Is HapFover safe?

Business

License

Is Hapfover Safe or Scam?

Introduction

Hapfover is a forex broker that has positioned itself in the competitive landscape of foreign exchange trading. With claims of offering various trading opportunities, it has attracted the attention of both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Many traders have fallen victim to scams, resulting in significant financial losses. Therefore, it is crucial to assess the legitimacy and safety of brokers like Hapfover before making any investments. This article investigates the safety of Hapfover, using various sources, including regulatory information, company background, trading conditions, and customer feedback, to provide a comprehensive overview.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that can determine its reliability. Hapfover has come under scrutiny due to its lack of regulation and warnings issued by financial authorities. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CONSOB | Not Available | Italy | Blacklisted |

| SFC | Not Available | Hong Kong | Blacklisted |

The absence of a valid trading license from reputable regulatory bodies raises serious concerns regarding the safety of funds and the overall legitimacy of Hapfover. Regulatory agencies like CONSOB and the Securities and Futures Commission (SFC) have blacklisted Hapfover, indicating a history of non-compliance and potentially fraudulent activities. Without proper oversight, the risk of encountering unfair trading practices and difficulties in fund withdrawals increases significantly.

Company Background Investigation

Hapfover Limited, the entity behind the platform, claims to be based in Hong Kong while presenting itself as a British forex broker. This discrepancy in location raises questions about its operational transparency. There is a notable lack of information regarding the ownership structure and management team of Hapfover. The absence of publicly available details about the company's executives and their professional backgrounds further complicates the assessment of its credibility. A transparent broker typically provides information about its leadership team and operational history, which is not the case here. This lack of transparency may indicate a higher risk for investors, as it is challenging to hold anonymous entities accountable in case of disputes or fraud.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Hapfover's fee structure is not clearly defined, which can be a red flag for potential investors. The following table summarizes the trading costs associated with Hapfover compared to industry averages:

| Fee Type | Hapfover | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | 0.5-1.5% |

The lack of transparency in trading costs can mislead traders into making uninformed decisions. Furthermore, the absence of clear policies regarding commissions and overnight fees raises concerns about hidden charges that could affect profitability. Traders should always seek brokers that provide detailed information about their trading conditions to avoid unexpected costs.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Hapfover's approach to fund security has been criticized due to its unregulated status. The broker does not appear to employ standard safety measures that protect client deposits, such as segregated accounts or investor protection schemes. Historically, many clients have reported issues with withdrawing their funds from Hapfover, which raises alarms about the security of their investments. The lack of a safety net for deposits leaves clients vulnerable to potential losses, making it imperative for traders to consider the risks of investing with Hapfover.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's credibility. Reviews of Hapfover reveal a pattern of dissatisfaction among users, with many reporting issues related to fund withdrawals and customer support. The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow Response |

| Transparency Concerns | High | No Response |

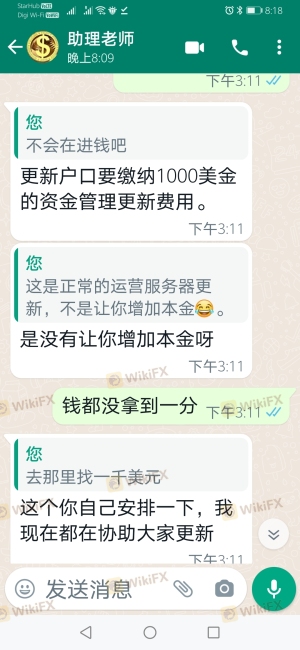

Numerous users have expressed frustration over their inability to withdraw funds, often citing excessive fees and delays. These complaints are serious and indicate a pattern of behavior that could be classified as fraudulent. In some cases, users report feeling pressured to deposit more funds without being able to access their existing balances, a tactic commonly employed by scam brokers.

Platform and Execution

The trading platform offered by Hapfover is another critical aspect to consider. While the platform claims to provide a user-friendly interface, reports of execution issues and slippage have emerged. Traders have noted instances where their orders were not executed as expected, leading to significant losses. The reliability of a trading platform is essential for effective trading, and any signs of manipulation or poor execution quality can severely impact a trader's experience.

Risk Assessment

Investing with Hapfover presents several risks that potential traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated and blacklisted |

| Fund Safety Risk | High | No investor protection measures |

| Trading Condition Risk | Medium | Lack of transparency in fees |

| Customer Support Risk | High | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers that offer better protection for their investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hapfover is not a safe trading platform. The lack of regulation, transparency issues, and numerous customer complaints indicate a high likelihood of fraudulent practices. Traders should exercise extreme caution when considering investing with Hapfover, as the risks associated with this broker far outweigh any potential benefits. For those seeking reliable trading options, it is advisable to explore other brokers that are regulated by reputable financial authorities and have a proven track record of customer satisfaction.

In summary, if you are asking, "Is Hapfover safe?" the answer is a resounding no. It is essential to prioritize safety and reliability in forex trading, and there are numerous alternative brokers that can provide a more secure trading environment.

Is HapFover a scam, or is it legit?

The latest exposure and evaluation content of HapFover brokers.

HapFover Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HapFover latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.