Is HKJRY safe?

Business

License

Is HKJRY Safe or a Scam?

Introduction

HKJRY is a forex broker based in Hong Kong that has gained attention in the trading community for its offerings and trading conditions. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the potential for scams and fraudulent activities remains high. In this article, we will evaluate whether HKJRY is safe for trading or if it raises red flags that suggest it could be a scam. Our investigation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer safety measures, and user feedback.

Regulation and Legitimacy

One of the most critical factors in determining the safety of a forex broker is its regulatory status. A regulated broker is subject to strict oversight, which helps protect traders from potential fraud. Unfortunately, HKJRY operates without any valid regulatory licenses.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation is a significant concern, as it indicates that HKJRY is not held accountable by any authoritative body, which increases the risk for traders. Without oversight, there is little recourse for clients in the event of disputes or financial mismanagement. Additionally, the lack of a regulatory history raises questions about the company's legitimacy and commitment to compliance.

Company Background Investigation

HKJRYs history and ownership structure are essential in assessing its credibility. Established in Hong Kong, the broker has been operational for a limited period, raising concerns about its longevity and stability. The management team behind HKJRY lacks publicly available information, which diminishes transparency and makes it difficult to evaluate their qualifications and experience in the financial sector.

Furthermore, the company's communication regarding its operations and services is minimal, leading to skepticism about its transparency and reliability. An absence of detailed information about the management team and ownership structure can be a red flag, as reputable brokers typically provide comprehensive details about their leadership and operational history.

Trading Conditions Analysis

Examining the trading conditions offered by HKJRY is crucial for understanding the overall cost of trading with this broker. The broker claims to provide competitive spreads and various account types, but without proper regulation, these claims must be approached with caution.

| Fee Type | HKJRY | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | 0.5% - 1.5% |

While the spread appears competitive, traders should be wary of hidden fees or unfavorable conditions that could arise, especially given the lack of oversight. Additionally, the absence of a commission structure raises concerns about how the broker generates revenue, which could lead to conflicts of interest.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's reliability. HKJRYs lack of regulatory oversight means that there are no mandated protections in place for client funds. This raises significant concerns regarding fund segregation and the overall security of deposits.

Traders should inquire about whether HKJRY employs any measures to protect client funds, such as segregating them from the company's operational funds. The absence of such measures could expose traders to risks of loss in the event of the broker's financial difficulties. Furthermore, there is no information available regarding investor protection schemes or negative balance protection, which are common safeguards offered by regulated brokers.

Customer Experience and Complaints

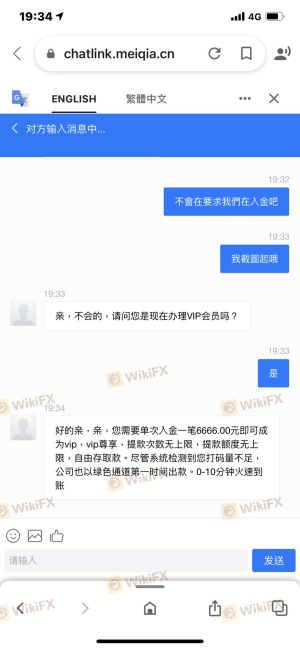

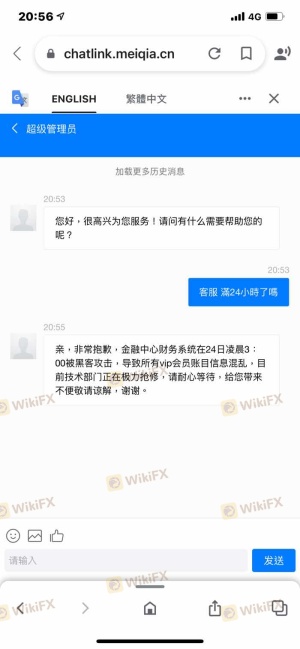

Customer feedback is a valuable source of information when assessing a broker's reputation. Unfortunately, HKJRY has received several complaints from users, indicating potential issues with its services.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Slippage and Order Execution | Medium | Average |

| Customer Service Response Time | High | Poor |

Common complaints include difficulties in withdrawing funds and poor customer service responses. These issues are concerning and suggest that traders may face challenges when attempting to access their funds. Moreover, the high severity of complaints indicates a pattern of dissatisfaction among users, which is a significant red flag for potential clients.

Platform and Execution

The trading platform provided by HKJRY plays a crucial role in the overall trading experience. Evaluating the platform's performance, stability, and user experience is essential for traders. While HKJRY claims to offer a reliable trading environment, the lack of transparency regarding execution quality and potential slippage raises concerns.

Traders have reported experiencing slippage during volatile market conditions, which can lead to unexpected losses. Additionally, there are no indications of platform manipulation, but the absence of regulatory oversight means that the broker is not held accountable for such practices.

Risk Assessment

Using HKJRY for trading comes with inherent risks that potential clients must be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or accountability for broker practices. |

| Fund Safety Risk | High | Lack of fund segregation and investor protection. |

| Customer Service Risk | Medium | Poor response times and unresolved complaints. |

Given these risks, traders must carefully consider their options and the potential consequences of trading with an unregulated broker like HKJRY. It is advisable to conduct thorough research and seek alternative, regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that HKJRY raises significant concerns regarding its safety and legitimacy. The lack of regulation, coupled with poor customer feedback and insufficient transparency, indicates that traders should approach this broker with caution. There are clear signs of potential fraud or at least questionable practices that warrant a warning.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities. Options such as eToro, Interactive Brokers, or other well-established firms offer the necessary protections and oversight that HKJRY lacks. Ultimately, ensuring the safety of your investments should be the top priority when choosing a forex broker.

In summary, is HKJRY safe? The overwhelming evidence suggests that it is not, and traders should be wary of engaging with this broker.

Is HKJRY a scam, or is it legit?

The latest exposure and evaluation content of HKJRY brokers.

HKJRY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HKJRY latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.