Is MWNG safe?

Business

License

Is MWNG Safe or Scam?

Introduction

MWNG, a broker operating in the forex market, has attracted attention for its promises of high leverage and trading opportunities. However, potential traders must approach this broker with caution. The forex market is rife with scams, and the stakes are high, making it crucial for traders to thoroughly evaluate any broker before investing their hard-earned money. This article investigates the legitimacy of MWNG by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. The information presented here is derived from various online sources, including reviews and regulatory warnings, to provide a comprehensive overview of whether MWNG is safe for trading.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation not only provides a framework for operational transparency but also serves as a safety net for traders funds. Unfortunately, MWNG operates without any regulatory oversight, which raises significant red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that MWNG is not subject to any governing authority's rules or standards, which typically protect investors from fraud and malpractice. The Financial Services and Markets Authority (FSMA) of Belgium has explicitly blacklisted MWNG, labeling it as a fraudulent entity. Such warnings indicate that trading with MWNG could expose investors to significant risks, including the potential loss of their capital without any recourse for recovery. Given these concerns, the question remains: Is MWNG safe? The evidence suggests otherwise, as unregulated brokers often operate with a lack of accountability.

Company Background Investigation

MWNG's corporate structure and ownership are shrouded in mystery. The company claims to be a part of MWNG Company Limited, yet it fails to disclose its physical location or provide any information about its management team. This lack of transparency is alarming, as reputable brokers typically provide clear details about their ownership and operational history.

The company does not appear to have any notable history or a track record of compliance with industry standards. The absence of publicly available information about the management team further complicates the assessment of MWNG's credibility. A transparent broker would usually highlight the qualifications and experience of its executives, reassuring potential clients of their expertise in the financial services sector. However, in MWNG's case, the lack of such information raises further questions about its legitimacy and operational integrity.

In summary, the obscure background of MWNG enhances the skepticism surrounding its safety. The absence of regulatory oversight and transparency about its operations strongly suggests that MWNG is not safe for trading.

Trading Conditions Analysis

When assessing a broker, understanding its trading conditions is essential. MWNG claims to offer competitive trading fees, including a minimum deposit requirement of $100 and leverage ratios up to 1:500. However, the absence of detailed information about spreads and commissions raises concerns about the overall cost structure.

| Fee Type | MWNG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding these fees is a significant issue. Brokers are expected to provide clear information about their fee structures to avoid hidden costs that could lead to unexpected losses for traders. Additionally, high leverage ratios, while attractive, come with increased risk, as they can amplify both gains and losses. This is particularly concerning for inexperienced traders who may not fully understand the implications of trading with such high leverage.

Given the vague information about MWNG's trading conditions, potential clients may find themselves at a disadvantage, questioning is MWNG safe for their trading activities. The lack of clarity surrounding fees and conditions suggests a need for caution.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. MWNG does not provide any information regarding the segregation of client funds, which is a critical practice among reputable brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of financial difficulties.

Moreover, MWNG has not mentioned any investor protection schemes, such as negative balance protection, which would safeguard traders from losing more than their initial investment. The absence of these safety measures is alarming and raises serious concerns about the security of funds held with MWNG.

In light of these factors, potential traders must ask themselves: Is MWNG safe? The lack of client fund protection and transparency surrounding financial practices strongly suggests that it is not a safe choice for traders looking to protect their investments.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Unfortunately, MWNG has received numerous complaints from users who have reported difficulties in withdrawing their funds. Common issues include blocked accounts and unresponsive customer service, which are significant red flags for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | None |

Many users have shared experiences of being pressured to deposit additional funds in order to access their existing balances. Such practices are indicative of a scam, where the broker aims to extract as much money as possible from clients before disappearing.

In light of these complaints, it is clear that MWNG is not safe for traders. The negative experiences reported by clients highlight the risks associated with engaging with this broker.

Platform and Trade Execution

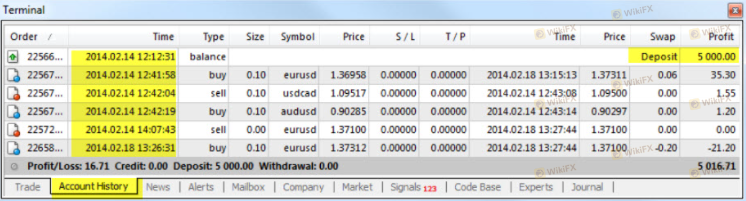

The trading platform offered by MWNG is reportedly based on the popular MetaTrader 4 (MT4) system. While MT4 is known for its reliability, the actual execution quality and user experience with MWNG remain questionable. Users have reported issues with order execution, including slippage and order rejections, which can significantly impact trading outcomes.

Furthermore, the lack of transparency regarding the broker's operational infrastructure raises concerns about potential platform manipulation. If a broker has control over the trading environment, it can engage in practices that disadvantage traders, such as manipulating spreads or executing trades at unfavorable prices.

Given these factors, traders should carefully consider whether MWNG is safe for their trading activities. The combination of platform issues and potential manipulation suggests that this broker may not provide a fair trading environment.

Risk Assessment

Using MWNG entails various risks that potential clients should be aware of. The absence of regulation, unclear trading conditions, and numerous customer complaints contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Potential issues with platform reliability. |

To mitigate these risks, traders should consider employing strict risk management strategies, such as limiting their investment amounts and avoiding high-leverage trades. Additionally, it is advisable to avoid brokers with poor reputations and to seek out regulated alternatives that offer better protections.

Conclusion and Recommendations

Based on the evidence presented, it is clear that MWNG is not safe for trading. The broker operates without regulation, lacks transparency, and has received numerous complaints regarding fund withdrawals and customer service. For traders seeking a reliable and secure trading environment, it is crucial to avoid MWNG and consider alternative options.

Instead, traders are encouraged to explore brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which offer robust investor protections and transparent trading conditions. Ultimately, due diligence and careful evaluation are essential to ensure the safety of investments in the forex market.

Is MWNG a scam, or is it legit?

The latest exposure and evaluation content of MWNG brokers.

MWNG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MWNG latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.