Is ROSYSTYLE safe?

Business

License

Is Rosystyle Safe or Scam?

Introduction

Rosystyle is an online forex broker that has garnered attention in the trading community for its diverse offerings and competitive trading conditions. However, with the proliferation of scams in the forex market, traders must exercise caution when selecting a broker. The reputation and reliability of a broker can significantly impact a trader's experience and financial safety. This article aims to provide a comprehensive analysis of Rosystyle, assessing its safety, regulatory compliance, and overall trustworthiness. Our evaluation is based on a thorough review of multiple sources, including regulatory databases, user reviews, and industry reports, to paint a clear picture of whether Rosystyle is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy. Brokers regulated by reputable authorities are generally considered safer, as they are required to adhere to strict guidelines designed to protect investors. In the case of Rosystyle, the broker's regulatory information raises several red flags.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Rosystyle does not appear to have any valid regulatory licenses, which is a significant concern for potential investors. Without oversight from a recognized authority, there is little assurance regarding the broker's operations, customer fund protection, and adherence to industry standards. Moreover, the absence of regulatory oversight can lead to higher risks of fraud and malpractice. Historical compliance issues with similar brokers further underscore the necessity for thorough due diligence. Therefore, it is essential for traders to ask themselves: Is Rosystyle safe?

Company Background Investigation

Rosystyle Wealth Limited, the parent company of the broker, was established in 2016 and claims to have a global presence, including branches in major financial hubs. However, the lack of transparency regarding its ownership structure and management team raises concerns. The company's website provides limited information about its founders or key personnel, which is often a warning sign.

The management team's experience and qualifications are critical in assessing the broker's reliability. If the leadership lacks expertise in trading or financial services, it could indicate potential operational issues. Furthermore, the company's transparency regarding its business practices is questionable, as many users have reported difficulties in obtaining clear information about its services. This lack of openness leads to doubts about whether Rosystyle is safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, understanding its fee structure is vital. Rosystyle advertises competitive spreads and low trading costs, but potential traders should scrutinize these claims closely. Unusual fees or hidden charges can significantly affect a trader's profitability.

| Fee Type | Rosystyle | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

While Rosystyle appears to offer lower spreads compared to the industry average, the absence of a clear commission structure can be concerning. Traders might find themselves facing unexpected costs that could erode their profits. It is crucial to investigate whether these fees are clearly disclosed and whether they align with industry standards. This brings us back to the question: Is Rosystyle safe? The potential for hidden fees makes it imperative for traders to conduct thorough research before committing funds.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. A reliable broker should implement robust security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, information regarding Rosystyle's client fund safety measures is scarce.

While some reviews indicate that the broker claims to use segregated accounts, there is no independent verification of these claims. Moreover, the lack of a clear investor protection policy raises concerns about the potential risks involved in trading with Rosystyle. Historical issues with fund safety among similar brokers further exacerbate these concerns. Traders must weigh these factors carefully when asking themselves, Is Rosystyle safe?

Customer Experience and Complaints

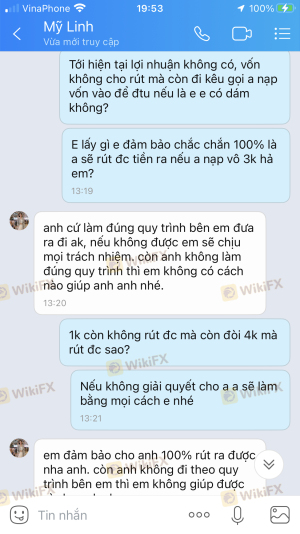

Customer feedback is invaluable in assessing a broker's reliability. Reviews for Rosystyle are mixed, with a significant number of users reporting difficulties in withdrawals, poor customer service, and lack of responsiveness. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service | Medium | Inconsistent |

| Transparency of Fees | High | Lack of Clarity |

Several users have shared experiences of being unable to withdraw funds after making deposits, which is a major red flag. The company's slow response to inquiries and complaints further diminishes its credibility. Such negative feedback raises serious questions about whether Rosystyle is safe for potential investors.

Platform and Trade Execution

The trading platform's performance is another crucial aspect of a broker's reliability. Rosystyle claims to offer a user-friendly trading environment with advanced tools and features. However, the stability and execution quality of the platform are vital for successful trading.

Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes. Additionally, any signs of platform manipulation should be investigated thoroughly. A broker that fails to provide a reliable trading platform may not be trustworthy. Therefore, it is essential to consider whether Rosystyle is safe for trading based on these experiences.

Risk Assessment

Using Rosystyle presents several risks that potential traders should be aware of. The absence of regulatory oversight, mixed customer reviews, and unclear fee structures contribute to a high-risk environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential hidden fees and charges |

| Operational Risk | Medium | Customer service and withdrawal issues |

To mitigate these risks, traders should consider starting with a small deposit and conducting thorough research before escalating their investment. It is crucial to remain vigilant and cautious when dealing with brokers like Rosystyle.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rosystyle raises several concerns regarding its safety and reliability as a forex broker. The lack of regulatory oversight, mixed customer feedback, and unclear fee structures indicate potential risks for traders. Therefore, it is essential for prospective clients to ask themselves: Is Rosystyle safe? Based on the information presented, it may be prudent to seek alternative brokers with established regulatory frameworks and positive customer experiences.

For traders seeking reliable options, consider brokers that are well-regulated and have demonstrated a commitment to transparency and customer service. Always conduct thorough research and due diligence before making any financial commitments.

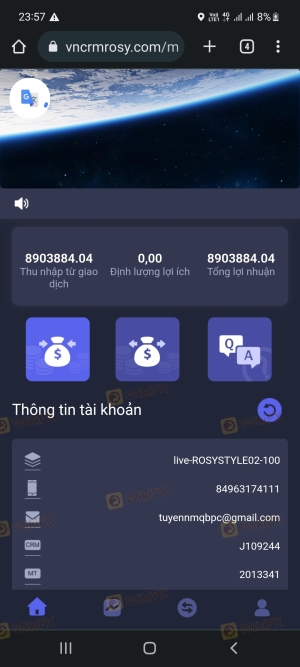

Is ROSYSTYLE a scam, or is it legit?

The latest exposure and evaluation content of ROSYSTYLE brokers.

ROSYSTYLE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROSYSTYLE latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.