Is ROSYSTYLE WEALTH safe?

Business

License

Is Rosystyle Wealth Safe or a Scam?

Introduction

Rosystyle Wealth is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a wide range of financial services, including forex, CFDs, and cryptocurrencies. As the forex market continues to attract traders worldwide, it becomes increasingly vital for investors to rigorously evaluate the legitimacy and safety of their chosen brokers. The potential for scams and fraudulent activities is a reality in this unregulated space, making it essential for traders to conduct thorough due diligence. This article aims to provide an objective assessment of Rosystyle Wealth by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we analyzed various online resources, including reviews from established financial platforms, regulatory databases, and user feedback. Our evaluation framework focuses on critical aspects such as regulatory compliance, company transparency, trading costs, customer security, and user experiences to determine whether Rosystyle Wealth is indeed safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A well-regulated broker is more likely to adhere to strict financial standards and protect traders' interests. Unfortunately, Rosystyle Wealth lacks valid regulatory oversight, which raises significant concerns regarding its operations.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a regulatory license indicates that Rosystyle Wealth may not be subject to any credible oversight, which is a red flag for potential investors. Regulatory bodies, such as the FCA in the UK or ASIC in Australia, are known for their stringent requirements to ensure broker transparency and client protection. The lack of such oversight means that traders using Rosystyle Wealth have limited recourse in the event of disputes or financial mishandling.

Moreover, the broker's claims of being established in the UK and having a global presence seem dubious without proper regulatory backing. The absence of a verified license also suggests that the broker may not be compliant with industry standards, further questioning its legitimacy. Thus, when asking, "Is Rosystyle Wealth safe?" the answer leans toward caution due to its unregulated status.

Company Background Investigation

Rosystyle Wealth claims to have been established in 2006, with a focus on providing diverse financial products to a global clientele. However, the lack of transparency surrounding its ownership and management structure raises additional concerns. The company's website offers limited information about its founders or executive team, which is a common characteristic of less reputable brokers.

A deeper investigation reveals that the broker's operational history is murky, with no clear evidence of its past compliance with industry standards. The absence of a verifiable track record makes it challenging to assess the company's credibility and operational practices. Furthermore, the company's claims of having a global presence and multiple branches in various regions appear unsubstantiated without any supporting documentation or regulatory recognition.

The overall transparency and information disclosure level regarding Rosystyle Wealth is alarmingly low. This lack of clarity can be detrimental to traders who rely on detailed information to make informed decisions. Therefore, when considering whether "Is Rosystyle Wealth safe?" the company's opacity and questionable history contribute to a negative assessment.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders looking to evaluate the overall cost of trading. Rosystyle Wealth claims to provide competitive spreads and various account types; however, the specifics of these trading conditions require careful examination. The broker advertises spreads starting from 0.0 pips and leverages up to 1:400, which may appear enticing at first glance.

| Cost Type | Rosystyle Wealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

However, the absence of clear information regarding commissions and overnight interest rates raises questions about hidden fees that may not be immediately apparent to traders. Unusual fee structures can lead to unexpected costs, which can significantly impact a trader's profitability. Without transparency in these areas, traders may find themselves facing higher costs than anticipated.

Additionally, the claims of ultra-low trading costs should be approached with skepticism, particularly given the broker's lack of regulatory oversight. Traders should be wary of brokers that promise exceptionally low costs, as this can sometimes be a tactic to lure unsuspecting investors into potentially unfavorable trading conditions. Thus, when evaluating "Is Rosystyle Wealth safe?" the ambiguous trading conditions and lack of clarity on fees suggest that caution is warranted.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. Rosystyle Wealth's approach to fund security is critical in determining whether it is a safe broker. Unfortunately, the broker does not provide substantial information about its fund security measures, including whether it segregates client funds from its operational funds, a practice that is standard among reputable brokers.

Furthermore, the absence of information regarding investor protection schemes or negative balance protection policies raises significant red flags. Traders should be aware that without such protections, they may be at risk of losing more than their initial investment in volatile market conditions.

