Is JunLe Capital safe?

Business

License

Is Junle Capital Safe or a Scam?

Introduction

Junle Capital is an online forex broker that has recently attracted attention within the trading community. Positioned as a provider of forex, stocks, and cryptocurrency trading services, the broker claims to offer a platform for traders of all experience levels. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market, while lucrative, is also rife with risks and potential scams. Therefore, evaluating the legitimacy and safety of Junle Capital is essential for any potential trader. This article aims to provide a comprehensive analysis of Junle Capital's regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

One of the primary factors in determining whether Junle Capital is safe revolves around its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct. Unfortunately, Junle Capital operates without any significant regulatory oversight, which raises red flags for potential investors. The table below summarizes the core regulatory information regarding Junle Capital:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Junle Capital does not have to comply with strict financial standards, which can lead to questionable practices. Additionally, the lack of a credible regulatory body overseeing its operations makes it challenging to assess the broker's history of compliance. Traders should be wary of engaging with unregulated brokers, as they often lack the necessary investor protections that regulated entities provide.

Company Background Investigation

Junle Capital Limited, the entity behind Junle Capital, has limited publicly available information regarding its history and ownership structure. The company is registered in Hong Kong, a region known for its relatively lax regulatory environment concerning financial services. The management team behind Junle Capital has not been disclosed, which further complicates efforts to assess the broker's legitimacy. Transparency in a company's ownership and management is critical for establishing trust, and the lack of such information raises concerns about the broker's reliability.

Moreover, the company's website does not provide extensive details regarding its operational history or the experience of its management team. Without this information, it is difficult to ascertain whether Junle Capital has a proven track record in the forex industry or if it is a newly established entity with little experience. The opacity surrounding Junle Capital's background is a significant factor in determining whether Junle Capital is safe for traders.

Trading Conditions Analysis

When evaluating whether Junle Capital is safe, it is essential to examine its trading conditions, including fees, spreads, and commissions. Junle Capital claims to offer competitive trading conditions; however, user reviews suggest otherwise. The following table outlines the core trading costs associated with Junle Capital compared to industry averages:

| Fee Type | Junle Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Varies | Standard |

Reports indicate that traders have encountered high spreads on major currency pairs, which can significantly impact profitability. Additionally, the commission structure is not clearly defined, leading to confusion among traders regarding the overall cost of trading. Such ambiguous fee structures can be indicative of a broker that may not prioritize transparency, further fueling concerns about Junle Capital's safety.

Client Funds Security

The safety of client funds is another critical aspect to consider when assessing whether Junle Capital is safe. A reputable broker typically employs measures such as segregated accounts to ensure that client funds are protected. However, Junle Capital has not provided clear information regarding its fund security measures. Without robust safeguards in place, traders' investments could be at risk.

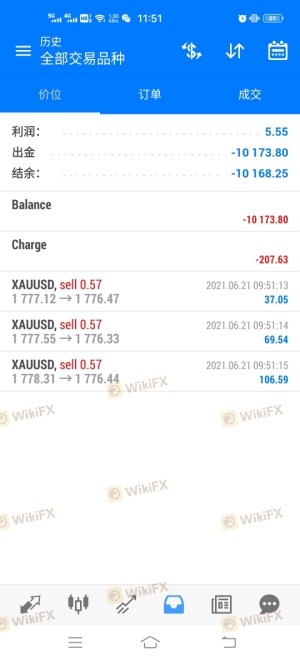

Moreover, the lack of investor protection mechanisms raises concerns about what would happen if the broker were to face financial difficulties or insolvency. In the absence of a regulatory framework, traders have little recourse in the event of a dispute or financial loss. Historical complaints against Junle Capital have also highlighted issues with fund withdrawals, further underscoring the potential risks associated with trading with this broker.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the trustworthiness of any broker, and Junle Capital is no exception. Many users have reported difficulties with fund withdrawals and poor customer support. The table below summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Responsiveness | Medium | Slow |

| Transparency of Fees | High | Unclear |

Numerous complaints have surfaced regarding the inability to withdraw funds, with some traders alleging that their requests were either ignored or met with unreasonable delays. Furthermore, the quality of customer support has been consistently criticized, with users reporting long wait times and unhelpful responses. These patterns of complaints raise serious concerns about the overall reliability of Junle Capital as a broker.

Platform and Trade Execution

Evaluating the trading platform and execution quality is essential in determining whether Junle Capital is safe. The trading platform offered by Junle Capital has received mixed reviews, with some users praising its user-friendly interface while others have reported issues with stability and execution speed. Problems such as slippage and rejected orders can significantly affect trading outcomes, making it crucial for a broker to provide a reliable platform.

Additionally, there have been allegations of potential platform manipulation, which raises further concerns about the broker's integrity. A trustworthy broker should provide transparent information about its execution practices and ensure that traders can execute their orders without undue interference.

Risk Assessment

In summary, the overall risk associated with trading with Junle Capital is considerable. The following risk assessment table summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Lack of fund security measures. |

| Customer Support Risk | Medium | Poor response to complaints. |

| Transparency Risk | High | Opaque fee structures and practices. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that offer robust regulatory oversight and transparent trading conditions.

Conclusion and Recommendations

After analyzing various aspects of Junle Capital, it is evident that there are significant concerns regarding its safety and legitimacy. The absence of regulation, combined with numerous complaints about fund withdrawals and poor customer support, paints a troubling picture. Therefore, potential traders should exercise extreme caution when considering whether Junle Capital is safe.

For those seeking reliable trading options, it is advisable to explore brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically provide better investor protection and more transparent trading conditions. In conclusion, while Junle Capital may offer enticing trading opportunities, the risks associated with it far outweigh the potential benefits.

Is JunLe Capital a scam, or is it legit?

The latest exposure and evaluation content of JunLe Capital brokers.

JunLe Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JunLe Capital latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.