Is MFG safe?

Business

License

Is MFG Safe or a Scam?

Introduction

MFG, also known as Millinium Fortune Group Limited, has emerged as a player in the forex trading market since its inception. With a focus on providing trading services to global clientele, MFG positions itself as a broker catering to retail traders and investors. However, the forex market is notorious for its volatility and the presence of unregulated brokers, making it imperative for traders to exercise caution when selecting a trading partner. This article aims to evaluate whether MFG is a trustworthy broker or a potential scam. Our investigation is based on a thorough analysis of regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is a pivotal factor in determining its legitimacy. A regulated broker is typically subject to oversight by relevant financial authorities, ensuring fair practices and the protection of client funds. MFG claims to be regulated by the Securities and Futures Commission (SFC) in Hong Kong; however, there are significant concerns regarding the validity of this claim.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AMV 148 | Hong Kong | Regulated |

Despite being listed under the SFC, MFG has faced scrutiny regarding its compliance with industry standards. The absence of a solid regulatory framework raises questions about the broker's operational legitimacy and adherence to best practices. Moreover, the lack of transparency regarding its licensing and regulatory details further complicates the assessment of MFG's safety. Traders should be wary of engaging with brokers that do not provide clear evidence of their regulatory status, as this can expose them to potential fraud and malpractice.

Company Background Investigation

MFG was established approximately 15 to 20 years ago, primarily focusing on providing trading services in forex, stocks, and CFDs. The company's ownership structure remains somewhat opaque, with limited information available regarding its management team and their qualifications. The absence of detailed disclosures about the company's history and leadership raises red flags, as reputable brokers typically provide comprehensive information to build trust with potential clients.

The management teams expertise is crucial in assessing a broker's reliability. However, MFG's website lacks information on the qualifications of its leadership, making it difficult to gauge the company's operational integrity. Furthermore, the overall transparency and information disclosure from MFG seem inadequate, which can lead to skepticism about its commitment to ethical practices. As such, potential clients should remain cautious when considering MFG as a trading partner.

Trading Conditions Analysis

When evaluating whether MFG is safe, it is essential to understand the trading conditions it offers. MFG advertises competitive spreads and various account types, but the actual fee structure lacks clarity.

| Fee Type | MFG | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | Variable | Varies by broker |

| Overnight Interest Range | Not specified | 0.5% - 3% |

The lack of transparency surrounding fees can lead to unexpected costs for traders, which is a common issue with less reputable brokers. Additionally, if MFG employs unusual or hidden fees, it may further indicate a lack of integrity. Traders should be cautious when engaging with brokers that do not provide comprehensive information about their fee structures, as this can lead to financial losses.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. MFG claims to implement various safety measures; however, the lack of regulatory oversight raises significant concerns about the actual effectiveness of these measures.

MFG does not provide clear information regarding its fund protection policies, which raises questions about the safety of client deposits. Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies. Without proper fund segregation, clients risk losing their deposits in the event of the broker's insolvency. Furthermore, the absence of any investor protection schemes leaves clients exposed to potential losses without recourse.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. Reviews of MFG reveal a mixed bag of experiences, with several users expressing significant concerns regarding withdrawal processes and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Service | Medium | Inconsistent support |

| Order Execution Issues | High | Lack of clarity |

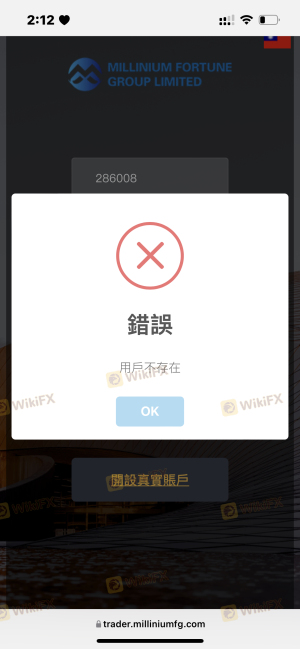

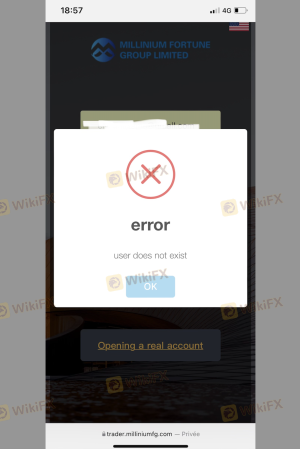

Many users have reported difficulties in withdrawing funds, indicating potential liquidity issues or inefficiencies within the company's internal processes. For instance, one trader experienced significant delays in withdrawing funds, leading to frustration and mistrust. Such complaints highlight operational issues within MFG, and traders should consider these factors when evaluating whether to engage with the broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a positive trading experience. MFG offers a trading platform that purportedly provides a range of features, but user reviews indicate varying levels of satisfaction. Concerns have been raised regarding order execution quality, including instances of slippage and rejected orders.

Traders need to be cautious, as signs of platform manipulation can severely impact their trading outcomes. The presence of such issues raises questions about MFG's operational integrity, and traders should prioritize brokers that demonstrate reliability and transparency in their operations.

Risk Assessment

Using MFG presents several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Lack of protection |

| Transparency Risk | Medium | Limited information |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and maintain a cautious approach when trading with MFG. The potential for fraud and operational issues makes MFG a risky choice for forex trading.

Conclusion and Recommendations

In conclusion, the investigation into MFG raises significant concerns about its legitimacy and safety. The absence of regulatory oversight, coupled with limited transparency and numerous customer complaints, suggests that traders should approach this broker with caution. The evidence leans towards skepticism regarding whether MFG is safe, and potential clients should exercise extreme caution before engaging with this broker.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of transparency and client satisfaction. Prioritizing safety and regulatory compliance is essential in navigating the forex market successfully.

Is MFG a scam, or is it legit?

The latest exposure and evaluation content of MFG brokers.

MFG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MFG latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.