Is ORTERSS safe?

Business

License

Is Orterss A Scam?

Introduction

Orterss is a forex broker that has recently attracted attention in the trading community. Positioned as a platform for both novice and experienced traders, it claims to offer a variety of trading instruments and competitive conditions. However, the trustworthiness of Orterss has come under scrutiny, raising concerns among potential investors. As the forex market continues to grow, it is crucial for traders to conduct thorough due diligence before committing their funds to any broker. This article aims to assess whether Orterss is a scam or a legitimate trading platform by evaluating its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a review of multiple online sources, including regulatory databases, customer feedback, and expert analyses.

Regulation and Legitimacy

One of the most critical factors in assessing the safety of a forex broker is its regulatory status. Orterss claims to operate under the jurisdiction of Australia, which requires brokers to be licensed by the Australian Securities and Investments Commission (ASIC). However, upon checking the ASIC database, it becomes evident that Orterss is unregulated, which is a significant red flag for any potential investor. The absence of regulatory oversight means that there are no formal mechanisms in place to protect traders funds or ensure fair trading practices.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unregulated |

The lack of a valid license raises questions about the broker's legitimacy and operational practices. Unregulated brokers often operate with less transparency and may engage in practices that are detrimental to traders. Furthermore, the absence of a regulatory history or compliance record makes it difficult to gauge the broker's reliability. In summary, the regulatory status of Orterss is a critical indicator that suggests it may not be a safe option for traders looking to invest their money.

Company Background Investigation

Understanding the background of a broker is essential for evaluating its trustworthiness. Orterss is said to be operated by Orterss Financial Group, but detailed information about the company's history, ownership structure, and management team is sparse. The broker's website, which is supposed to provide insights into its operations, is reportedly non-functional, further complicating efforts to verify its legitimacy.

The lack of transparency regarding the management team and their qualifications is concerning. A reputable broker typically provides information about its executives, their professional backgrounds, and their experience in the financial industry. This information is crucial for building trust with potential clients. Without it, traders are left with unanswered questions about who is behind the broker and whether they have the necessary expertise to manage client funds responsibly.

In light of these factors, the company background of Orterss does not inspire confidence. The absence of a clear history, ownership details, and information about the management team suggests that this broker may not be operating with the level of transparency expected in the financial services industry.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer can significantly impact a trader's experience. Orterss claims to provide competitive spreads and various trading instruments, but the specifics of their fee structure raise concerns. A thorough examination reveals a lack of clarity regarding trading costs, which is often a tactic employed by less reputable brokers to obscure their true pricing.

| Fee Type | Orterss | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 3.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | 0.5% - 3.0% |

Unusual or hidden fees can significantly affect trading profitability. If a broker imposes high withdrawal fees, hidden commissions, or unfavorable overnight interest rates, it can erode a trader's capital quickly. Moreover, the lack of clarity in Orterss's fee structure is a significant concern, as traders may find themselves facing unexpected costs that could impact their overall trading strategy.

In summary, while Orterss may present itself as a competitive broker, the opacity surrounding its trading conditions is a cause for concern. Traders should be wary of brokers that do not provide clear and transparent information regarding their fees, as this could indicate potential issues down the line.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Orterss's approach to fund security is questionable, as there is little information available regarding its policies on fund segregation, investor protection, and negative balance protection. Reputable brokers typically maintain client funds in segregated accounts, ensuring that traders' money is kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency.

Furthermore, the absence of information on investor protection mechanisms raises alarms. Many regulated brokers offer compensation schemes that protect clients in case of broker failure. Without such safeguards in place, traders using Orterss may be exposing themselves to significant risks.

Historically, unregulated brokers have been associated with numerous financial disputes and security issues. If Orterss has faced any similar controversies, it would further indicate that traders should exercise extreme caution when considering this broker.

Customer Experience and Complaints

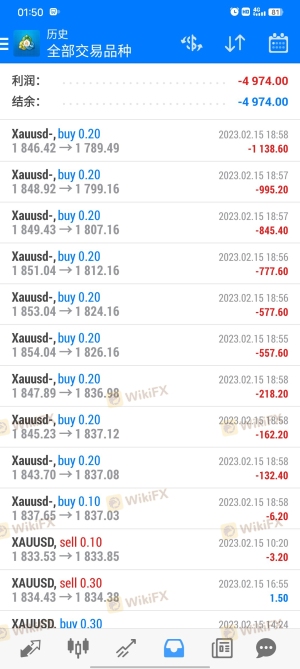

Customer feedback is a vital aspect of evaluating a broker's reliability. A search for reviews of Orterss reveals a significant number of negative experiences reported by former clients. Common complaints include difficulties in withdrawing funds, lack of communication from customer support, and aggressive sales tactics encouraging further investments.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Misleading Promotions | High | No resolution offered |

Two notable cases highlight the challenges faced by clients of Orterss. In one instance, a trader reported being unable to withdraw their funds for several months, citing technical issues as the reason. Despite multiple attempts to contact customer support, the trader received little to no assistance. Another user expressed frustration over aggressive sales calls, leading them to invest more than initially planned, only to face difficulties in accessing their funds later.

The patterns of complaints suggest that customer experience with Orterss may be significantly below industry standards. Traders should carefully consider these insights before engaging with this broker.

Platform and Trade Execution

The trading platform's performance is another critical factor that affects a trader's experience. Orterss claims to offer a user-friendly trading environment, but the lack of information regarding the platform's stability and execution quality raises concerns. Traders rely on swift and reliable order execution, and any signs of slippage or rejections can impact their trading strategies negatively.

Moreover, potential indications of platform manipulation should be scrutinized. If traders experience consistent slippage during high volatility, it may suggest that the broker is not operating fairly. Unfortunately, without access to user testimonials or performance data, it is challenging to assess Orterss's platform effectiveness comprehensively.

In conclusion, while Orterss markets itself as a viable trading option, the lack of transparency regarding its platform and execution quality raises concerns. Traders should prioritize brokers with proven, reliable platforms and transparent operational practices.

Risk Assessment

When considering whether to trade with Orterss, it is imperative to evaluate the overall risk involved. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Lack of fund security and protection mechanisms. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

| Execution Risk | Medium | Potential manipulation or slippage in trade execution. |

To mitigate these risks, traders should conduct thorough research, consider starting with a minimal investment, and remain vigilant regarding any unusual broker behavior. It is also advisable to utilize brokers with transparent regulatory oversight and a proven track record.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Orterss raises several red flags. The absence of regulation, unclear trading conditions, and numerous customer complaints suggest that this broker may pose significant risks to traders. Potential investors should exercise extreme caution and consider alternative options.

For those seeking a reliable trading environment, it is advisable to explore brokers that are regulated by reputable authorities such as the FCA, ASIC, or SEC. These brokers typically offer better protections for clients and have established reputations within the industry.

In summary, while Orterss may present itself as a viable trading option, the findings indicate that it is prudent for traders to seek alternatives that offer greater transparency, security, and customer support.

Is ORTERSS a scam, or is it legit?

The latest exposure and evaluation content of ORTERSS brokers.

ORTERSS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ORTERSS latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.