Is KILCOR safe?

Pros

Cons

Is Kilcor Safe or Scam?

Introduction

Kilcor is a forex brokerage that has recently garnered attention in the trading community. Positioned in the financial markets, it claims to offer a range of trading options, including forex, commodities, and indices. However, with the increasing number of unregulated brokers in the industry, traders are urged to exercise caution and perform thorough evaluations before committing their funds to any brokerage. This article aims to investigate whether Kilcor is a legitimate broker or a potential scam. The analysis is based on a comprehensive review of available information, including regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when assessing its legitimacy. Kilcor has been found to lack proper regulation, which raises significant concerns about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

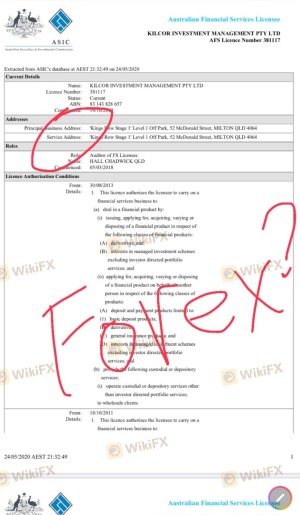

Without regulatory oversight, brokers can engage in practices that may not align with industry standards, exposing traders to potential risks. The absence of a valid license from recognized authorities like the ASIC (Australian Securities and Investments Commission) or FCA (Financial Conduct Authority) suggests that Kilcor operates outside the protective framework that these regulatory bodies provide. In our investigation, we found that Kilcor has been flagged for suspicious activities, and traders are advised to be cautious when dealing with unregulated entities.

Company Background Investigation

Kilcor Investment Management Pty Ltd, the entity behind Kilcor, was established around 2010. However, its operational history is marred by a lack of transparency regarding its ownership structure and management team.

The company's website provides limited information about its founders or key personnel, which is a red flag in the financial services industry. A well-established brokerage typically has a transparent organizational structure, detailing the backgrounds and qualifications of its management team. Unfortunately, Kilcor falls short in this regard, making it difficult for potential clients to assess the expertise and reliability of the individuals managing their investments.

Moreover, the company claims to have a presence in Malaysia, yet there are no substantial credentials or endorsements from reputable financial institutions. This lack of transparency raises questions about Kilcor's commitment to ethical practices and regulatory compliance. In summary, the company's obscure background and insufficient information about its leadership cast doubt on its legitimacy, leading us to question, "Is Kilcor safe?"

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. Kilcor's trading fees and conditions appear to be less favorable compared to industry standards, which could be a potential warning sign for traders.

| Fee Type | Kilcor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of specific figures in the table above indicates a lack of transparency in Kilcor's pricing structure. Traders often face hidden fees that can significantly impact their overall profitability, and without clear information, it becomes challenging to assess the true cost of trading with Kilcor. Additionally, traders have reported unusual fee policies, which could lead to unexpected financial burdens. Therefore, potential clients should consider these factors seriously when determining whether to proceed with Kilcor.

Client Fund Safety

The safety of client funds is another vital aspect to consider when evaluating a broker's reliability. Kilcor's policies regarding fund security are unclear, and there is no concrete evidence to suggest that it employs robust measures to protect client assets.

In reputable brokerages, client funds are typically held in segregated accounts, ensuring that they are not used for operational expenses. This practice is crucial for safeguarding traders' investments, especially in the event of a broker's insolvency. However, Kilcor's lack of transparency regarding its fund management practices raises concerns about the safety of traders' deposits.

Moreover, there have been no reported investor protection schemes associated with Kilcor, which further exacerbates the risk associated with trading through this broker. Given these factors, it is imperative for potential clients to ask themselves, "Is Kilcor safe?" before entrusting their funds to this brokerage.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of Kilcor, reviews from users reveal a troubling pattern of complaints and dissatisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

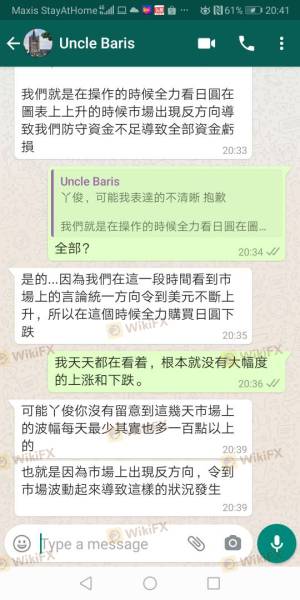

Many clients have reported difficulties in withdrawing funds, a common issue among unregulated brokers. A lack of responsive customer support has also been highlighted, leaving traders feeling abandoned and frustrated. One notable case involved a trader who struggled to access their funds after multiple requests, ultimately leading to a loss of trust in the brokerage. Such experiences raise significant concerns regarding Kilcors operational integrity and prompt the question, "Is Kilcor safe?"

Platform and Execution

The trading platform is another critical element that affects a trader's experience. Kilcor offers a trading platform that, according to user feedback, has experienced stability issues and slow execution times.

Traders have reported instances of slippage and rejected orders, which can severely impact trading outcomes. Such problems are particularly concerning in the fast-paced forex market, where timely execution is essential for capitalizing on market movements. Furthermore, any signs of platform manipulation, such as artificially widening spreads during volatile periods, can further erode trust in the brokerage. Given these factors, potential clients should carefully consider whether they are willing to risk their capital with Kilcor.

Risk Assessment

Evaluating the overall risk of trading with a broker is paramount. Kilcor presents several risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulation |

| Fund Safety | High | Unclear fund management |

| Customer Support Issues | Medium | Poor response to complaints |

The high-risk levels associated with Kilcor stem from its lack of regulation, unclear fund safety measures, and negative customer experiences. To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trades, and prioritize brokers with established regulatory oversight and positive reviews.

Conclusion and Recommendations

In conclusion, the investigation into Kilcor raises significant red flags regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency in its operations and negative customer feedback, leads to the conclusion that traders should exercise extreme caution when considering this broker.

For those seeking reliable trading options, it is advisable to explore alternatives that are regulated by reputable authorities and have a proven track record of positive customer experiences. Brokers such as Pepperstone or IG Markets, which are known for their strong regulatory frameworks and excellent customer service, may offer safer trading environments. Ultimately, the question remains: "Is Kilcor safe?" The evidence suggests that it may be prudent to look elsewhere for your trading needs.

Is KILCOR a scam, or is it legit?

The latest exposure and evaluation content of KILCOR brokers.

KILCOR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KILCOR latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.