Is FXRevolution safe?

Business

License

Is FXRevolution A Scam?

Introduction

FXRevolution is a forex and CFD broker that positions itself as a global trading platform, offering various financial instruments to traders. Established in 2019, the broker claims to provide a user-friendly trading experience with competitive trading conditions. However, the forex market is notorious for its high risks, and traders must exercise caution when selecting a broker. The lack of regulation and transparency can lead to significant financial losses. This article aims to investigate whether FXRevolution is a safe trading option or a potential scam. Our analysis is based on a review of multiple sources, including regulatory information, user feedback, and industry evaluations.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for assessing its credibility. FXRevolution operates without any valid regulatory oversight, making it an unregulated broker. This absence of regulation raises significant concerns regarding the safety of traders' funds. Below is a summary of the regulatory status of FXRevolution:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of a regulatory license means that FXRevolution does not adhere to any established financial standards or consumer protection laws. Regulated brokers are required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This segregation offers a layer of security for traders, as it reduces the risk of losing funds in case the broker faces financial difficulties. Unfortunately, FXRevolution does not provide any such guarantees, which raises the risk profile significantly. The company is based in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment, further emphasizing the need for caution when dealing with this broker.

Company Background Investigation

FXRevolution is owned by Savi Holdings Ltd, and its operations are primarily based in Saint Vincent and the Grenadines. The company claims to offer a range of trading instruments, including forex pairs, commodities, indices, and CFDs. However, the lack of detailed information regarding its ownership structure and management team is concerning. A transparent broker typically provides information about its founders and key personnel, including their qualifications and experience. In the case of FXRevolution, there is minimal information available, which raises questions about its legitimacy and operational integrity.

Furthermore, the company's transparency regarding its business practices is questionable. Traders should expect clear communication about fees, terms of service, and any potential conflicts of interest. The absence of such information may indicate a lack of accountability, which is a red flag for potential scams. The overall opacity surrounding FXRevolution's operations necessitates a careful evaluation of its trustworthiness.

Trading Conditions Analysis

FXRevolution offers various account types with different minimum deposit requirements and trading conditions. However, the overall fee structure appears to be less favorable compared to industry standards. Below is a comparison of core trading costs:

| Fee Type | FXRevolution | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs at FXRevolution is notably high, which can significantly impact trading profitability. A spread of 3 pips is considered excessive, especially when compared to the industry average of 1.5 pips. Additionally, the absence of a clear commission structure raises concerns about hidden fees that could further erode traders' profits.

Moreover, FXRevolution imposes a 20% withdrawal fee, which is extraordinarily high and not typical among reputable brokers. Such policies can deter traders from withdrawing their funds and may indicate a lack of commitment to fair trading practices. Therefore, potential clients should approach FXRevolution's trading conditions with caution.

Client Fund Security

The safety of client funds is a critical aspect of any trading platform. FXRevolution does not provide adequate measures to protect traders' investments. For instance, the absence of segregated accounts means that client funds are not kept separate from the brokers operational funds. This lack of protection significantly increases the risk of losing funds in the event of the broker's insolvency.

Furthermore, FXRevolution does not offer negative balance protection, which means traders could potentially lose more than their initial investment. The absence of such safety nets is a significant concern, especially for inexperienced traders who may not fully understand the risks involved in trading.

Historically, there have been complaints regarding fund withdrawal issues, with users reporting difficulties in accessing their funds. Such incidents raise serious questions about the brokers reliability and operational integrity. The lack of a robust framework for ensuring the safety of client funds adds to the skepticism surrounding FXRevolution's legitimacy.

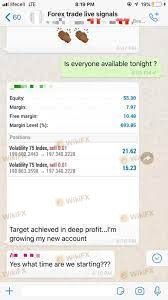

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews of FXRevolution reveal a pattern of complaints related to withdrawal issues and poor customer support. Many users have reported that their withdrawal requests were either delayed or outright denied, leading to frustration and financial loss. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Account Management | High | Poor |

One notable case involved a trader who deposited $250 and was later pressured to invest more money. When the trader attempted to withdraw their funds, they were met with excuses and delays, ultimately leading to a loss of their investment. Such experiences highlight the potential risks associated with trading through FXRevolution and underscore the importance of conducting thorough research before engaging with any broker.

Platform and Trade Execution

The trading platform offered by FXRevolution is the widely-used MetaTrader 4 (MT4), known for its user-friendly interface and robust features. However, the overall performance, stability, and execution quality of the platform remain questionable. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

While MT4 is generally regarded as a reliable trading platform, the lack of transparency regarding FXRevolution's execution policies raises concerns. Traders should be cautious, as any signs of platform manipulation or poor execution can lead to substantial financial losses. Therefore, potential clients must weigh the benefits of using a familiar platform against the risks posed by an unregulated broker.

Risk Assessment

Engaging with FXRevolution presents several risks that traders should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Security Risk | High | Lack of segregation and negative balance protection. |

| Withdrawal Risk | High | History of delayed or denied withdrawals. |

| Platform Risk | Medium | Potential issues with order execution and slippage. |

To mitigate these risks, traders are advised to conduct thorough research before investing and consider using regulated brokers that offer greater security and transparency. Additionally, maintaining a diversified investment portfolio can help reduce exposure to any single broker's risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXRevolution poses significant risks to traders. The lack of regulation, poor customer feedback, and questionable trading conditions raise serious concerns about the broker's legitimacy. While the platform may offer familiar trading tools like MT4, the associated risks outweigh the potential benefits.

Traders should exercise extreme caution when considering FXRevolution as a trading option. It is advisable to seek out regulated brokers that provide robust consumer protections and transparent trading conditions. Some reputable alternatives include brokers regulated by the FCA or CySEC, which offer a higher level of security for traders' investments.

Ultimately, ensuring the safety of your funds should be the top priority when choosing a broker, and the evidence indicates that FXRevolution is not a safe option for trading.

Is FXRevolution a scam, or is it legit?

The latest exposure and evaluation content of FXRevolution brokers.

FXRevolution Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXRevolution latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.