Is Linton Financial safe?

Business

License

Is Linton Financial Safe or Scam?

Introduction

Linton Financial, a forex broker established in 2012 and based in the United Kingdom, has positioned itself as a provider of investment opportunities, particularly in the cryptocurrency sector. As the forex market continues to grow, it becomes increasingly crucial for traders to carefully evaluate the brokers they choose to work with. With numerous reports of scams and fraudulent activities in the industry, understanding the credibility of a broker is essential. This article aims to provide a detailed analysis of Linton Financial, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple online sources, including user reviews, regulatory information, and expert assessments.

Regulatory and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, ensuring compliance with industry standards and providing a layer of protection for traders. Unfortunately, Linton Financial is currently unregulated, which raises significant concerns about its legitimacy and safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Linton Financial does not adhere to the same standards as licensed brokers. This lack of regulation can expose traders to various risks, including potential loss of capital, limited legal recourse in disputes, and a higher likelihood of fraudulent activities. It is essential for traders to be aware of these risks when considering whether Linton Financial is safe to trade with.

Company Background Investigation

Linton Financial was founded in 2012 and claims to be registered in the United Kingdom. However, despite its long-standing presence in the market, the company's legitimacy is called into question due to its unregulated status. The ownership structure and management team are not well-documented, leading to concerns about transparency.

The management teams backgrounds and professional experiences are not readily available, which is a red flag for potential investors. A lack of information about the team can hinder traders' confidence and raises questions about the broker's commitment to ethical practices. Furthermore, the company's information disclosure level is inadequate, leaving potential clients in the dark about critical operational aspects.

Trading Conditions Analysis

Trading conditions are vital for assessing a broker's reliability. Linton Financial offers several account types, each with varying minimum deposit requirements and promised returns. However, the lack of transparency regarding fees raises concerns.

| Fee Type | Linton Financial | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commission structures makes it difficult for traders to gauge the true cost of trading with Linton Financial. Additionally, the promise of high returns within short timeframes may appear enticing but could also indicate a potential risk of scams or Ponzi schemes. Traders should be cautious and conduct thorough research before engaging with this broker.

Client Fund Security

When it comes to the safety of client funds, Linton Financial's unregulated status raises serious concerns. Regulatory bodies typically require brokers to implement measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard client funds.

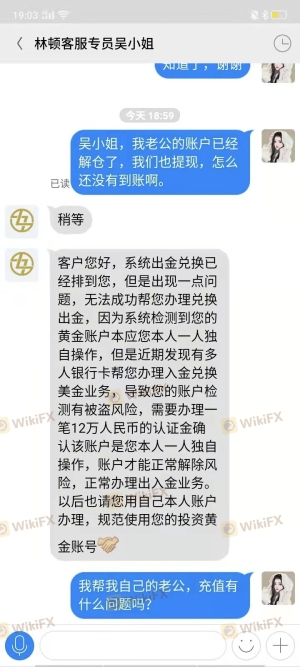

Unfortunately, Linton Financial does not provide clear information regarding these safety measures. The lack of transparency surrounding client fund security is alarming, especially considering the potential risks associated with unregulated brokers. Historical incidents involving fund mismanagement or loss further underscore the necessity for traders to exercise caution.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews of Linton Financial reveal a mixed bag of experiences. While some users report positive interactions, others highlight significant issues, particularly regarding withdrawal processes and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Fair |

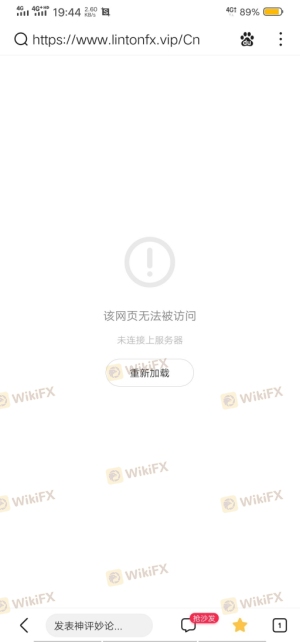

Common complaints include delayed withdrawals and a perceived lack of transparency in operations. For instance, users have reported waiting weeks or even months for their funds to be processed, which is a significant red flag. The company's response to complaints has been criticized as inadequate, with many users feeling ignored or dismissed. This raises further concerns about whether Linton Financial is safe to trust with investments.

Platform and Trade Execution

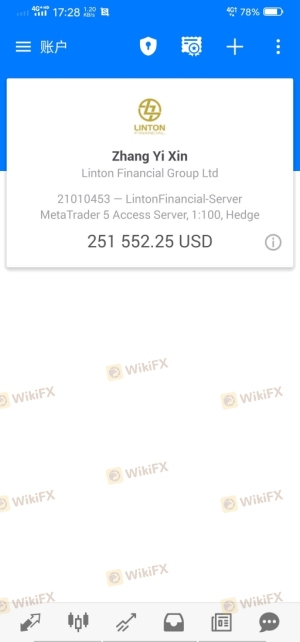

The trading platform's performance is another critical aspect of a broker's credibility. Linton Financial claims to utilize the MetaTrader 5 platform, which is widely recognized for its reliability and advanced features. However, user experiences indicate mixed results regarding platform stability and execution quality.

Many traders have reported issues with slippage and order rejections, which can significantly impact trading outcomes. Additionally, there are concerns about potential platform manipulation, particularly given the broker's unregulated status. Traders should be wary of any signs of manipulation and consider whether they can trust the execution quality offered by Linton Financial.

Risk Assessment

Using Linton Financial involves various risks that traders must consider. The lack of regulation, transparency issues, and mixed customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Financial Risk | Medium | Potential for loss of invested capital. |

| Operational Risk | High | Concerns about withdrawal delays. |

To mitigate these risks, traders should conduct thorough due diligence, seek alternative regulated brokers, and avoid investing more than they can afford to lose. It is crucial to prioritize safety and security when selecting a forex broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Linton Financial poses significant risks for traders. The lack of regulation, transparency issues, and mixed customer experiences raise serious concerns about its credibility. While some users may have had positive experiences, the overall risk profile indicates that potential investors should exercise extreme caution.

If you are considering trading in the forex market, it is advisable to seek out regulated brokers with a proven track record and positive customer feedback. Some reputable alternatives include brokers regulated by the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC). Ultimately, ensuring your safety and security should be the top priority when choosing a forex broker. Thus, based on the current analysis, it is prudent to conclude that Linton Financial is not safe for trading.

Is Linton Financial a scam, or is it legit?

The latest exposure and evaluation content of Linton Financial brokers.

Linton Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Linton Financial latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.