Regarding the legitimacy of Gsgold forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Gsgold safe?

Business

License

Is Gsgold markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

金銀海貴金屬有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港荃灣海盛路11號One Midtown 19樓1913室Phone Number of Licensed Institution:

85231882277Licensed Institution Certified Documents:

Is GSGOLD Safe or a Scam?

Introduction

GSGOLD is a forex broker that positions itself as a provider of trading services in precious metals, particularly gold and silver, using the widely recognized MetaTrader 5 platform. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the presence of unregulated or fraudulent entities poses significant risks. The importance of due diligence cannot be overstated, as many traders have fallen victim to scams that result in substantial financial losses. This article aims to evaluate the legitimacy of GSGOLD by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and potential risks. The analysis is based on a review of various online sources, including regulatory databases and user feedback.

Regulation and Legitimacy

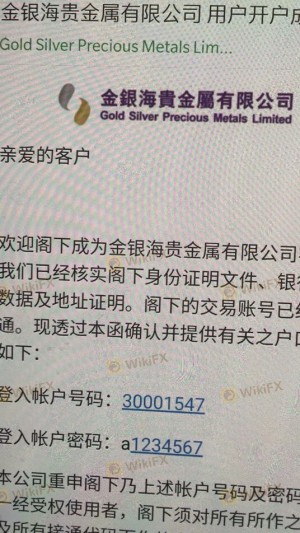

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. GSGOLD claims to operate under the auspices of regulatory authorities, but a closer examination reveals several red flags. The broker is associated with a suspicious clone license in Hong Kong, which raises concerns about its legitimacy. Below is a summary of GSGOLD's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| HK GX | 146 | Hong Kong | Suspicious Clone |

The lack of credible regulatory oversight is a significant concern, particularly given that GSGOLD has been flagged as operating under a potentially cloned license. This indicates that the broker may not adhere to the rigorous standards typically enforced by reputable regulatory bodies, which can expose traders to heightened risks. Furthermore, the absence of transparency regarding its regulatory compliance history suggests that GSGOLD may not prioritize the protection of its clients' interests.

Company Background Investigation

GSGOLD, operating under the name Gold Silver Precious Metals Limited, has a somewhat opaque corporate history. The company claims to have been in operation for 5 to 10 years, but the limited information available raises questions about its credibility. The management team behind GSGOLD lacks substantial public profiles, which is another indicator of potential issues regarding transparency and accountability.

The absence of detailed information about the company's ownership structure and its management team's qualifications further complicates the assessment of GSGOLD's reliability. A broker's transparency is vital for fostering trust, and the lack of accessible information about its operations can lead to skepticism among potential clients. Without a clear understanding of who operates the broker and their qualifications, traders may find it challenging to feel secure in their investment decisions.

Trading Conditions Analysis

When evaluating whether GSGOLD is safe, it's essential to consider its trading conditions, including fees and spreads. The broker offers a range of trading options in the forex and precious metals markets; however, the overall fee structure remains unclear. Traders have reported unusual fees and a lack of transparency regarding costs, which can significantly impact profitability.

Heres a comparison of GSGOLD's trading costs against industry averages:

| Fee Type | GSGOLD | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of specific details about spreads and commissions is concerning, as traders require this information to make informed decisions. Additionally, any hidden fees can erode profits and lead to a negative trading experience. Overall, the opacity surrounding GSGOLD's trading conditions raises doubts about its legitimacy and whether it can be deemed safe for traders.

Customer Funds Safety

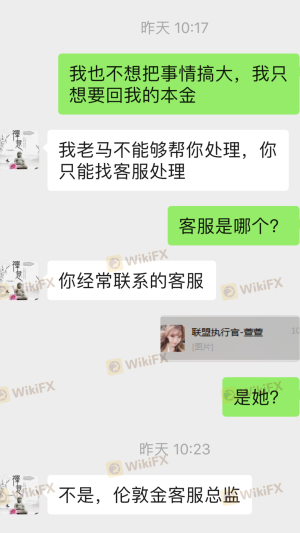

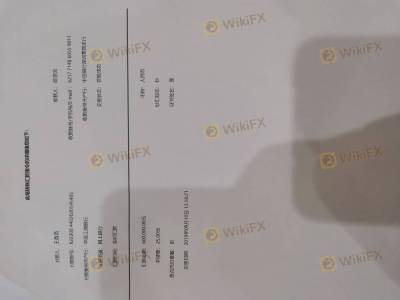

The safety of customer funds is a paramount concern for any forex trader. GSGOLD's approach to fund security is lacking in several areas. Reports indicate that the broker does not provide adequate information regarding fund segregation or investor protection measures, which are essential for safeguarding client assets.

Moreover, the absence of a clear negative balance protection policy raises further concerns. Traders need assurance that their investments are protected from significant losses that exceed their account balance. Historical disputes involving GSGOLD suggest that clients have experienced difficulties in retrieving their funds, indicating potential risks associated with using this broker.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. GSGOLD has received numerous complaints from users, highlighting issues related to fund withdrawal, lack of transparency, and poor customer service.

Here's a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Transparency Concerns | Medium | Inadequate |

| Customer Support Quality | High | Poor |

Two notable case studies illustrate the challenges faced by GSGOLD clients. In one instance, a trader reported being unable to withdraw funds for several weeks, leading to significant frustration and financial strain. Another user expressed concern over the lack of communication from customer support, further exacerbating their negative experience. These patterns of complaints raise alarms about the broker's operational integrity and responsiveness to client needs.

Platform and Execution

The trading platform offered by GSGOLD is based on MetaTrader 5, a widely respected platform known for its reliability and advanced features. However, user reports indicate that the execution quality may not meet industry standards. Issues such as slippage and order rejections have been reported, which can severely impact trading outcomes.

A thorough evaluation of the platform's performance and execution quality is essential for determining whether GSGOLD is safe. Traders should be wary of any signs of platform manipulation, as this could indicate deeper issues within the broker's operational framework.

Risk Assessment

Using GSGOLD carries several risks, primarily stemming from its unregulated status and lack of transparency. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating without credible oversight. |

| Financial Risk | High | Potential loss of funds due to hidden fees and withdrawal issues. |

| Operational Risk | Medium | Concerns about platform stability and execution quality. |

To mitigate these risks, traders should consider conducting thorough research and exploring alternative brokers with robust regulatory frameworks and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that GSGOLD exhibits several characteristics commonly associated with potentially fraudulent brokers. The lack of regulatory oversight, transparency issues, and negative user experiences raise significant concerns about its safety.

Traders should exercise extreme caution when considering GSGOLD as their forex broker. For those seeking reliable alternatives, brokers with established regulatory frameworks, transparent fee structures, and positive customer feedback are recommended. Ultimately, ensuring the safety of investments should be the top priority for any trader navigating the forex market.

In summary, is GSGOLD safe? The overwhelming evidence points to the conclusion that it is not a safe option for traders, and potential clients should be wary of engaging with this broker.

Is Gsgold a scam, or is it legit?

The latest exposure and evaluation content of Gsgold brokers.

Gsgold Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gsgold latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.