In the past, there have been reports of issues related to fund security and withdrawal difficulties with brokers lacking proper oversight. Without a clear history of safe fund management practices, potential investors should approach Rosystyle Wealth with caution. Therefore, when asking, "Is Rosystyle Wealth safe?" the lack of transparency and security measures significantly undermines its credibility.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability and overall service quality. An analysis of online reviews and forums reveals mixed experiences among Rosystyle Wealth's clients. While some users report satisfactory trading experiences, a significant number of complaints highlight issues related to withdrawals, customer service responsiveness, and overall transparency.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow |

| Lack of Transparency | High | No Response |

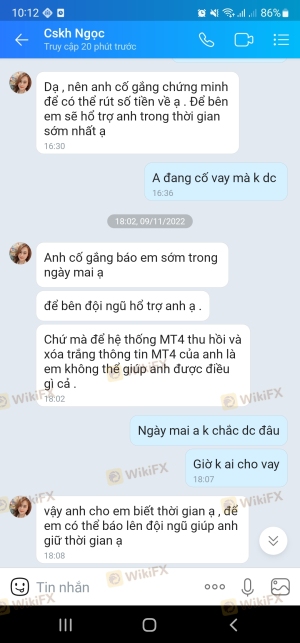

Common complaints include prolonged withdrawal processes, which can be a significant concern for traders looking to access their funds quickly. Additionally, the quality of customer support has been criticized, with users reporting slow response times and unhelpful answers to inquiries. These issues can create a frustrating trading environment and indicate a lack of commitment to customer service.

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to a loss of confidence in the broker's reliability. Such experiences raise concerns about Rosystyle Wealth's commitment to maintaining a trustworthy relationship with its clients. Therefore, the answer to "Is Rosystyle Wealth safe?" is further complicated by the negative customer experiences reported by users.

Platform and Trade Execution

The trading platform's performance is a critical factor in determining the overall trading experience. Rosystyle Wealth claims to offer a robust trading platform, yet the lack of specific details regarding its stability and user experience is concerning. Traders need a reliable platform that ensures smooth order execution, minimal slippage, and a user-friendly interface.

A review of user feedback indicates mixed experiences with the trading platform's performance. Some users report satisfactory execution speeds, while others highlight issues with slippage and order rejections, which can significantly impact trading outcomes. Additionally, there are concerns about potential platform manipulation, a serious issue that can undermine trader confidence.

In the absence of comprehensive information about its trading platform and execution quality, traders should be cautious. A broker's inability to provide a reliable trading environment can lead to substantial financial losses. Thus, when considering "Is Rosystyle Wealth safe?" the mixed reviews regarding platform performance and execution quality warrant careful consideration.

Risk Assessment

Using Rosystyle Wealth involves several risks that traders need to be aware of. The lack of regulatory oversight, ambiguous trading conditions, and negative customer experiences contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Financial Risk | Medium | Unclear fee structures and costs. |

| Operational Risk | High | Reports of withdrawal issues and poor customer support. |

To mitigate these risks, traders should consider the following strategies:

- Conduct Thorough Research: Before engaging with any broker, ensure you have adequate information regarding their regulatory status, trading conditions, and customer feedback.

- Start Small: If you decide to trade with Rosystyle Wealth, consider starting with a small investment until you gain confidence in their operations.

- Monitor Transactions Closely: Keep track of your trades and withdrawals to identify any issues early on.

In conclusion, the risks associated with using Rosystyle Wealth are significant, particularly due to the lack of regulatory oversight and transparency in their operations.

Conclusion and Recommendations

After a comprehensive analysis of Rosystyle Wealth, it is evident that the broker raises several red flags that potential investors should consider. The absence of regulatory oversight, coupled with ambiguous trading conditions and negative customer experiences, suggests that traders should exercise caution when dealing with this broker.

In response to the question, "Is Rosystyle Wealth safe?" the evidence indicates that there are considerable risks associated with trading through this platform. As such, it may be prudent for traders to seek alternatives that offer better regulatory protection and customer service.

For those seeking reliable trading options, consider brokers that are well-regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of positive customer experiences. By prioritizing safety and transparency, traders can better protect their investments in the volatile forex market.

Is ROSYSTYLE WEALTH a scam, or is it legit?

The latest exposure and evaluation content of ROSYSTYLE WEALTH brokers.

ROSYSTYLE WEALTH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROSYSTYLE WEALTH latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.