Is QBIGINVEST safe?

Business

License

Is QBigInvest Safe or Scam?

Introduction

QBigInvest is a forex broker that has emerged in the competitive landscape of online trading, particularly targeting retail traders looking for accessible and diverse trading opportunities. With a low minimum deposit requirement and a variety of account types, QBigInvest aims to attract both novice and experienced traders. However, as with any financial service, it is crucial for traders to carefully assess the legitimacy and safety of the brokerage they choose. The forex market is rife with both reputable and fraudulent brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article investigates whether QBigInvest is a safe trading option or if it exhibits characteristics of a scam. Our evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

When evaluating the safety of any broker, regulatory oversight is a critical factor. A well-regulated broker provides a level of security and trust that is essential for protecting traders' investments. Unfortunately, QBigInvest operates without any valid regulatory oversight, which raises significant concerns about its legitimacy and accountability. Below is a summary of the regulatory status of QBigInvest:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulation means that QBigInvest does not adhere to the industry standards typically enforced by regulatory bodies. This lack of oversight can elevate the risk of fraudulent activities, market manipulation, and security breaches. Moreover, traders have limited recourse in the event of disputes or financial losses. The regulatory landscape is designed to protect investors, and operating without such oversight can be a major red flag. Historical compliance issues in the absence of regulation can lead to a lack of trust and security for users. Thus, the question remains: Is QBigInvest safe? Based on its regulatory status, potential investors should proceed with caution.

Company Background Investigation

Understanding a broker's history and ownership structure is vital in assessing its reliability. QBigInvest was reportedly founded in the last few years and is registered in Saint Vincent and the Grenadines. While this offshore location is common among many forex brokers, it often lacks the rigorous regulatory frameworks found in more established jurisdictions. The ownership structure of QBigInvest is not transparently disclosed, which complicates the assessment of its accountability.

The management team behind QBigInvest has not been prominently featured in available resources, making it difficult to evaluate their experience and qualifications. Transparency in information disclosure is crucial for building trust with clients, and the lack of detailed information about the management team raises concerns. Without a clear understanding of who is operating the brokerage, traders may find it challenging to assess the companys credibility. Therefore, the opacity surrounding QBigInvest's operational structure further complicates the question of whether QBigInvest is safe for potential traders.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, can significantly impact a trader's profitability. QBigInvest offers various account types, with spreads starting at 1.8 pips for fixed accounts and as low as 1.1 pips for standard variable accounts. However, the lack of transparency regarding other potential fees can be concerning. Heres a comparison of QBigInvest's core trading costs:

| Fee Type | QBigInvest | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not specified | 0.5% - 2% |

While QBigInvest claims to offer competitive spreads, the absence of a clear commission structure and overnight interest rates can lead to unexpected costs for traders. This lack of clarity can be a potential warning sign, suggesting that traders may face hidden fees that could erode their profits. Thus, while QBigInvest advertises attractive trading conditions, the ambiguity surrounding its fee structure raises further doubts about whether QBigInvest is safe for trading.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. QBigInvest has not provided clear information regarding its measures for fund security, such as fund segregation and negative balance protection. The absence of such policies can expose traders to significant financial risks. Without regulatory oversight, there are no guarantees that client funds are kept in separate accounts, which is a common practice among regulated brokers to protect client assets in the event of bankruptcy.

Furthermore, historical issues regarding fund safety have been reported by users, indicating a potential lack of effective security measures. These concerns underscore the importance of understanding how a broker safeguards client funds and the potential risks involved. As such, traders must carefully consider whether QBigInvest is safe, especially given the lack of transparency in its financial security policies.

