Is RONGXIN safe?

Business

License

Is Rongxin Safe or a Scam?

Introduction

Rongxin is a forex broker that has emerged in the competitive landscape of online trading, particularly in the Asian markets. With the rapid expansion of the forex industry, traders are often drawn to brokers that promise high returns and advanced trading platforms. However, the influx of unregulated and potentially fraudulent brokers has made it imperative for traders to exercise caution and conduct thorough due diligence before investing their hard-earned money. This article aims to analyze the legitimacy of Rongxin by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on various online sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory environment plays a crucial role in ensuring the safety and integrity of forex trading platforms. A well-regulated broker is typically required to adhere to strict compliance standards, providing traders with a level of protection against fraud and malpractice. Unfortunately, Rongxin appears to operate without any valid regulatory oversight, as indicated by multiple sources.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation raises significant concerns about the broker's legitimacy and operational practices. Without oversight from a recognized regulatory body, traders are exposed to potential risks, including the possibility of fund mismanagement, lack of transparency, and difficulties in withdrawing funds. Historical compliance issues have been reported, with claims of fund withholding and account locking, which further exacerbate the skepticism surrounding Rongxin's operations. This lack of regulatory framework is a significant red flag for anyone considering trading with Rongxin, leading to the question, "Is Rongxin safe?"

Company Background Investigation

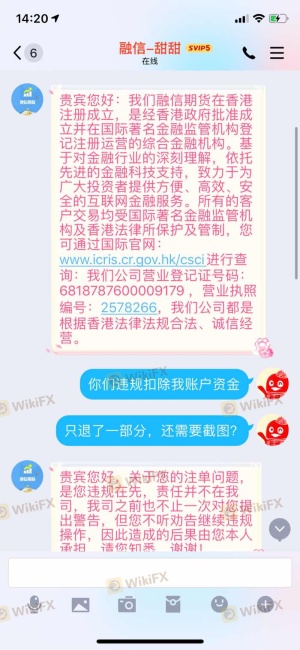

Rongxin operates under the name 香港融信期货投资理财有限公司 (Hong Kong Rongxin Futures Investment Management Limited). The company has been in operation for a few years, but its ownership structure and management team remain somewhat opaque. A thorough investigation reveals limited information about its founders and executive team, which is concerning for potential investors. Transparency in ownership and management is vital for establishing trust in a trading platform, and the lack of readily available information raises questions about the broker's reliability.

The company claims to be based in Hong Kong, which is known for its robust financial regulations. However, the absence of a valid license from any regulatory authority undermines this assertion. Furthermore, reports of suspicious business practices, including allegations of money laundering and fraudulent activities, further tarnish Rongxin's reputation. In light of these factors, it becomes increasingly difficult to answer the question, "Is Rongxin safe?"

Trading Conditions Analysis

Rongxin's trading conditions are another critical aspect that potential traders must evaluate. The broker offers various trading instruments, including forex pairs, commodities, and indices. However, the overall fee structure and trading costs have raised concerns among users. Reports indicate that Rongxin employs an unusual fee policy, which may include hidden charges and unfavorable trading conditions.

| Cost Type | Rongxin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | High | Average |

The high spreads and variable commission model could significantly affect trading profitability, especially for those employing high-frequency trading strategies. Moreover, the presence of hidden fees and unclear terms can lead to unexpected costs, making it challenging for traders to manage their budgets effectively. This lack of transparency in trading conditions raises further doubts about the broker's reliability, leading many to question, "Is Rongxin safe?"

