Is FXSuit safe?

Business

License

Is FXSuit A Scam?

Introduction

FXSuit is a forex brokerage that positions itself as an international online trading platform, offering access to various financial instruments, including forex, commodities, and cryptocurrencies. With the rise of online trading, it has become crucial for traders to thoroughly evaluate the legitimacy and reliability of their chosen brokers. The forex market is rife with opportunities, but it is also plagued by scams and unregulated entities that can jeopardize traders' investments. Therefore, understanding the regulatory status, company background, trading conditions, and customer experiences associated with a broker like FXSuit is paramount. This article investigates whether FXSuit is safe or a potential scam, employing a comprehensive assessment framework based on regulatory compliance, company history, trading conditions, and user feedback.

Regulation and Legitimacy

The regulatory environment surrounding a forex broker is fundamental to its credibility. Regulation provides a safety net for traders, ensuring that their funds are protected and that the broker operates within established legal frameworks. In the case of FXSuit, it is crucial to note that the brokerage operates under the auspices of Salvax Limited, a company registered in Bermuda. However, Bermuda does not have a regulatory framework for forex trading, which raises significant concerns about the safety of funds deposited with FXSuit.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bermuda Monetary Authority | N/A | Bermuda | Unregulated |

The lack of a legitimate regulatory authority overseeing FXSuit means that there is no recourse for traders in case of disputes or fraudulent activities. Historical compliance records indicate that FXSuit has been flagged by various financial authorities, including warnings from the Spanish CNMV and the Italian CONSOB, which have categorized it as an unregistered firm operating without authorization. This lack of oversight is a major red flag and suggests that FXSuit may not be a safe option for traders looking to invest their money.

Company Background Investigation

FXSuit claims to have been operational since 2017, with its parent company, Salvax Limited, registered in Bermuda. However, the company's history and ownership structure are shrouded in ambiguity. There is limited publicly available information regarding the management team and their professional backgrounds. Transparency is a critical factor in assessing a broker's reliability, and the lack of accessible information about FXSuit's executives raises concerns about the broker's integrity.

Moreover, the absence of verifiable contact information and the use of a private registration for the brokerage's domain further obscure its legitimacy. Traders are often advised to be cautious when dealing with companies that lack transparency, as this can indicate potential risks associated with their operations. Overall, the company's opaque background and the absence of regulatory oversight suggest that FXSuit may not be a trustworthy broker.

Trading Conditions Analysis

FXSuit offers a variety of trading conditions, including a minimum deposit requirement as low as $5, which may appear attractive to novice traders. However, the overall fee structure and trading costs associated with the broker warrant a closer examination. Traders should be aware that low minimum deposit requirements can sometimes be a tactic to lure inexperienced investors into a potentially unsafe trading environment.

| Fee Type | FXSuit | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 pips | 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by FXSuit, particularly on major currency pairs, are notably higher than the industry average. High spreads can erode trading profits and indicate that the broker may not be operating with the best interests of its clients in mind. Additionally, the absence of a clear commission structure raises questions about hidden fees that may be imposed on traders. Overall, the trading conditions at FXSuit do not align with what is typically expected from reputable brokers, further casting doubt on whether FXSuit is safe for trading.

Client Fund Security

The safety of client funds is a paramount concern when evaluating a forex broker. FXSuit's lack of regulation raises serious questions about the security measures in place to protect traders' investments. A regulated broker is typically required to maintain segregated accounts for client funds, ensuring that traders' money is kept separate from the broker's operational funds. However, FXSuit does not provide any information regarding such practices, which significantly heightens the risk for traders.

Moreover, the absence of investor protection mechanisms and negative balance protection policies means that traders could potentially lose more than their initial investment without any recourse. Historical accounts of traders experiencing difficulties in withdrawing their funds from FXSuit further emphasize the potential risks involved. Given these factors, it is evident that FXSuit may not offer a safe environment for trading, making it imperative for potential clients to exercise caution.

Customer Experience and Complaints

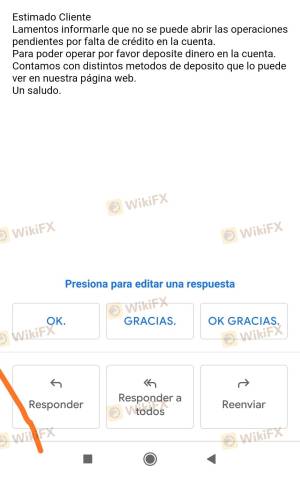

Analyzing customer feedback is essential in determining the overall reliability of a broker. Reviews of FXSuit indicate a pattern of dissatisfaction among clients, with numerous complaints about withdrawal issues and poor customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Spreads | Medium | Unaddressed |

| Poor Customer Service | High | Unresponsive |

Many users have reported difficulties in accessing their funds, with claims that the broker employs tactics to delay or deny withdrawal requests. Additionally, the quality of customer support has been criticized, with clients stating that their inquiries often go unanswered or are met with inadequate responses. These issues, combined with the broker's lack of regulatory oversight, suggest that FXSuit may not be a safe choice for traders seeking a trustworthy trading environment.

Platform and Trade Execution

The trading platform offered by FXSuit is MetaTrader 4 (MT4), a widely recognized platform in the forex trading community. While MT4 is known for its user-friendly interface and robust trading tools, the overall performance of the platform at FXSuit has been called into question. Reports of slippage and order rejections have raised concerns about the quality of trade execution, which is critical for traders aiming to capitalize on market movements.

Moreover, the lack of transparency regarding the broker's order execution policies and any potential manipulation raises additional red flags. Traders should be wary of platforms that do not provide clear information about how trades are executed, as this can indicate potential risks associated with the broker's operations.

Risk Assessment

When evaluating the overall risk of trading with FXSuit, several factors come into play. The lack of regulatory oversight, combined with the broker's opaque company structure and poor customer feedback, contributes to a high-risk environment for traders. The following risk assessment summarizes key risk areas associated with FXSuit:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No segregation of funds or investor protection. |

| Customer Service Risk | Medium | Poor response rates and unresolved complaints. |

| Trading Execution Risk | High | Reports of slippage and order rejection. |

To mitigate these risks, potential traders are advised to consider alternative brokers that are regulated and offer better customer service and fund protection.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the legitimacy and safety of FXSuit as a forex broker. The lack of regulatory oversight, combined with numerous customer complaints and questionable trading conditions, suggests that FXSuit may not be a safe option for traders. Potential clients should be particularly cautious, as engaging with an unregulated broker poses inherent risks to their investments.

For traders seeking a more secure trading environment, it is advisable to explore alternatives that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds, transparent trading conditions, and responsive customer service. Overall, the risks associated with FXSuit suggest that it is prudent for traders to look elsewhere for their forex trading needs.

Is FXSuit a scam, or is it legit?

The latest exposure and evaluation content of FXSuit brokers.

FXSuit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXSuit latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.