Is inception commercial limited safe?

Business

License

Is Inception.Commercial Limited Safe or a Scam?

Introduction

Inception.Commercial Limited is a relatively new player in the forex trading market, having been established in 2021 and operating out of Australia. As with any financial service provider, it is crucial for traders to conduct thorough research before committing their funds. The forex market is rife with opportunities, but it also poses significant risks, particularly when dealing with unregulated brokers. This article aims to evaluate the safety and legitimacy of Inception.Commercial Limited, exploring its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a comprehensive review of multiple sources, including regulatory records, customer feedback, and industry analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. Inception.Commercial Limited operates without oversight from any recognized financial authority, which raises red flags for potential clients. Regulation is essential as it provides a layer of protection for traders, ensuring that brokers adhere to strict operational standards and are accountable for their actions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Australia | Not Regulated |

The absence of regulation means that Inception.Commercial Limited is not subject to any compliance checks, which can lead to issues such as fraud, market manipulation, and security breaches. Traders utilizing unregulated brokers often find it challenging to seek recourse in the event of disputes or financial losses. Moreover, the lack of a regulatory framework indicates that Inception.Commercial Limited does not offer the legal protections typically available through licensed brokers. Given these factors, it is prudent for potential traders to exercise caution when considering whether Inception.Commercial Limited is safe.

Company Background Investigation

Inception.Commercial Limited was founded in 2021, and its short history raises questions about its experience and reliability. The company's ownership structure is not transparent, which is concerning for prospective clients who seek accountability. A lack of information about the management team and their professional backgrounds further complicates the evaluation of the broker's trustworthiness.

Typically, reputable brokers will provide detailed information about their leadership, including professional qualifications and industry experience. In contrast, Inception.Commercial Limited's website lacks such disclosures, which could indicate a lack of transparency. Furthermore, the company's limited operational history means it has not yet established a track record of navigating market challenges or maintaining customer trust over time.

The overall opacity surrounding Inception.Commercial Limited's operations and ownership structure raises significant concerns about its credibility. Without a clear understanding of who is behind the broker, traders may be putting their funds at risk. As such, it is essential to consider whether Inception.Commercial Limited is safe based on the available information.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is vital to understand the fee structure and any potential hidden costs that may affect profitability. Inception.Commercial Limited offers a relatively low minimum deposit requirement of $100, which makes it accessible to a broad range of traders. However, this low entry point may come with additional risks, particularly considering the lack of regulatory oversight.

| Fee Type | Inception.Commercial Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | $0.03 per lot (ECN) | $0.01-$0.05 per lot |

| Overnight Interest Range | Varies | Varies |

The trading fees at Inception.Commercial Limited, particularly the variable spreads, can be problematic. Variable spreads can widen significantly during periods of high volatility, which can lead to unexpected trading costs. Additionally, the commission structure for ECN accounts may not be competitive compared to industry standards, potentially affecting overall trading performance.

Traders should also be wary of any unusual fees that may not be clearly outlined on the broker's website. The lack of transparency regarding additional charges can lead to unexpected costs that diminish trading profits. Therefore, it is essential to assess whether Inception.Commercial Limited is safe in terms of its trading conditions and fee structures.

Client Funds Safety

The safety of client funds is paramount when evaluating a trading broker. Inception.Commercial Limited's lack of regulation raises concerns regarding its fund protection measures. Regulated brokers are typically required to segregate client funds from their operational funds, providing an additional layer of security in the event of financial difficulties.

Unfortunately, there is no information available regarding whether Inception.Commercial Limited practices fund segregation or offers investor protection schemes such as negative balance protection. The absence of these safety measures could leave traders vulnerable to significant losses, especially in volatile market conditions.

Moreover, any historical issues related to fund security or disputes should be closely examined. A broker's track record in handling client funds can provide insight into its reliability. However, Inception.Commercial Limited's limited operational history makes it difficult to assess its past performance in this regard. As a result, potential clients should carefully consider whether Inception.Commercial Limited is safe for trading and whether their funds would be adequately protected.

