Is O-Locate safe?

Business

License

Is O Locate Safe or Scam?

Introduction

O Locate is a relatively new player in the forex trading market, positioning itself as a viable option for traders seeking access to global currency markets. As the forex industry is rife with both legitimate and fraudulent brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any trading platform. The importance of assessing a broker's credibility cannot be overstated, as the financial stakes are high, and the risk of losing money to scams is a genuine concern. In this article, we will investigate the safety of O Locate by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our analysis will be grounded in data collected from various reputable sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory landscape is a fundamental aspect of any forex broker's legitimacy, as it provides a framework for ensuring that brokers adhere to industry standards and protect traders' interests. Unfortunately, O Locate lacks any valid regulatory licenses, which raises significant concerns about its credibility. Below is a table summarizing the core regulatory information regarding O Locate:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight can expose traders to various risks, including the potential for unfair practices, untransparent fee structures, and even the possibility of losing their entire investment without recourse. In the forex industry, reputable brokers are often regulated by top-tier authorities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. These regulators enforce strict compliance measures to protect investors, making it imperative for traders to engage only with brokers who operate under such oversight. The lack of regulation for O Locate raises serious red flags, suggesting that it may not be a safe option for traders.

Company Background Investigation

O Locate's company history and ownership structure are crucial factors in assessing its credibility. Unfortunately, information regarding the company's establishment, ownership, and operational history is sparse. The lack of transparency raises concerns about the broker's intentions and operational integrity. A legitimate broker typically provides detailed information about its founders, management team, and operational milestones, allowing potential clients to evaluate its credibility thoroughly.

In terms of management, the absence of publicly available information about the team behind O Locate further compounds concerns about the broker's transparency. A reputable broker usually showcases the expertise and qualifications of its management team, which helps build trust among potential clients. Given the limited information available, it is challenging to assess whether O Locate is governed by experienced professionals or if it is merely a front for unscrupulous activities.

Trading Conditions Analysis

Understanding the trading conditions offered by O Locate is essential for evaluating its safety. The broker's fee structure and trading conditions can significantly impact a trader's profitability and overall trading experience. O Locate's trading conditions appear to be opaque, with limited information available regarding spreads, commissions, and other associated costs. Below is a comparative table of core trading costs:

| Fee Type | O Locate | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies (0-10 USD) |

| Overnight Interest Range | N/A | Varies (0-5%) |

The lack of transparency regarding spreads and commission models raises concerns about the broker's intentions. Traders should be wary of brokers that do not disclose their fee structures, as this could indicate hidden costs that may erode trading profits. Additionally, high spreads and commissions can significantly impact a trader's ability to execute profitable trades. Without clear information on these aspects, it is challenging to determine whether O Locate operates within industry standards or engages in potentially exploitative practices.

Customer Funds Safety

Ensuring the safety of customer funds is a top priority for any reputable broker. O Locate's policies regarding fund security, segregation of client accounts, and investor protection measures are critical factors in assessing its safety. Unfortunately, O Locate has not provided sufficient information about its fund safety measures, which raises significant concerns.

A trustworthy broker typically segregates client funds into separate accounts to protect them from operational risks. Additionally, many regulated brokers offer investor protection schemes that provide compensation in the event of insolvency or fraudulent activities. Without clear policies regarding fund safety, traders may be at risk of losing their investments without recourse. Furthermore, any historical issues related to fund safety or disputes involving O Locate could further indicate potential risks associated with trading through this broker.

Customer Experience and Complaints

Customer feedback is a valuable source of insight when evaluating a broker's reliability. Unfortunately, O Locate has received mixed reviews from users, with several complaints highlighting issues related to withdrawal delays, unresponsive customer support, and unclear trading conditions. Below is a table summarizing the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

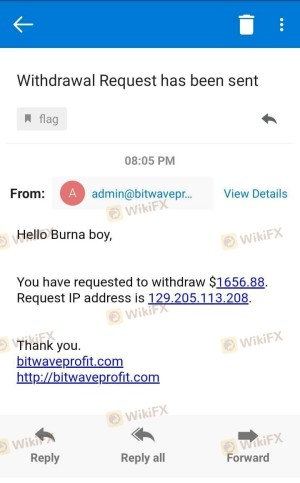

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Average |

| Unclear Trading Conditions | High | Poor |

Customer complaints regarding withdrawal issues are particularly concerning, as they may indicate that O Locate may be engaging in practices that limit clients' access to their funds. A broker that is unresponsive to customer concerns or fails to address complaints in a timely manner may not prioritize client satisfaction or trustworthiness. The severity of these complaints raises questions about whether O Locate is a safe choice for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are vital for a smooth trading experience. Traders expect a stable platform that allows for quick execution of orders without excessive slippage or rejections. Unfortunately, O Locate's platform performance has not been adequately assessed due to limited user feedback and reviews. However, any signs of platform manipulation, such as frequent disconnections or unfair execution practices, could indicate a lack of integrity.

Given the absence of detailed information about O Locate's platform, traders should proceed with caution. A reputable broker typically provides a robust trading infrastructure with minimal downtime and efficient order execution. Without clear evidence of O Locate's platform capabilities, it is challenging to determine whether it meets industry standards.

Risk Assessment

Engaging with O Locate comes with inherent risks, primarily due to its lack of regulation and transparency. Below is a risk scorecard summarizing the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Opaque fee structures and withdrawal issues |

| Operational Risk | Medium | Limited information about platform performance |

Given the high-risk levels associated with O Locate, traders should consider alternative options that offer greater transparency, regulatory oversight, and a proven track record of customer satisfaction. To mitigate risks, traders should conduct thorough research and consider using brokers with established reputations and regulatory compliance.

Conclusion and Recommendations

In conclusion, the investigation into O Locate raises several red flags regarding its safety and reliability. The absence of regulatory oversight, limited transparency, and mixed customer feedback suggest that O Locate may not be a trustworthy option for traders. Is O Locate safe? Based on the available evidence, it appears to be a high-risk choice, and traders should exercise caution.

For those looking to engage in forex trading, we recommend considering brokers that are regulated by reputable authorities, offer clear and transparent fee structures, and prioritize customer satisfaction. Brokers such as [insert reputable broker names] provide a safer trading environment and may be better suited for traders seeking to minimize risks. Ultimately, conducting thorough research and due diligence is essential for ensuring that your trading experience is both secure and rewarding.

Is O-Locate a scam, or is it legit?

The latest exposure and evaluation content of O-Locate brokers.

O-Locate Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

O-Locate latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.