Regarding the legitimacy of Goodwill Gold forex brokers, it provides HKGX and WikiBit, .

Is Goodwill Gold safe?

Risk Control

License

Is Goodwill Gold markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

鴻豐金業集團(香港)有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.gwgold.com.hkExpiration Time:

--Address of Licensed Institution:

九龍佐敦廣東道513-531號玉器交易廣場1樓29室Phone Number of Licensed Institution:

39788188Licensed Institution Certified Documents:

Is GWGOLD A Scam?

Introduction

GWGOLD is a Hong Kong-based forex broker that has been operational since 2017, primarily focusing on trading precious metals such as gold and silver. As the forex market continues to grow, traders are increasingly faced with a myriad of options when selecting a broker. This proliferation necessitates a cautious approach, as the safety and reliability of trading platforms can vary significantly. In this article, we will explore whether GWGOLD is a safe trading option or a potential scam. Our investigation is based on an analysis of its regulatory standing, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

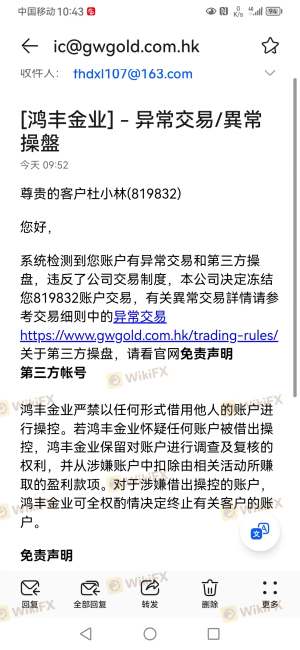

The regulatory status of a broker is a critical factor in determining its legitimacy. GWGOLD claims to be regulated by the Hong Kong Gold Exchange (HKGX), which is a significant body overseeing precious metals trading in Hong Kong. However, the effectiveness and strictness of the regulation are essential for ensuring the safety of client funds and fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold Exchange | 050 | Hong Kong | Verified |

While being regulated by HKGX provides a layer of security, it is essential to note that some reports suggest that the license may be a "suspicious clone," implying that it may not be as robust as it appears. The reputation of the regulatory body plays a vital role in assessing the safety of trading with GWGOLD. A lack of significant regulatory disclosures during our evaluation period raises questions about the broker's compliance history and overall operational integrity.

Company Background Investigation

GWGOLD is operated by Hong Kong-based Hongfeng Gold Group Limited. Established relatively recently, the company has been building its presence in the forex market, focusing primarily on the Chinese market. The management team comprises individuals with backgrounds in finance and trading, but detailed information about their professional experience and track records is limited. This lack of transparency can lead to concerns regarding the company's accountability and the quality of its services.

Furthermore, the company's ownership structure is not fully disclosed, making it challenging for potential clients to ascertain who is ultimately responsible for the broker's operations. Transparency in ownership is crucial for building trust, and the absence of this information may contribute to the skepticism surrounding GWGOLD's legitimacy.

Trading Conditions Analysis

An essential aspect of evaluating whether GWGOLD is safe involves examining its trading conditions. The broker offers a range of trading instruments, primarily focusing on spot gold and silver, with leverage options of up to 1:50. However, the overall fee structure and any hidden costs are critical to consider.

| Fee Type | GWGOLD | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of clarity regarding the specific spreads and commissions on major currency pairs is concerning. Traders should be wary of any unusual or excessive fees that could eat into their profits. A transparent fee structure is vital for ensuring that traders know what to expect, and any ambiguity can signal potential issues.

Client Fund Safety

The safety of client funds is paramount when considering a broker. GWGOLD claims to implement measures such as segregated accounts for client funds, which is a standard practice among reputable brokers. This practice ensures that client funds are kept separate from the broker's operational funds, providing an additional layer of security.

However, there is little information available regarding investor protection schemes or negative balance protection policies. The absence of these protections can be a red flag, particularly for traders who may be vulnerable to market volatility. Historical issues or controversies related to fund safety can significantly impact a broker's reputation, and there are reports of clients experiencing difficulties with withdrawals, which raises further concerns.

Customer Experience and Complaints

Examining customer feedback is crucial for understanding the real-world experiences of traders using GWGOLD. Many reviews indicate a mix of experiences, with some users reporting satisfactory service, while others have voiced concerns about withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

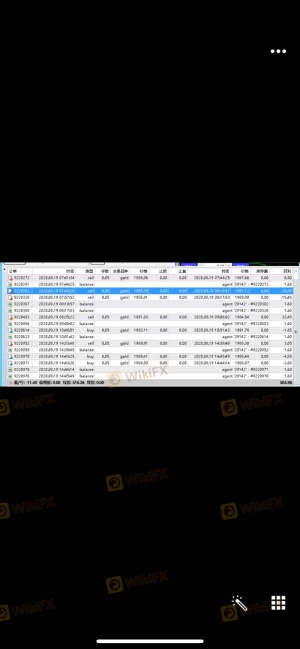

| Withdrawal Difficulties | High | Slow Response |

| Order Execution Issues | Medium | Inconsistent |

Common complaints include delays in withdrawal processing and issues with order execution, such as slippage and rejections. These complaints suggest that while some customers have had positive experiences, significant issues exist that could deter potential traders. Specific case studies reveal instances where clients were unable to access their funds, leading to frustration and distrust.

Platform and Execution

The trading platform offered by GWGOLD is based on MetaTrader 4 (MT4), a widely used platform known for its robust features and user-friendly interface. However, the performance and stability of the platform are crucial for ensuring a smooth trading experience.

Traders have reported varying levels of order execution quality, with some experiencing slippage during high volatility periods. The frequency of rejected orders can also indicate potential manipulation or issues with the broker's execution environment. These factors contribute to the overall perception of whether GWGOLD is a safe trading option.

Risk Assessment

Engaging with any broker entails inherent risks, and GWGOLD is no exception. A comprehensive risk assessment is necessary to evaluate the potential challenges traders may face.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Potential issues with regulatory legitimacy. |

| Fund Safety | Medium | Concerns regarding fund protection measures. |

| Customer Support Quality | Medium | Reports of slow response times and issues. |

To mitigate these risks, traders should conduct thorough research, maintain a cautious approach, and consider starting with a demo account before committing significant capital.

Conclusion and Recommendations

In conclusion, while GWGOLD presents itself as a regulated broker with various trading options, significant concerns regarding its regulatory legitimacy, customer fund safety, and client experiences raise red flags. The potential for withdrawal issues and a lack of transparency regarding fees and company structure suggest that traders should exercise caution.

For those considering trading with GWGOLD, it is advisable to weigh the risks carefully and consider alternative brokers with a more established reputation and stronger regulatory oversight. Reliable options may include brokers with transparent fee structures, robust customer support, and a proven track record of fund safety. Ultimately, ensuring that your trading environment is secure and trustworthy should be the top priority for any trader.

Is Goodwill Gold a scam, or is it legit?

The latest exposure and evaluation content of Goodwill Gold brokers.

Goodwill Gold Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Goodwill Gold latest industry rating score is 7.82, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.82 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.