Client Fund Safety

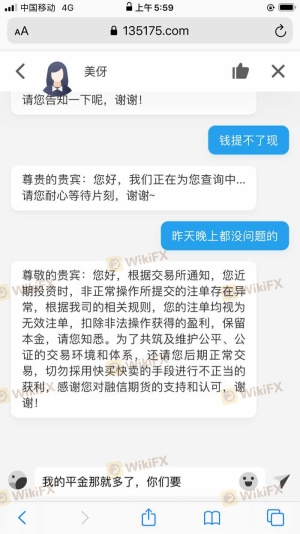

The safety of client funds is paramount when selecting a forex broker. Traders need to understand the measures a broker has in place to protect their investments. In the case of Rongxin, the absence of regulatory oversight raises serious concerns about the safety of client funds. Reports suggest that the broker does not implement adequate fund segregation practices, which means that traders' deposits may not be kept in separate accounts, exposing them to the risk of loss in the event of the broker's insolvency.

Additionally, there are no indications that Rongxin offers investor protection schemes or negative balance protection policies, which are essential features for safeguarding traders' capital. Historical issues, including allegations of fund withholding and account lockouts, have further compounded concerns about the broker's practices. Given these factors, it is crucial for traders to carefully consider whether "Is Rongxin safe?" before committing any funds.

Customer Experience and Complaints

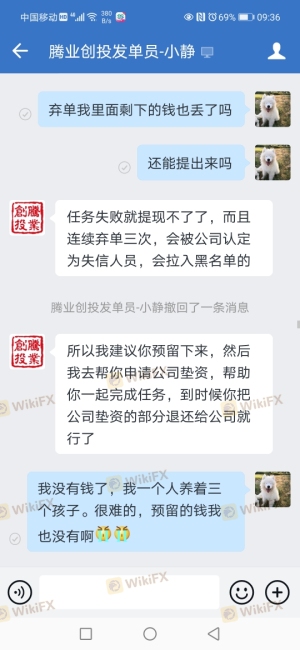

Customer feedback is invaluable in assessing the legitimacy of a forex broker. In the case of Rongxin, numerous user reviews indicate a pattern of complaints related to withdrawal difficulties, poor customer service, and account management issues. Many users have reported being unable to withdraw their funds after making deposits, which is a significant red flag in the forex industry.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Lockouts | High | Poor |

| Customer Service Quality | Medium | Poor |

Typical complaints include users being pressured to deposit more funds, only to find their accounts locked or their withdrawal requests denied. This troubling pattern has led many to label Rongxin as a scam, prompting the question, "Is Rongxin safe?" The overall sentiment among users suggests a lack of trust and confidence in the broker's ability to operate ethically.

Platform and Execution

The trading platform offered by Rongxin is another area of concern. Users have reported issues with platform stability, order execution quality, and instances of slippage. A reliable trading platform should provide seamless execution and minimal slippage, but many users have expressed dissatisfaction with their trading experiences on Rongxin's platform.

The reports of execution delays and high slippage rates raise suspicions about potential platform manipulation, which can severely impact traders' profitability. Given these concerns, it is essential for traders to question the reliability of Rongxin's trading environment and consider whether "Is Rongxin safe?" for their trading activities.

Risk Assessment

The overall risk profile associated with trading with Rongxin is concerning. The lack of regulation, combined with negative user experiences and questionable trading conditions, presents a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Lack of fund segregation |

| Trading Condition Risk | Medium | High spreads and hidden fees |

| Customer Service Risk | High | Poor response to complaints |

Given these risks, traders should approach Rongxin with caution. It is advisable to seek alternative brokers with robust regulatory oversight and a positive reputation in the market.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rongxin presents several red flags that warrant concern. The absence of regulatory oversight, poor customer feedback, and questionable trading conditions raise significant doubts about the broker's legitimacy. For traders asking, "Is Rongxin safe?" the answer appears to lean toward caution.

For those considering trading in the forex market, it is recommended to choose brokers that are well-regulated and have a proven track record of reliability and transparency. Some reputable alternatives include brokers regulated by the FCA, ASIC, or NFA, which offer better protection for traders funds and more favorable trading conditions. Always conduct thorough research and consider starting with a demo account to assess a broker's platform and services before committing real funds.

Is RONGXIN a scam, or is it legit?

The latest exposure and evaluation content of RONGXIN brokers.

RONGXIN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RONGXIN latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.