Regarding the legitimacy of JD Trader forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is JD Trader safe?

Pros

Cons

Is JD Trader markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

JDTRADER PRIME LIMITED

Effective Date:

2021-08-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2025-06-30Address of Licensed Institution:

Level 3, 74 Taharoto Road, Takapuna, Auckland, 0622, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is JDNX A Scam?

Introduction

JDNX is a forex broker that has garnered attention in the trading community, primarily due to its range of financial products and services. As the forex market continues to grow, traders must exercise caution when evaluating brokers to ensure their investments are safe. The potential for scams and fraudulent activities is high, making it essential for traders to conduct thorough research before engaging with any broker. This article aims to assess the safety and legitimacy of JDNX by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is critical for assessing its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client funds. As of now, JDNX lacks any valid regulatory licenses, which raises significant concerns about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation is a serious red flag. Regulatory bodies like the FCA (Financial Conduct Authority) in the UK or the ASIC (Australian Securities and Investments Commission) impose stringent guidelines on brokers to ensure transparency and fairness. Without such oversight, traders may be exposed to higher risks, including the potential for fraud and mismanagement of funds. Historical compliance data also reveals that unregulated brokers often have a history of complaints and issues related to fund withdrawals and transparency.

Company Background Investigation

JDNX has been operational for several years, but its ownership structure and history remain opaque. The company does not disclose key information about its management team or ownership, which is another cause for concern. Transparency is crucial in the financial industry, and a lack of information could indicate that the broker has something to hide.

The management team's background is particularly important in assessing the broker's credibility. Experienced professionals with a solid track record in finance and trading can significantly enhance a broker's reputation. Unfortunately, JDNX does not provide any information regarding its leadership, making it difficult for potential clients to gauge the company's reliability.

Overall, the lack of transparency in JDNX's corporate structure and management raises questions about its commitment to ethical practices and investor protection.

Trading Conditions Analysis

When evaluating a broker like JDNX, understanding the trading conditions is essential for making informed decisions. This includes examining the fee structure, spreads, and commission models to determine if they align with industry standards.

| Fee Type | JDNX | Industry Average |

|---|---|---|

| Spread for Major Pairs | High | Low |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Traders have reported that JDNX's spreads are higher than average, which can eat into profits and affect overall trading performance. Moreover, the absence of clear information regarding commissions and overnight interest rates adds to the uncertainty surrounding the broker's trading conditions. High fees and unclear policies can be indicative of a broker that may not have the best interests of its clients in mind.

Client Fund Security

The security of client funds is paramount when selecting a broker. JDNX's practices regarding fund security are concerning, especially in light of its unregulated status. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection.

Traders should be aware that without proper regulatory oversight, JDNX may not have robust security measures in place. This lack of protection could lead to significant financial losses, particularly in the event of a broker insolvency or mismanagement of funds. Historical complaints from users indicate that there have been issues with fund withdrawals, further underscoring the potential risks involved with JDNX.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. JDNX has received mixed reviews, with several users expressing dissatisfaction regarding their experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Poor |

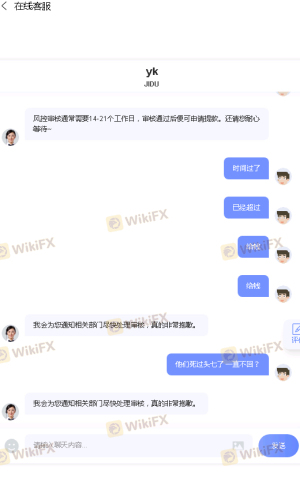

Common complaints include difficulties with fund withdrawals and slow customer service responses. One particular case involved a trader who reported being unable to withdraw funds for over a month, which is a significant concern for potential clients. The company's lack of effective responses to these issues raises alarms about its customer service and operational integrity.

Platform and Trade Execution

The trading platform offered by JDNX is another critical aspect to consider. A reliable platform should provide stable performance, quick order execution, and minimal slippage. However, users have reported issues with order execution quality, including instances of slippage and rejected orders.

The absence of transparency in how trades are executed can further exacerbate concerns about potential manipulation. Traders should be cautious and consider whether the platform meets their trading needs before committing funds.

Risk Assessment

Using JDNX presents several risks that traders should carefully consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid licenses |

| Fund Security Risk | High | Lack of protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

Overall, the combination of unregulated status, questionable fund security measures, and negative user experiences indicates that trading with JDNX carries significant risks. Traders should implement risk mitigation strategies, such as starting with a small deposit and thoroughly researching the broker's practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that JDNX exhibits several characteristics commonly associated with scam brokers. The lack of regulation, transparency, and consistent complaints from users raises serious concerns about its legitimacy. Traders should approach JDNX with caution and consider alternative brokers that offer robust regulatory oversight and a proven track record of customer satisfaction.

For those seeking reliable forex trading options, consider brokers regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically provide better security for client funds and more transparent trading conditions. Always perform due diligence and prioritize safety when selecting a trading partner.

Is JD Trader a scam, or is it legit?

The latest exposure and evaluation content of JD Trader brokers.

JD Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JD Trader latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.