Regarding the legitimacy of PFCForex forex brokers, it provides FCA, ASIC and WikiBit, (also has a graphic survey regarding security).

Is PFCForex safe?

Business

License

Is PFCForex markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Panmure Liberum Limited

Effective Date:

2005-02-11Email Address of Licensed Institution:

amber.wood@panmureliberum.comSharing Status:

No SharingWebsite of Licensed Institution:

www.panmureliberum.comExpiration Time:

--Address of Licensed Institution:

Ropemaker Place, Level 12 25 Ropemaker Street London EC2Y 9LY UNITED KINGDOMPhone Number of Licensed Institution:

+4402031002000Licensed Institution Certified Documents:

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

KAKARIKI CAPITAL PTY LIMITED

Effective Date:

2010-09-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 12, 17 Castlereagh Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is PFCForex Safe or Scam?

Introduction

PFCForex is an online forex broker that positions itself as a facilitator for traders looking to engage in the foreign exchange market. As a relatively new entrant, it claims to offer a wide range of trading instruments, including currencies, commodities, and indices. However, the influx of online trading platforms has made it increasingly important for traders to exercise caution and thoroughly evaluate the credibility of their chosen brokers. This article aims to investigate whether PFCForex is a safe trading option or a potential scam. Our assessment will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experience, and risk factors associated with the broker.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety for traders. Regulatory bodies enforce standards that protect traders from fraud and ensure that brokers operate transparently. In the case of PFCForex, there is limited information regarding its regulatory oversight, which raises concerns about its credibility.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license from a recognized authority such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is a significant red flag. A broker without proper regulation may not adhere to industry standards for transparency and client fund protection. This lack of oversight can lead to potential risks for traders, including the possibility of fund mismanagement and withdrawal issues. Hence, it is essential to consider is PFCForex safe when evaluating its regulatory compliance.

Company Background Investigation

PFCForex's company history and ownership structure are vital components in assessing its reliability. Unfortunately, there is scant information available about the broker's establishment date, ownership, and operational history. The lack of transparency regarding the management team and their professional backgrounds further complicates the evaluation.

A credible broker typically provides detailed information about its founders and key executives, along with their experience in the financial sector. This information helps build trust among potential clients. In the case of PFCForex, the absence of such details raises questions about its operational integrity. Potential clients should be wary of brokers that do not disclose their ownership structure or management team, as this could indicate a lack of accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by PFCForex is essential for evaluating its competitiveness in the market. The broker claims to offer competitive spreads and various account types; however, specific details about fees and commissions are not readily available on their website.

| Fee Type | PFCForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clear information regarding trading costs may indicate hidden fees or unfavorable trading conditions. Traders should be cautious of brokers that do not provide transparent fee structures, as this could lead to unexpected costs and reduced profitability. Therefore, it is crucial to assess is PFCForex safe in terms of its trading conditions and cost transparency.

Customer Fund Security

The safety of customer funds is a top priority when selecting a forex broker. PFCForex's policies regarding fund security, including the segregation of client funds and negative balance protection, are critical factors to consider. A reputable broker typically keeps client funds in segregated accounts, ensuring that they are not used for operational expenses. This practice safeguards traders' money in the event of the broker's insolvency.

Unfortunately, there is no clear information available about PFCForex's fund protection measures. The absence of such details may indicate a lack of commitment to safeguarding client assets. Traders should be particularly cautious with brokers that do not provide explicit information about their fund security policies. Evaluating whether is PFCForex safe involves scrutinizing its commitment to protecting client funds.

Customer Experience and Complaints

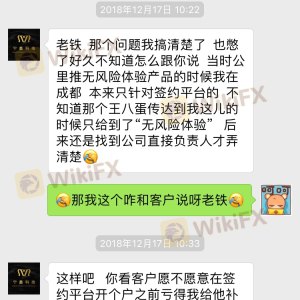

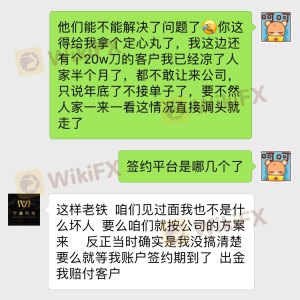

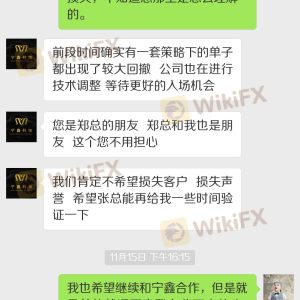

Customer feedback is a valuable indicator of a broker's reliability and service quality. An analysis of reviews and complaints about PFCForex reveals a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised concerns about withdrawal issues and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. A broker's ability to process withdrawals promptly is a critical aspect of its credibility. Reviews highlighting withdrawal issues should be taken seriously, as they can indicate potential problems with the broker's operational integrity. Hence, it is essential to question is PFCForex safe based on customer experiences and feedback.

Platform and Execution

The performance and stability of the trading platform are crucial for a seamless trading experience. PFCForex claims to offer a user-friendly platform; however, specific details about its execution quality, slippage rates, and order rejection incidents are not readily available. Traders should be cautious of brokers that do not provide comprehensive information about their trading platforms, as this could indicate potential manipulation or operational issues.

Risk Assessment

Trading with PFCForex carries inherent risks that traders should consider. A thorough risk assessment can help identify potential pitfalls associated with using this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No verified regulation. |

| Fund Security Risk | High | Lack of information on fund segregation. |

| Customer Service Risk | Medium | Reports of poor response times. |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and maintain realistic expectations about trading outcomes. Understanding the risks involved in trading with PFCForex is essential for making informed decisions.

Conclusion and Recommendations

In conclusion, the investigation into PFCForex raises several concerns regarding its safety and credibility. The lack of regulatory oversight, transparency about trading conditions, and mixed customer feedback indicate that traders should approach this broker with caution.

While some users may have positive experiences, the potential risks associated with unregulated brokers cannot be overlooked. For traders seeking a safer environment, it is advisable to consider more established and regulated options. Brokers like IC Markets, FXCM, and Pepperstone offer robust regulatory frameworks and transparent trading conditions, making them more trustworthy alternatives. Ultimately, being vigilant and well-informed is key to successful trading in the forex market.

Is PFCForex a scam, or is it legit?

The latest exposure and evaluation content of PFCForex brokers.

PFCForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PFCForex latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.