Regarding the legitimacy of Hricai forex brokers, it provides VFSC and WikiBit, .

Is Hricai safe?

Business

License

Is Hricai markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Gleneagle Securities Pty Limited

Effective Date:

2023-01-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

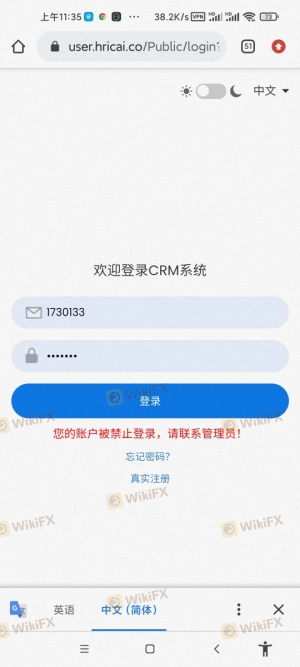

Is Hricai Safe or Scam?

Introduction

Hricai is a relatively new player in the forex market, positioning itself as a broker catering primarily to Chinese-speaking traders. As the forex landscape becomes increasingly crowded, traders must exercise caution when selecting a broker, given the prevalence of scams and unregulated entities. Evaluating a broker's legitimacy involves scrutinizing its regulatory status, company background, trading conditions, and customer feedback. This article employs a comprehensive investigative approach, utilizing various sources to assess whether Hricai is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory environment is crucial for any forex broker, as it ensures a level of oversight and consumer protection. Hricai claims to operate under the auspices of several regulatory bodies; however, scrutiny reveals significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | Not Provided | Vanuatu | Suspicious Clone |

The above table summarizes Hricai's regulatory standing, which raises red flags. The Vanuatu Financial Services Commission (VFSC) is often criticized for its lax regulations, allowing brokers to operate with minimal oversight. Furthermore, Hricai has been flagged as a "suspicious clone," indicating that it may be impersonating a legitimate entity. This lack of robust regulatory oversight is alarming, as it suggests that traders may not have adequate protection for their funds. Historically, brokers with such dubious licenses have been associated with high risks of fraud, making it imperative for traders to question, "Is Hricai safe?"

Company Background Investigation

Hricai's company history and ownership structure are critical in determining its credibility. Founded in late 2022, Hricai is registered under Gleneagle Securities Pty Ltd., with its operations based in Australia. However, the company appears to have a limited operational history, with many details about its management team and ownership being obscured.

Transparency is a major concern; the lack of publicly available information about the management team and their qualifications raises questions about the broker's reliability. A strong management team with a proven track record is essential for fostering trust in any financial institution. In Hricai's case, the opacity surrounding its leadership makes it difficult to ascertain whether the broker is genuinely committed to ethical practices. Thus, the question remains: Is Hricai safe?

Trading Conditions Analysis

The trading conditions offered by Hricai are another important aspect to consider. The broker claims to provide competitive spreads and various account types. However, an in-depth analysis reveals a potentially problematic fee structure that could impact traders negatively.

| Fee Type | Hricai | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Hidden Fees | Transparent |

| Overnight Interest Range | Varies | Standard |

The table above compares Hricai's trading costs with industry averages. The high spreads on major currency pairs could erode traders' profits, while hidden fees associated with the commission model suggest a lack of transparency. Such practices are often indicative of brokers that prioritize profit over client interests, prompting further investigation into whether Hricai is safe for potential investors.

Client Fund Safety

The safety of client funds should be a top priority for any forex broker. Hricai claims to implement various measures to secure client funds, such as segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

There are no guarantees that Hricai adheres to these practices, especially considering its dubious licensing. Historical incidents involving similar brokers indicate that clients have faced difficulties accessing their funds, leading to significant losses. Traders must be cautious and weigh these risks carefully, as the safety of their investments is paramount. Therefore, the question of Is Hricai safe? looms large.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability. Reviews of Hricai reveal a mixed bag of experiences, with some users reporting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Service | Medium | Unresponsive |

| Transparency Concerns | High | Ignored |

The table above outlines the main types of complaints against Hricai, highlighting the severity and the company's response. The recurring theme of withdrawal issues is particularly concerning, as it often indicates deeper systemic problems within the broker's operations. Additionally, the lack of responsiveness from customer service can exacerbate traders' frustrations, leading to a loss of trust. Given these complaints, the question Is Hricai safe? becomes increasingly pressing.

Platform and Trade Execution

The trading platform's performance and execution quality are critical for any trading experience. Hricai offers a platform that is reportedly user-friendly, but there are concerns regarding its stability and execution speed. Instances of slippage and order rejections have been noted, which can significantly impact trading outcomes.

The absence of clear data on execution quality raises alarms about potential manipulation or inefficiencies within the trading environment. Traders must be vigilant and question whether the platform can deliver the reliability needed for successful trading. Therefore, the inquiry into Is Hricai safe? remains unresolved.

Risk Assessment

Finally, a comprehensive risk assessment is essential when evaluating Hricai as a trading option.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a questionable license |

| Operational Risk | Medium | Limited transparency and historical issues |

| Financial Stability | High | New company with potential fund access issues |

The risk assessment table summarizes the key risk areas associated with Hricai. The high regulatory risk is particularly concerning, as it indicates a lack of consumer protection. Additionally, the operational and financial stability risks further compound the uncertainty surrounding this broker. Traders should carefully weigh these risks and consider whether they are willing to accept them, prompting the question, Is Hricai safe?

Conclusion and Recommendations

In conclusion, the investigation into Hricai reveals numerous red flags that suggest it may not be a safe option for traders. The lack of robust regulation, questionable company background, and numerous customer complaints raise significant concerns.

Traders are advised to exercise caution and consider alternative brokers with stronger regulatory oversight and proven track records. Recommendations for reliable brokers include those regulated by top-tier authorities such as the FCA or ASIC, which provide greater protection for investors. Ultimately, the evidence suggests that Hricai may not be a trustworthy choice, reinforcing the need for thorough due diligence in the forex market.

Is Hricai a scam, or is it legit?

The latest exposure and evaluation content of Hricai brokers.

Hricai Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hricai latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.