Customer Experience and Complaints

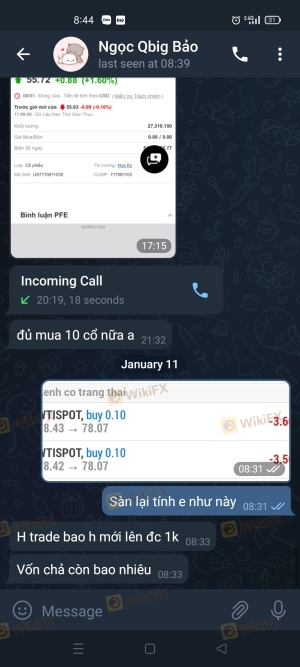

Customer feedback is a vital component in assessing the reliability of a broker. Reviews for QBigInvest have been mixed, with several users reporting negative experiences. Common complaints include difficulties in fund withdrawals, poor customer service responses, and issues with trade execution. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Quality | Medium | Inconsistent support |

| Trade Execution Problems | High | Unresolved issues |

Several traders have reported challenges in withdrawing their funds, indicating a potential risk of fraud. For example, one user claimed to have lost a significant amount due to poor guidance from customer support, which failed to provide accurate trading instructions. These types of complaints raise serious questions about the operational integrity of QBigInvest. Therefore, potential traders should be cautious and consider whether QBigInvest is safe based on the negative experiences shared by other users.

Platform and Trade Execution

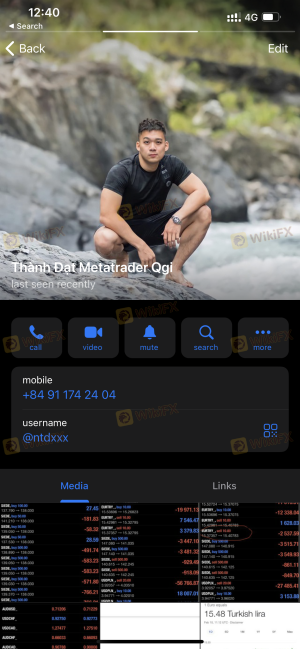

The performance of a trading platform is crucial for executing trades efficiently. QBigInvest offers access to popular platforms such as MetaTrader 4, which is well-regarded for its user-friendly interface and robust analytical tools. However, reports of slippage and order rejections have surfaced, which can impact trading performance. The quality of trade execution is essential for successful trading, and any signs of manipulation or poor performance could be detrimental.

Moreover, the overall stability of the platform is a critical factor in determining whether QBigInvest is safe. If users consistently experience technical issues or delays in order fulfillment, it can lead to financial losses and frustration. Traders should be aware of these potential pitfalls when considering QBigInvest as a trading option.

Risk Assessment

Using QBigInvest comes with inherent risks that potential traders should be aware of. The lack of regulation, combined with customer complaints and unclear trading conditions, creates a landscape of heightened risk. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Financial Risk | Medium | Unclear fees and withdrawal issues can lead to losses. |

| Operational Risk | High | Complaints about execution and customer service. |

To mitigate these risks, traders should approach QBigInvest with caution. It is advisable to start with a small investment, utilize demo accounts to familiarize oneself with the platform, and conduct thorough research before making significant financial commitments. Understanding the risks involved is essential for ensuring a safer trading experience.

Conclusion and Recommendations

After a comprehensive analysis of QBigInvest, it is evident that potential traders should exercise caution. The absence of regulatory oversight, coupled with negative customer experiences and unclear trading conditions, raises significant concerns about the safety and legitimacy of this broker. While QBigInvest offers some attractive trading features, the risks associated with trading on this platform cannot be overlooked.

In conclusion, QBigInvest is not considered safe for traders seeking a reliable and secure trading environment. For those looking for trustworthy alternatives, brokers with robust regulatory frameworks and positive customer feedback, such as IG Group or OANDA, may be more suitable options. Always prioritize safety and transparency when choosing a forex broker to protect your investments effectively.

Is QBIGINVEST a scam, or is it legit?

The latest exposure and evaluation content of QBIGINVEST brokers.

QBIGINVEST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QBIGINVEST latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.