Regarding the legitimacy of SaveFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is SaveFX safe?

Business

License

Is SaveFX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Saveable Limited

Effective Date:

2017-03-02Email Address of Licensed Institution:

compliance@withplum.comSharing Status:

No SharingWebsite of Licensed Institution:

www.withplum.comExpiration Time:

--Address of Licensed Institution:

Plum Fintech Ltd 2-7 Clerkenwell Green London Islington EC1R 0DE UNITED KINGDOMPhone Number of Licensed Institution:

+442033931340Licensed Institution Certified Documents:

Is SaveFX A Scam?

Introduction

SaveFX is a forex brokerage that has recently gained attention in the trading community, primarily due to its aggressive marketing strategies and promises of high returns. As the forex market continues to attract a wide range of investors, it is crucial for traders to carefully evaluate the legitimacy and safety of brokers they consider for trading. The potential for scams in this industry is significant, and traders need to ensure they are dealing with reputable and regulated firms. This article aims to provide a comprehensive analysis of SaveFX, examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. The evaluation is based on a thorough review of multiple sources, including regulatory databases, customer feedback, and expert analyses.

Regulation and Legitimacy

The regulatory environment is one of the most critical factors in determining whether a forex broker is safe or a scam. SaveFX operates without any significant regulatory oversight, which raises serious concerns about its legitimacy. A broker that is not regulated is not held accountable to any financial authority, leaving clients vulnerable to potential fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that SaveFX is not required to adhere to strict operational standards, which include safeguarding client funds and providing transparent trading conditions. This lack of oversight is a significant red flag, as it indicates that SaveFX may not be a trustworthy broker. In fact, the Financial Conduct Authority (FCA) in the UK has issued warnings against unregulated entities like SaveFX, advising potential investors to exercise extreme caution. Such warnings should not be taken lightly, as they often indicate a history of unethical practices or a lack of transparency.

Company Background Investigation

Understanding the background of a brokerage firm is essential for assessing its credibility. SaveFX appears to lack transparency regarding its ownership and operational history. There is limited information available about the companys founding members, management team, and corporate structure. This anonymity is concerning, as reputable brokers typically provide detailed information about their leadership and organizational framework.

The lack of transparency can be indicative of a scam, as it makes it difficult for potential investors to verify the legitimacy of the broker. Furthermore, the company's claims of being based in multiple jurisdictions, including the UK and Switzerland, have not been substantiated by any regulatory bodies. This raises questions about the authenticity of its operations and the safety of client funds. Without a clear understanding of who is behind SaveFX, traders are left exposed to significant risks.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. SaveFX claims to offer competitive trading conditions, including low spreads and various account types. However, the reality of its fee structure raises concerns.

| Fee Type | SaveFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $0 | $5 per trade |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by SaveFX are higher than the industry average, which can significantly impact a trader's profitability. Additionally, the lack of a clear commission structure may suggest hidden fees or unfavorable trading conditions. Traders should be wary of brokers that do not transparently disclose their fees, as this can lead to unexpected costs that diminish returns. These factors contribute to the growing concern about whether SaveFX is a safe broker for traders.

Client Fund Security

The security of client funds is paramount when choosing a forex broker. SaveFX does not appear to have adequate measures in place to protect client deposits. There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to ensure that client money is protected in the event of financial difficulties.

Moreover, SaveFX does not offer negative balance protection, which means that clients could potentially lose more money than they initially deposited. This lack of safeguards is alarming and raises significant concerns about the brokers reliability. Historical reports suggest that unregulated brokers often face issues related to fund mismanagement, leading to losses for clients. Therefore, it is crucial for traders to consider these factors when evaluating whether SaveFX is safe.

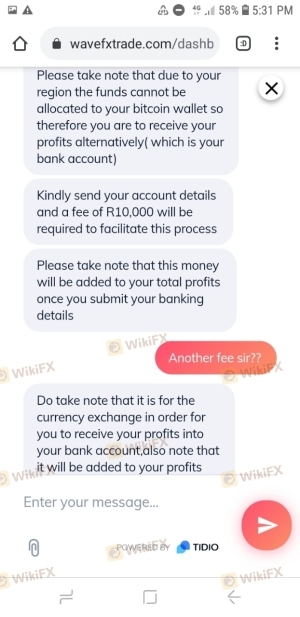

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of SaveFX reveal a troubling pattern of complaints related to withdrawal issues, poor customer service, and misleading marketing practices. Many users have reported difficulties in accessing their funds, with some claiming that their withdrawal requests were ignored or delayed indefinitely.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Slow Response |

| Misleading Promotions | High | No Resolution |

The severity of these complaints suggests a systemic issue within SaveFX's operations. Traders have expressed frustration over the lack of support and the company's unwillingness to address their concerns. This poor customer service record further reinforces the notion that SaveFX may not be a trustworthy broker.

Platform and Trade Execution

The trading platform offered by SaveFX is another critical aspect to consider. Users have reported that the platform is prone to technical issues, including slow execution times and frequent downtime. These problems can severely impact a trader's ability to execute trades effectively and capitalize on market opportunities. Moreover, reports of slippage and order rejections have raised concerns about the platform's reliability.

A broker's ability to provide a stable and efficient trading environment is essential for traders looking to succeed in the competitive forex market. If SaveFX's platform is unreliable, it could lead to significant financial losses for traders.

Risk Assessment

The overall risk associated with trading through SaveFX is high, given its unregulated status and the numerous complaints from clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, potential for fraud. |

| Fund Security Risk | High | No segregation of funds, no negative balance protection. |

| Customer Service Risk | Medium | Poor response to client issues. |

| Platform Risk | High | Technical issues, slippage, and order rejections. |

To mitigate these risks, traders should consider using regulated brokers that offer better protection for their funds and more reliable trading conditions.

Conclusion and Recommendations

In summary, the evidence suggests that SaveFX operates in a manner that raises significant concerns about its safety and legitimacy. The lack of regulation, poor customer experiences, and questionable trading conditions all point to the conclusion that SaveFX is likely not a safe broker. Traders are advised to exercise extreme caution and consider alternative, regulated brokers that provide better security and transparency.

For those seeking reliable trading options, brokers such as OANDA, IG, and Forex.com offer robust regulatory oversight and positive customer feedback. Ultimately, the decision to engage with SaveFX should be approached with skepticism, given the potential risks involved. Always prioritize safety and due diligence when selecting a forex broker.

Is SaveFX a scam, or is it legit?

The latest exposure and evaluation content of SaveFX brokers.

SaveFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SaveFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.