Is MARKETRIP safe?

Business

License

Is Marketrip A Scam?

Introduction

Marketrip is an online brokerage that positions itself in the forex, cryptocurrency, and CFD trading markets. With the rise of online trading, it has become increasingly crucial for traders to evaluate the legitimacy and reliability of brokers before investing their hard-earned money. The proliferation of scams in the financial sector has made it imperative for traders to conduct thorough due diligence. This article aims to assess the safety and legitimacy of Marketrip by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. The analysis is based on a detailed review of various online sources and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. Marketrip operates as an unregulated broker, which raises significant concerns about the safety of traders' funds. Unregulated brokers can often take advantage of their lack of oversight, leading to potential scams and fraudulent activities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Marketrip is reportedly based in Saint Vincent and the Grenadines, a location known for its lax regulatory environment. This allows brokers to operate without stringent oversight, making it easier for unscrupulous entities to exploit traders. Furthermore, the Financial Conduct Authority (FCA) in the UK and the Central Bank of Ireland (CBI) have issued warnings against Marketrip for operating without authorization. Such warnings indicate a high level of risk associated with trading through this platform, making it essential for potential investors to consider these factors seriously.

Company Background Investigation

Marketrip‘s history and ownership structure remain largely opaque. The company does not disclose any information about its founders or management team, which is a significant red flag for potential investors. Transparency in a brokerage’s ownership and management is vital for establishing trust and credibility within the trading community.

The absence of clear information regarding the company‘s operational history and ownership raises concerns about its legitimacy. Without knowledge of who runs the company, traders cannot assess the experience or qualifications of the management team. This lack of transparency contributes to doubts about Marketrip’s reliability and safety.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and associated costs is essential. Marketrip offers various account types with different minimum deposit requirements, ranging from $250 for a basic account to $250,000 for a VIP account. However, the overall fee structure raises concerns.

| Fee Type | Marketrip | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Marketrip's spreads are notably higher than the industry average, which can significantly impact trading profitability. Additionally, the broker imposes various fees, such as a $100 monthly inactivity fee for accounts dormant for 45 days. Such practices are often associated with less reputable brokers, suggesting that traders should exercise caution when considering Marketrip as their trading platform.

Customer Fund Safety

The safety of customer funds is paramount when choosing a broker. Marketrip claims to keep client funds in segregated accounts; however, without regulation, there is no guarantee that these measures are effective. The broker does not provide clear information about investor protection mechanisms, such as negative balance protection or compensation schemes.

Traders should be aware that investing with an unregulated broker like Marketrip poses a significant risk to their funds. Historical accounts of clients struggling to withdraw their money from the platform further exacerbate concerns about fund safety. Given these factors, it is crucial for potential investors to weigh the risks associated with Marketrip carefully.

Customer Experience and Complaints

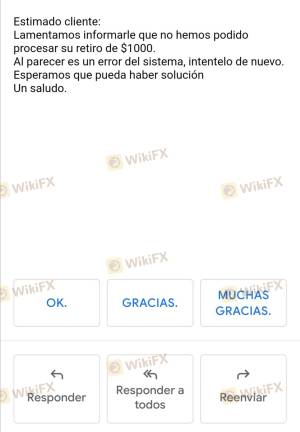

User feedback is a vital component in assessing a broker's credibility. A significant number of complaints have surfaced regarding Marketrip, particularly concerning withdrawal issues. Many users report being unable to access their funds, with some stating that their accounts were blocked or that they were pressured to invest more money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Customer Service Quality | Medium | Poor |

Case studies reveal a pattern where clients experience difficulties withdrawing funds, often leading to frustration and financial loss. The lack of timely and effective responses from Marketrip's customer service team further compounds these issues, leading to a negative overall user experience.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. Marketrip claims to offer a web-based trading platform alongside the popular MetaTrader 4 (MT4). However, user reviews indicate that the platform may not function as advertised, with many users unable to access MT4.

Concerns about order execution quality, including slippage and order rejections, have also been raised. These issues can significantly affect trading outcomes, particularly in fast-moving markets.

Risk Assessment

Using Marketrip comes with an array of risks that traders should consider seriously.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Fund Security Risk | High | Lack of investor protection measures. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

To mitigate these risks, traders should consider using regulated brokers with transparent practices and positive user reviews. Conducting thorough research and reading user experiences can help in making an informed decision.

Conclusion and Recommendations

In summary, the evidence suggests that Marketrip poses significant risks for potential traders. The lack of regulation, transparency issues, high fees, and numerous complaints about fund withdrawals strongly indicate that this broker may not be a safe option. Therefore, it is advisable for traders to proceed with caution and consider alternative, regulated brokers that offer better security and customer service.

If you are considering trading, it may be worth exploring options like brokers regulated by the FCA or ASIC, which provide greater security and investor protection. In conclusion, is Marketrip safe? Based on the available information, it is prudent to view Marketrip with skepticism and to prioritize safety by choosing a more reputable broker.

Is MARKETRIP a scam, or is it legit?

The latest exposure and evaluation content of MARKETRIP brokers.

MARKETRIP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MARKETRIP latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.