Is Proactive Trade safe?

Business

License

Is Proactive Trade A Scam?

Introduction

Proactive Trade is an online trading broker that positions itself within the forex market, claiming to offer a wide range of trading services, including forex, commodities, and cryptocurrencies. In the increasingly crowded and competitive landscape of online trading, it is crucial for traders to carefully assess the legitimacy and reliability of trading platforms before committing their funds. The rise of online trading has unfortunately also given way to numerous scams, making it essential for potential investors to conduct thorough due diligence. This article will delve into the various aspects of Proactive Trade, evaluating its regulatory status, company background, trading conditions, customer experience, and overall safety to determine whether Proactive Trade is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. Proactive Trade has been flagged as an unregulated broker, which means it operates without oversight from any major financial regulatory authority. This raises significant concerns regarding the safety of traders' funds and the potential for fraudulent activities. The absence of regulation implies that traders have limited legal recourse in the event of disputes or issues related to fund withdrawals.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework can expose traders to various risks, including the possibility of losing their investments without any means of recovery. Regulatory bodies like the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) provide essential protections for traders, ensuring that brokers are held accountable for their actions. However, Proactive Trade has not been registered with any such authorities, which raises red flags about its operational legitimacy.

Company Background Investigation

Understanding the background of Proactive Trade is essential in assessing its credibility. Unfortunately, limited information is available regarding the company's history, ownership structure, or management team. The lack of transparency surrounding these critical aspects makes it challenging to gauge the broker's reliability.

Typically, reputable brokers provide comprehensive details about their founders and management teams, including their qualifications and industry experience. In the case of Proactive Trade, this information is conspicuously absent. This lack of disclosure can be a warning sign, as legitimate companies usually prioritize transparency to build trust with their clients.

Furthermore, the company's website does not provide a physical address or any verifiable contact information, which is another indication that Proactive Trade may not be safe. The absence of a clear operational history and ownership details further complicates any trust a trader might have in this broker.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer play a significant role in the decision-making process. Proactive Trade claims to provide competitive spreads and a variety of trading instruments; however, the lack of transparency regarding their fees raises concerns. Traders should be wary of any broker that does not clearly outline its fee structure.

| Fee Type | Proactive Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information about spreads, commissions, and overnight fees can be a red flag. Traders may find themselves facing hidden charges or unfavorable trading conditions that were not disclosed upfront. This lack of clarity can lead to unexpected costs, making it imperative for traders to proceed with caution when dealing with Proactive Trade.

Customer Funds Security

The safety of customer funds is paramount in the trading industry. Proactive Trades lack of regulation raises significant concerns about the security measures in place to protect traders' investments. Reputable brokers typically implement strong security protocols, such as segregating client funds, offering investor protection schemes, and providing negative balance protection.

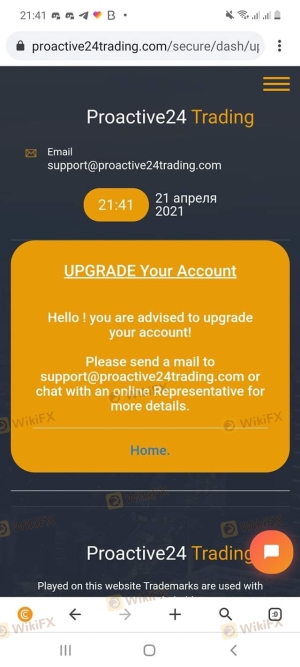

However, Proactive Trade does not provide clear information regarding these safety measures. The absence of a robust security framework leaves traders vulnerable to potential fraud or mismanagement of their funds. Additionally, there have been reports of difficulties in withdrawing funds from the platform, further highlighting concerns about the safety of investments made with Proactive Trade.

Customer Experience and Complaints

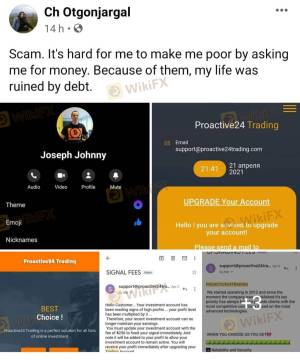

Customer feedback is a valuable resource for assessing the reliability of a trading platform. Reviews of Proactive Trade reveal a pattern of complaints from users, primarily revolving around withdrawal issues and lack of responsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Service | Medium | Poor |

Many users have reported that their withdrawal requests were either ignored or took an excessively long time to process. In some cases, traders claimed they were asked to pay additional fees before their withdrawals could be processed, which is a common tactic used by scam brokers. These patterns of complaints suggest that Proactive Trade may not be safe for traders looking for a reliable platform.

Platform and Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Proactive Trade's platform has been described as unstable, with reports of frequent downtime and execution issues. Traders have noted instances of slippage and rejected orders, which can significantly impact trading outcomes.

The quality of order execution is vital for traders, and any signs of manipulation or unfair practices can be detrimental to a broker's reputation. The lack of transparency surrounding Proactive Trade's execution policies further raises concerns about its legitimacy and reliability.

Risk Assessment

Engaging with unregulated brokers like Proactive Trade carries inherent risks. The absence of regulatory oversight, combined with a lack of transparency and numerous complaints, paints a concerning picture for potential investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Withdrawal Risk | High | Reports of withdrawal issues and delays |

| Transparency Risk | Medium | Lack of clear information about fees and policies |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer satisfaction. It is essential to conduct thorough research and only engage with platforms that prioritize transparency and customer protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that Proactive Trade is not safe for traders. The lack of regulation, transparency, and numerous customer complaints indicate potential fraudulent practices. Traders should exercise extreme caution when considering this broker for their trading activities.

For those seeking reliable trading platforms, it is advisable to explore options that are regulated by reputable authorities and have positive user reviews. Brokers like IG, OANDA, and Forex.com are examples of platforms that have established a solid reputation within the trading community. Always prioritize safety and due diligence when selecting a trading partner to protect your investments.

Is Proactive Trade a scam, or is it legit?

The latest exposure and evaluation content of Proactive Trade brokers.

Proactive Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Proactive Trade latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.