Is HOPFIST WEALTH safe?

Business

License

Is Hopfist Wealth Safe or Scam?

Introduction

Hopfist Wealth is an online forex broker that positions itself in the competitive landscape of foreign exchange trading. Established in 2022 and registered in the United Kingdom, it offers a range of trading instruments, including currency pairs, commodities, and indices, through the popular MetaTrader 5 platform. However, the forex market is rife with risks, and traders must exercise due diligence when selecting a broker. This article aims to provide a comprehensive assessment of Hopfist Wealth's legitimacy, focusing on regulatory compliance, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on multiple credible sources, including user reviews, regulatory databases, and financial analysis.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to ethical standards and operational guidelines. Unfortunately, Hopfist Wealth operates without any regulatory oversight from recognized financial authorities, raising significant concerns about its legitimacy and safety. Below is a summary of the regulatory information regarding Hopfist Wealth:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that there are no protective measures in place for traders, making them vulnerable to potential malpractice. Regulatory bodies play an essential role in monitoring brokers, ensuring that they maintain fair trading practices and protect client funds. Without such oversight, traders may find themselves exposed to risks such as market manipulation, fraudulent activities, and other unethical practices. Therefore, it is crucial for potential clients to consider this lack of regulation when asking, "Is Hopfist Wealth safe?"

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its trustworthiness. Hopfist Wealth is operated by Hopfist Wealth Ltd, a relatively new entity that has not yet established a strong reputation in the forex industry. Founded in 2022, the company lacks a comprehensive history, which can be a red flag for many traders.

The management team‘s experience and background are also essential indicators of a broker's reliability. Unfortunately, specific details about the team behind Hopfist Wealth are limited, making it difficult for traders to gauge the expertise and professionalism of those managing their investments. Furthermore, the company’s transparency regarding its ownership structure and operational practices is lacking, which raises additional concerns.

In the financial industry, transparency and clear communication are crucial for building trust with clients. The absence of detailed information about the company's history and its management team suggests a potential lack of accountability, further complicating the question of whether "Is Hopfist Wealth safe?"

Trading Conditions Analysis

An essential aspect of any forex broker is its trading conditions, including fees and spreads. Hopfist Wealth claims to offer competitive trading conditions, with spreads allegedly starting from 0.0 pips and leverage up to 400:1. However, such claims should be approached with caution, especially given the broker's lack of regulation. Below is a comparison of the core trading costs associated with Hopfist Wealth:

| Fee Type | Hopfist Wealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 0.5 - 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of a clear commission structure and the lack of transparency regarding overnight interest rates are concerning. Traders should be wary of any hidden fees that may not be disclosed upfront. Additionally, the high leverage offered can amplify both potential gains and losses, making it a double-edged sword for traders. Therefore, it is vital to carefully consider the overall cost structure and ask, "Is Hopfist Wealth safe?" before committing funds.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any brokerage. Hopfist Wealth's lack of regulatory oversight raises significant questions about its fund security measures. Typically, regulated brokers are required to maintain segregated accounts for client funds, ensuring that traders' money is kept separate from the company's operational funds. However, Hopfist Wealth does not provide information on whether it follows such practices.

Moreover, the absence of investor protection schemes, such as those provided by regulatory bodies, further jeopardizes the safety of client funds. Traders should also be aware of the potential for negative balance protection, which prevents them from losing more than their initial investment. Unfortunately, there is no information available regarding Hopfist Wealth's policies on these critical safety measures.

Given the lack of transparency and regulatory compliance, traders must carefully consider their options and ask themselves, "Is Hopfist Wealth safe?" before investing their hard-earned money.

Customer Experience and Complaints

Customer feedback is a crucial component of assessing a broker's legitimacy. Reviews from Hopfist Wealth users highlight a range of experiences, with several complaints indicating issues related to fund withdrawals and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Unresponsive |

| Poor Customer Support | Medium | Limited Communication |

| Misleading Information | High | Lack of Transparency |

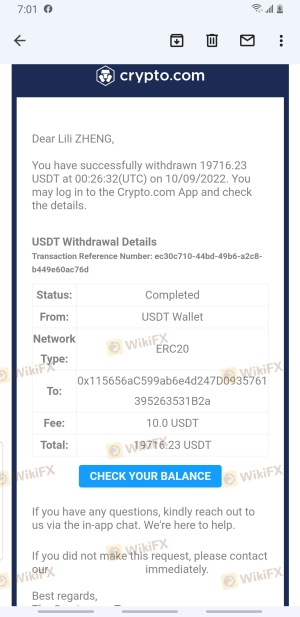

Many users have reported being unable to withdraw their funds without making additional payments, which raises significant red flags about the broker's practices. For instance, one user claimed they were told to deposit more money before being allowed to withdraw their initial investment. Such practices are often indicative of scams and should not be taken lightly.

In light of these complaints, potential clients must critically evaluate their decision and question, "Is Hopfist Wealth safe?" based on the experiences of others.

Platform and Execution

The trading platform offered by a broker is another critical factor in assessing its reliability. Hopfist Wealth utilizes the MetaTrader 5 platform, which is well-regarded in the industry for its user-friendly interface and robust features. However, the performance and stability of the platform are vital for traders looking for a seamless trading experience.

Reports from users indicate mixed experiences with order execution, with some mentioning instances of slippage and rejected orders. Such issues can significantly impact trading outcomes, especially in a fast-moving market. The potential for platform manipulation or technical glitches further complicates the question of whether "Is Hopfist Wealth safe?"

Risk Assessment

When evaluating the overall risk of trading with Hopfist Wealth, several key factors emerge. Below is a summary of the primary risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight, increasing risk |

| Fund Security | High | Lack of information on fund protection |

| Customer Support | Medium | Reports of unresponsive customer service |

| Trading Conditions | Medium | Potential hidden fees and high leverage risks |

Given these risks, traders should carefully consider their risk tolerance and take appropriate precautions. It is advisable to conduct thorough research and seek alternative, regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the analysis of Hopfist Wealth raises significant concerns about its legitimacy and safety. The lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that potential traders should exercise extreme caution. The question of "Is Hopfist Wealth safe?" remains largely unanswered, with many indicators pointing towards potential risks and fraudulent practices.

For traders looking to engage in forex trading, it may be prudent to consider alternative options. Reputable brokers that are regulated by top-tier authorities can provide a safer trading environment and greater peace of mind. Always prioritize due diligence and research before committing any funds to ensure a secure trading experience.

Is HOPFIST WEALTH a scam, or is it legit?

The latest exposure and evaluation content of HOPFIST WEALTH brokers.

HOPFIST WEALTH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HOPFIST WEALTH latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.