, while Scotia International is a regulated entity with a solid backing from Scotiabank, potential traders should remain cautious. The broker's regulatory compliance, fund protection measures, and overall reputation are positive indicators of its legitimacy. However, the higher-than-average fees, mixed customer feedback, and occasional platform stability issues warrant careful consideration.

For traders seeking a reliable broker, Scotia International may be a viable option, particularly for those who value the backing of a well-established financial institution. However, those who prioritize lower fees and superior customer service might find better alternatives in the market.

In summary, while there are no overt signs of fraud associated with Scotia International, it is essential for traders to conduct their own research and assess their individual trading needs before proceeding.

Is Scotia International a scam, or is it legit?

The latest exposure and evaluation content of Scotia International brokers.

Scotia International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Scotia International latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.