Is HonFX safe?

Business

License

Is HonFX A Scam?

Introduction

HonFX is a forex broker that has been operating since 2017, positioning itself as a player in the competitive foreign exchange market. With various trading instruments and the promise of favorable trading conditions, it attracts traders from different backgrounds. However, given the prevalence of scams in the forex industry, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide a comprehensive analysis of HonFX, focusing on its regulatory status, company background, trading conditions, safety measures, customer feedback, platform performance, and overall risk assessment. The investigation relies on various sources, including user reviews, regulatory databases, and industry reports, to ensure an objective evaluation.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is a critical factor in determining its legitimacy. HonFX claims to be regulated by multiple authorities, including the Financial Services Commission (FSC) of Mauritius and the Labuan Financial Services Authority (LFSA) in Malaysia. However, it is essential to scrutinize the quality and reputation of these regulators.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC Mauritius | Not specified | Mauritius | Verified |

| LFSA | Not specified | Labuan | Verified |

| FSA SVG | Not specified | St. Vincent | Verified |

While these licenses provide some level of oversight, they are not considered tier-1 regulations, which are typically associated with stricter compliance and investor protection measures. The absence of a license from more reputable regulators such as the FCA in the UK or ASIC in Australia raises questions about the safety of trading with HonFX. Furthermore, user complaints and reports of withdrawal issues have surfaced, indicating potential operational risks. Therefore, when assessing whether HonFX is safe, it is prudent to consider these regulatory nuances.

Company Background Investigation

HonFX is operated by Honor Capital Markets Limited, which has its headquarters in St. Vincent and the Grenadines, with additional offices in Mauritius and Malaysia. The company was established in 2017, aiming to provide a wide range of trading services to its clients. However, the ownership structure and management team remain somewhat opaque, with limited publicly available information.

The management team consists of individuals with backgrounds in finance and trading, but specific details about their experience and qualifications are not readily disclosed. This lack of transparency can be a red flag for potential investors, as it raises concerns about the company's accountability and operational integrity. Moreover, the company does not publicly disclose its financial statements, which is a common practice among reputable brokers. In evaluating whether HonFX is safe, the opaque nature of its corporate governance and the absence of detailed disclosures are significant factors to consider.

Trading Conditions Analysis

When analyzing the trading conditions offered by HonFX, it is essential to look at the overall fee structure and any potential hidden costs. The broker claims to offer competitive spreads and no commission on trades, which can be appealing to traders. However, there have been reports of unusual fees that can affect the overall trading experience.

| Fee Type | HonFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

While the spreads may seem competitive, the potential for hidden fees or unfavorable trading conditions should not be overlooked. Additionally, the absence of a clear commission structure can lead to confusion for traders, especially those who are new to the forex market. As such, when considering is HonFX safe, it is vital to scrutinize the trading conditions closely to avoid any unexpected costs that could erode profits.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. HonFX claims to implement various security measures, including segregated accounts and negative balance protection. However, the effectiveness of these measures is often contingent on the regulatory framework under which the broker operates.

HonFX does not participate in any investor compensation schemes, which means that in the event of insolvency, clients may not have any recourse to recover their funds. Moreover, historical complaints regarding withdrawal issues raise concerns about the broker's commitment to fund safety. Reports of clients being unable to withdraw their funds after making profits are particularly alarming and suggest potential operational inefficiencies or worse.

In evaluating whether HonFX is safe, it is essential to consider these safety measures critically. While the broker offers some protections, the lack of tier-1 regulation and investor compensation schemes increases the risk associated with trading with HonFX.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of HonFX reveal a mixed bag of experiences. While some users praise the trading platform and customer support, many others have reported significant issues, particularly concerning withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Management Problems | Medium | Occasionally Responsive |

| Platform Stability Issues | Medium | Generally Responsive |

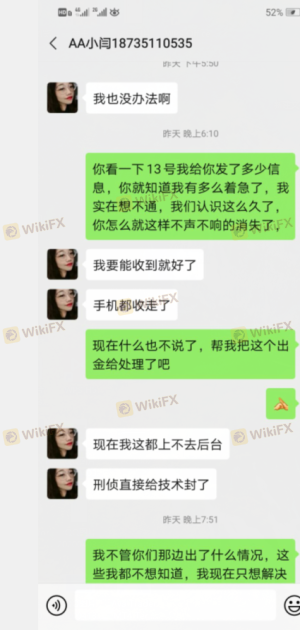

Several users have reported that their withdrawal requests were delayed or denied without sufficient explanation. In some cases, account managers pressured clients to continue trading instead of processing withdrawals. Such practices are concerning and lead to the perception that HonFX may not be safe for traders looking for a reliable and transparent trading experience.

Platform and Execution

The trading platform offered by HonFX is primarily MetaTrader 5 (MT5), which is known for its robust features and user-friendly interface. However, the performance and execution quality of the platform are critical for a positive trading experience. Users have reported mixed experiences regarding order execution, with some experiencing slippage and delays during volatile market conditions.

The broker claims to provide true ECN connectivity, which should theoretically enhance order execution quality. However, reports of rejected orders and platform manipulation have surfaced, raising concerns about the integrity of the trading environment. When evaluating is HonFX safe, the quality of the trading platform and execution must be carefully considered, as they directly impact traders' ability to operate effectively in the market.

Risk Assessment

Using HonFX comes with inherent risks that potential traders should be aware of. The combination of regulatory concerns, customer complaints, and operational transparency issues contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Operates under tier-3 regulations |

| Withdrawal Reliability | High | Numerous complaints about withdrawals |

| Trading Conditions | Medium | Potential hidden fees and high spreads |

To mitigate these risks, it is advisable for traders to maintain a cautious approach. Conducting thorough research, starting with a demo account, and only investing funds that one can afford to lose are prudent measures when engaging with HonFX.

Conclusion and Recommendations

In conclusion, while HonFX presents itself as a legitimate forex broker, several factors raise concerns about its safety and reliability. The lack of tier-1 regulation, numerous customer complaints regarding withdrawals, and the opaque nature of its corporate governance suggest that potential traders should exercise caution.

For those considering trading with HonFX, it is essential to weigh the risks carefully. Traders seeking reliable options may want to explore alternatives that offer stronger regulatory oversight and a better track record of customer satisfaction. Recommended alternatives include brokers with tier-1 regulation and positive user feedback, such as OANDA or IG, which provide a more secure trading environment. Ultimately, is HonFX safe? The evidence suggests that potential traders should proceed with caution and conduct further research before committing their funds.

Is HonFX a scam, or is it legit?

The latest exposure and evaluation content of HonFX brokers.

HonFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HonFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.