Is Owl Option safe?

Business

License

Is Owl Option Safe or Scam?

Introduction

Owl Option is a forex broker that positions itself in the competitive landscape of online trading, offering various financial instruments to traders. With the rise of online trading platforms, it's crucial for traders to conduct thorough assessments of brokers before committing their funds. This is particularly important as the forex market is rife with potential scams and unregulated entities that can jeopardize traders' investments. In this article, we will explore the safety and legitimacy of Owl Option by examining its regulatory status, company background, trading conditions, customer experience, and overall risk factors. Our analysis is based on a comprehensive review of available data, user feedback, and industry standards.

Regulatory and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. A broker operating under strict regulations is generally more trustworthy than one without oversight. Unfortunately, Owl Option has been found to lack valid regulatory licenses, which raises significant concerns regarding its legitimacy. The absence of regulation means that there is no authoritative body overseeing its operations, increasing the risk for traders.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of a regulatory framework can lead to issues such as unregulated trading practices, potential fraud, and a lack of recourse for clients in case of disputes. Additionally, the company has been reported to have a history of non-compliance with industry standards. Traders should be extremely cautious when dealing with unregulated brokers like Owl Option, as the risk of losing funds increases significantly.

Company Background Investigation

Owl Option's company history is relatively opaque, with little information available about its founding and ownership structure. The broker claims to have been operational for several years, but its domain registration suggests a more recent establishment. The lack of transparency regarding its ownership and management team further complicates the assessment of its credibility.

The management teams qualifications and experience are also essential indicators of a broker's reliability. However, there is minimal information available about the individuals behind Owl Option, making it difficult to evaluate their expertise and commitment to ethical trading practices. The absence of clear information about the company's operational history and management raises red flags for potential investors, leading to questions about the broker's integrity.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. Owl Option presents a mixed bag regarding its fee structure and trading conditions. While the broker advertises competitive spreads and commission structures, a closer examination reveals several potentially problematic policies that could impact traders negatively.

| Fee Type | Owl Option | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per trade |

| Overnight Interest Range | High | Low - Medium |

The variability in spreads can lead to increased trading costs, particularly during volatile market conditions. Additionally, the commission model is not clearly defined, which could result in unexpected fees that traders may not be prepared for. This lack of transparency in pricing can create a disadvantage for traders, making it essential to fully understand the cost implications before engaging with Owl Option.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. Unfortunately, Owl Option does not provide sufficient information regarding its fund security measures. Traders should look for brokers that implement strict fund segregation, investor protection policies, and negative balance protection to ensure their investments are safeguarded.

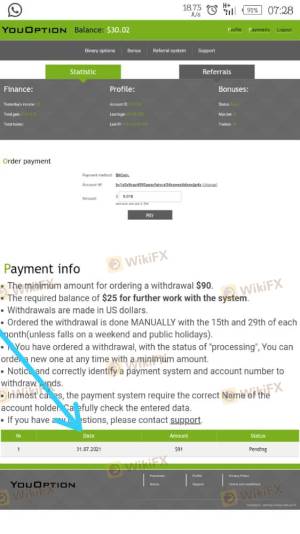

The absence of clear policies on fund security raises concerns about how Owl Option manages client funds. Reports of delayed withdrawals and unresponsive customer service further exacerbate these concerns, indicating potential issues with the broker's financial practices. Traders should be wary of engaging with a broker that lacks robust security measures, as it can lead to significant financial losses.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation and service quality. In the case of Owl Option, many users have reported negative experiences, particularly regarding withdrawal processes and customer support responsiveness. Common complaints include delayed withdrawals, unresponsive customer service, and lack of transparency regarding account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Lack of Transparency | High | Poor |

Several users have shared their experiences of attempting to withdraw funds, only to face prolonged delays and unresponsive communication from the broker. These issues indicate a lack of professionalism and reliability that can significantly impact traders' experiences. Potential clients should consider these complaints seriously when evaluating whether Owl Option is safe.

Platform and Execution

A broker's trading platform plays a critical role in the overall trading experience. Owl Option's platform has received mixed reviews regarding its performance and user experience. Users have reported issues with order execution quality, including slippage and high rejection rates, which can affect trading outcomes.

The presence of platform manipulation signs, such as unusual price movements or inconsistent order fills, can further diminish trust in the broker. Traders should prioritize platforms that offer stable performance and transparent execution practices to ensure a fair trading environment.

Risk Assessment

Engaging with any broker comes with inherent risks, and Owl Option is no exception. The absence of regulation, poor customer feedback, and questionable trading conditions contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Customer Service Risk | Medium | Unresponsive support and withdrawal issues |

| Financial Risk | High | Lack of transparency in fees and fund security |

To mitigate these risks, traders should conduct thorough research, consider using regulated alternatives, and approach Owl Option with caution. It may be wise to start with a small investment or explore demo accounts before committing larger sums.

Conclusion and Recommendation

In conclusion, the evidence suggests that Owl Option raises several concerns regarding its safety and legitimacy. The lack of regulatory oversight, poor customer feedback, and questionable trading conditions indicate potential risks for traders. While the broker may offer appealing trading options, the associated risks may outweigh the benefits.

For those considering trading with Owl Option, it is advisable to exercise caution and thoroughly evaluate all available information. If you are seeking a safer trading environment, consider exploring regulated alternatives with proven track records and positive customer experiences. Ultimately, the question of "Is Owl Option safe?" leans toward skepticism based on the current data and user experiences available.

Is Owl Option a scam, or is it legit?

The latest exposure and evaluation content of Owl Option brokers.

Owl Option Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Owl Option latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.