Is Prudent International safe?

Business

License

Is Prudent International Safe or Scam?

Introduction

Prudent International is a forex broker that has positioned itself as a player in the competitive online trading market. With claims of offering various trading instruments, including forex, commodities, and indices, it attracts traders looking for potentially high returns. However, the integrity of forex brokers is paramount, as traders need to ensure that their investments are secure and that they are dealing with a reputable entity. Given the prevalence of scams in the forex industry, it is crucial for traders to conduct thorough due diligence before committing their funds. This article investigates the legitimacy of Prudent International by examining its regulatory status, company background, trading conditions, customer safety measures, and user feedback.

Regulation and Legitimacy

The regulation of forex brokers is vital for ensuring the safety of traders' funds and maintaining market integrity. A well-regulated broker is typically subject to strict oversight, which can provide a layer of security for investors. In the case of Prudent International, the broker claims to be regulated by various authorities, including Indonesia's Bappebti and the ICDX. However, investigations reveal that these claims may be misleading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | N/A | Indonesia | Not Listed |

| ICDX | N/A | Indonesia | Not Listed |

| Belize FSC | N/A | Belize | Not Listed |

The lack of valid regulatory oversight raises significant concerns regarding the safety of funds with Prudent International. The absence of a license from recognized regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) indicates that this broker operates in a high-risk environment. Furthermore, the inability to find Prudent International in the databases of these regulatory agencies suggests that it may not be a legitimate trading entity. Therefore, the question remains: Is Prudent International safe? The evidence leans towards a negative response, as the broker does not appear to have the necessary regulatory framework to protect its clients.

Company Background Investigation

Prudent International claims to have a robust operational history and a team of experienced professionals. However, a closer examination reveals a lack of transparency regarding its ownership structure and management team. The broker's website provides minimal information about its founders or key executives, which is a red flag for potential investors. A credible broker typically discloses detailed information about its management to instill trust among its clients.

The company's operational base is reportedly located in Belize, a jurisdiction often associated with less stringent regulatory requirements. This raises concerns about the broker's accountability and the protection of client funds. Additionally, the absence of a clear and accessible history of compliance with industry standards further compounds the skepticism surrounding Prudent International. Given these factors, it is challenging to ascertain whether Prudent International is safe for traders looking to invest their hard-earned money.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Prudent International claims to provide competitive spreads and leverage options. However, the reality may not align with these assertions. The broker has a minimum deposit requirement of $2,000, which is significantly higher than the industry average, often ranging between $100 and $250. This high barrier to entry could deter many potential traders.

| Fee Type | Prudent International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the broker advertises spreads starting from 1.5 pips, actual trading conditions reveal that spreads are typically around 2 pips, which is higher than many regulated brokers. Additionally, there is no clear information regarding commission structures or overnight interest rates, further obscuring the true cost of trading with Prudent International. This lack of transparency raises questions about whether Prudent International is safe for traders, as unclear fee structures can lead to unexpected costs that erode profits.

Customer Funds Safety

The safety of customer funds is a critical consideration when determining the legitimacy of a forex broker. Prudent International claims to implement various measures to safeguard client funds, such as segregated accounts. However, without regulatory oversight, these claims lack credibility. The broker's website does not provide detailed information about its fund protection policies or whether it offers negative balance protection, which is a standard feature among reputable brokers.

The absence of investor compensation schemes and the vague descriptions of fund security measures suggest that traders' investments may not be adequately protected. Historical complaints and reports of fund mismanagement associated with unregulated brokers further exacerbate these concerns. Therefore, potential investors must carefully consider whether Prudent International is safe, as the lack of robust safety measures could put their funds at significant risk.

Customer Experience and Complaints

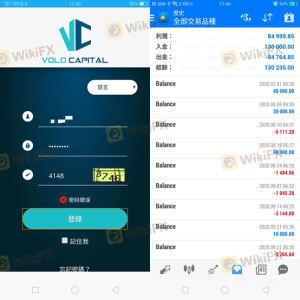

Analyzing customer feedback is essential for understanding the overall reputation of a broker. Reviews of Prudent International reveal a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and misleading marketing practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Several users have reported that after making initial deposits, they encountered challenges when attempting to withdraw their funds, often facing delays or outright refusals. These experiences indicate a troubling trend that raises questions about the integrity of Prudent International. For instance, one user reported being pressured to deposit more funds before being allowed to withdraw their initial investment, a tactic commonly associated with fraudulent brokers. Given these alarming reports, it is crucial to ask whether Prudent International is safe for prospective traders.

Platform and Execution

The trading platform used by a broker is a significant factor influencing the trading experience. Prudent International utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and comprehensive trading tools. However, user reviews suggest that the platform may suffer from issues such as slippage and delayed order execution, which can adversely affect trading outcomes.

Traders have reported instances of orders being rejected or executed at unfavorable prices, raising concerns about the broker's operational integrity. These issues can significantly impact a trader's ability to manage their positions effectively. If a broker manipulates platform performance or fails to execute trades as promised, it can lead to substantial financial losses. Therefore, the question remains: Is Prudent International safe? The evidence suggests that potential traders should exercise caution when considering this broker.

Risk Assessment

Engaging with a broker like Prudent International involves inherent risks. The lack of regulatory oversight, combined with negative user experiences and unclear trading conditions, contributes to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | High minimum deposit and unclear fees |

| Operational Risk | Medium | Potential issues with platform execution |

Given these risk factors, traders should approach Prudent International with extreme caution. It is advisable to consider alternative brokers with established regulatory frameworks and a proven track record of reliability. For those who still wish to engage with Prudent International, implementing strict risk management strategies and only risking funds that one can afford to lose is essential.

Conclusion and Recommendations

In conclusion, the investigation into Prudent International reveals several alarming concerns that suggest it may not be a trustworthy broker. The lack of valid regulatory oversight, combined with negative user feedback and unclear trading conditions, raises significant doubts about the safety of investing with this broker. Therefore, it is reasonable to conclude that Prudent International is not safe and may pose a considerable risk to traders.

For those seeking reliable trading options, it is recommended to consider brokers that are well-regulated and have a proven history of positive customer experiences. Options such as brokers regulated by the FCA or CySEC could offer a more secure trading environment. Ultimately, traders must prioritize their safety and due diligence when selecting a broker in the forex market.

Is Prudent International a scam, or is it legit?

The latest exposure and evaluation content of Prudent International brokers.

Prudent International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prudent International latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.