Customer Experience and Complaints

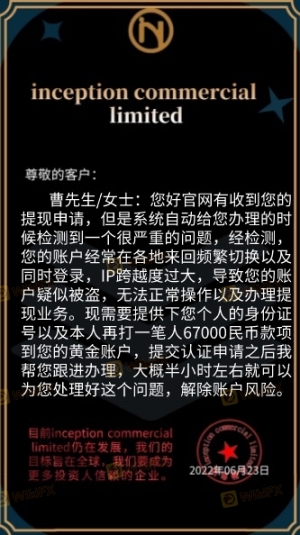

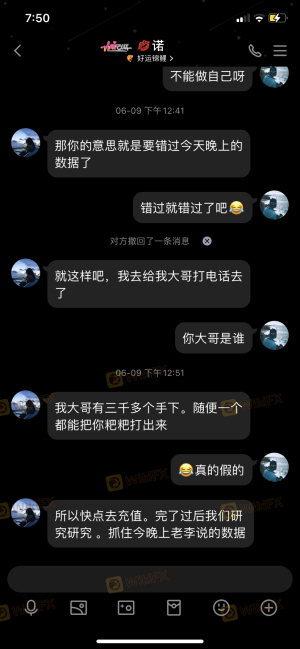

Customer feedback is a valuable indicator of a broker's reliability and service quality. Inception.Commercial Limited has received numerous complaints, with many users expressing dissatisfaction with their experiences. Common issues include difficulties in withdrawing funds, slow customer service responses, and a lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Delays | Medium | Inconsistent |

| Fee Transparency Concerns | High | Poor Communication |

Two notable cases illustrate the challenges faced by clients. One user reported being unable to withdraw funds after multiple requests, leading to frustration and financial losses. Another client highlighted the lack of response from customer service when seeking clarification on fees, indicating a lack of support for traders.

These patterns of complaints raise serious concerns about Inception.Commercial Limited's customer service and operational integrity. The inability to resolve issues promptly and effectively can lead to a negative trading experience. Therefore, it is essential for potential clients to evaluate whether Inception.Commercial Limited is safe, considering the prevalent customer feedback and complaint history.

Platform and Execution

The trading platform offered by Inception.Commercial Limited is another critical factor in assessing its reliability. The broker utilizes the MetaTrader 5 (MT5) platform, which is widely recognized for its advanced features and user-friendly interface. However, the platform's performance, including order execution quality and slippage rates, must also be evaluated.

Many traders have reported experiencing slippage during high volatility periods, which can adversely affect trade outcomes. Additionally, any indications of platform manipulation or technical issues could further undermine trust in the broker.

A reliable trading platform should provide seamless execution and minimal disruptions. Traders should consider whether the platform meets their needs and whether Inception.Commercial Limited is safe in terms of its execution capabilities.

Risk Assessment

The risks associated with trading through Inception.Commercial Limited are multifaceted. The absence of regulation, combined with a lack of transparency regarding fees and fund safety, presents a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for traders. |

| Transparency Risk | Medium | Limited information about fees and operations. |

| Fund Safety Risk | High | Potential for inadequate fund protection measures. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Inception.Commercial Limited. It is advisable to start with a small investment and closely monitor trading conditions and customer service responsiveness. Additionally, considering alternative brokers with established regulatory oversight may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that traders should approach Inception.Commercial Limited with caution. The broker's lack of regulatory oversight, combined with numerous customer complaints and transparency issues, raises significant concerns about its safety and legitimacy.

While Inception.Commercial Limited offers some attractive trading conditions, the associated risks may outweigh the potential benefits. Traders are advised to carefully consider whether Inception.Commercial Limited is safe for their trading activities. For those seeking more reliable alternatives, brokers with established regulatory credentials and positive customer feedback may be a more prudent choice.

Is inception commercial limited a scam, or is it legit?

The latest exposure and evaluation content of inception commercial limited brokers.

inception commercial limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

inception commercial limited latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.