Is FUNRATS safe?

Business

License

Is Funrats Safe or a Scam?

Introduction

Funrats is a forex broker that has emerged in the competitive landscape of online trading, positioning itself as a platform for diverse financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders are increasingly drawn to the potential for high returns. However, with these opportunities come risks, making it essential for traders to carefully assess the legitimacy and safety of brokers like Funrats. This article aims to provide an objective analysis of whether Funrats is a safe trading option or a potential scam. The investigation will utilize various sources, including regulatory information, customer reviews, and industry comparisons, to evaluate Funrats comprehensively.

Regulation and Legitimacy

The regulatory status of a broker is a critical aspect that affects its credibility and safety. Funrats operates under an unregulated status according to the United States National Futures Association (NFA), which raises significant concerns regarding its adherence to industry standards and investor protection. Below is a summary of Funrats' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0538882 | United States | Unregulated |

The lack of regulation from a reputable authority indicates that Funrats does not adhere to the stringent compliance measures typically required for investor protection. This unregulated status is alarming, as it suggests that the broker may not be subject to routine audits or oversight, which are essential for maintaining operational integrity and safeguarding client funds. Furthermore, Funrats holds an NFA license for non-forex activities, which limits its regulatory oversight in forex trading. Therefore, when asking the question, "Is Funrats safe?" it is crucial to consider the implications of its regulatory status seriously.

Company Background Investigation

Established in 2010, Funrats Wealth Ltd. is registered in the United Kingdom. However, its unregulated status raises questions about its operational transparency and accountability. The company's management team and ownership structure are not extensively documented, which complicates the evaluation of its credibility. Without clear information on the backgrounds of its executives and their professional experience, traders may find it challenging to trust the broker fully.

Transparency is a vital aspect of any financial service provider. Funrats appears to lack comprehensive information regarding its operations, making it difficult for potential clients to ascertain its legitimacy. The absence of detailed disclosures about the company's financial health, ownership, and management team further compounds concerns about its reliability. Therefore, for traders considering Funrats, understanding the companys background is essential in answering the question, "Is Funrats safe?"

Trading Conditions Analysis

When evaluating a broker, the overall cost structure and trading conditions play a significant role in determining its attractiveness. Funrats offers competitive trading conditions, including low spreads and high leverage options. However, potential clients should be cautious about the high minimum deposit requirement of $1,000, which may deter new or smaller investors.

The following table outlines the core trading costs associated with Funrats:

| Cost Type | Funrats | Industry Average |

|---|---|---|

| Major Currency Pair Spread | As low as 0 pips | Varies (1-2 pips) |

| Commission Model | Not specified | Varies (0-10 USD) |

| Overnight Interest Range | Not disclosed | Varies (0.5%-3%) |

While the low spreads are appealing, the lack of transparency regarding commissions and overnight interest rates raises red flags. Traders should be wary of hidden fees that could significantly impact their profitability. When considering the overall trading conditions, it is essential to ask, "Is Funrats safe?" as the absence of clear information can lead to unexpected costs and reduced trust.

Client Fund Security

The safety of client funds is paramount in the forex trading industry. Funrats claims to implement measures to protect client funds, but the lack of regulation raises concerns about the effectiveness of these measures. Client funds should ideally be kept in segregated accounts to prevent misuse, and brokers should offer investor protection mechanisms. However, Funrats has not provided detailed information regarding its fund security policies.

Historically, unregulated brokers have faced significant scrutiny regarding their handling of client funds, with many cases involving fund misappropriation and withdrawal issues. Therefore, it is essential to evaluate whether Funrats has encountered similar issues in the past. When assessing the question, "Is Funrats safe?" the absence of robust fund protection measures should be a significant consideration for potential clients.

Customer Experience and Complaints

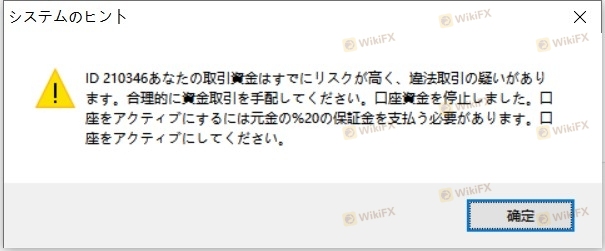

Customer feedback is a valuable indicator of a broker's reliability and service quality. Funrats has received mixed reviews, with several users expressing dissatisfaction with various aspects of the trading experience. Common complaints include withdrawal issues, lack of transparency, and poor customer support.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow responses |

| Lack of Transparency | Medium | Minimal information |

| Customer Support Issues | High | Inconsistent quality |

Several users have reported difficulties in withdrawing their funds, raising concerns about the broker's trustworthiness. Additionally, the slow response times from customer support can exacerbate issues for traders in need of immediate assistance. When considering "Is Funrats safe?" the patterns of complaints and the company's response quality should significantly influence potential clients' decisions.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Funrats utilizes the widely recognized MetaTrader 4 platform, which is known for its reliability and user-friendly interface. However, the overall performance, stability, and execution quality of trades on the platform must be assessed to determine its effectiveness.

Traders have reported mixed experiences regarding order execution quality, with some experiencing slippage and delays during high volatility periods. Such issues can significantly impact trading outcomes and raise concerns about the broker's reliability. Therefore, when evaluating the question, "Is Funrats safe?" it is essential to consider the platform's performance and any potential signs of manipulation.

Risk Assessment

Using Funrats as a trading platform involves several risks that traders must be aware of. The following risk assessment summarizes the key risk factors associated with Funrats:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Fund Security Risk | High | Lack of transparency in fund protection |

| Customer Support Risk | Medium | Inconsistent support can affect trading |

| Platform Stability Risk | Medium | Reports of execution issues |

To mitigate these risks, potential clients should conduct thorough research before engaging with Funrats. This includes testing the platform with a demo account, if available, and ensuring they fully understand the trading conditions and potential costs involved.

Conclusion and Recommendations

In conclusion, the evidence suggests that Funrats presents several red flags that traders should carefully consider. The unregulated status, lack of transparency regarding fees, and mixed customer feedback raise significant concerns about its safety and reliability. Therefore, when asking, "Is Funrats safe?" it appears that there are substantial risks associated with using this broker.

For traders seeking a reliable trading experience, it may be prudent to consider alternatives that are regulated by reputable authorities and offer clear information about their operations. Brokers such as FP Markets and IG Group provide a more transparent and secure trading environment, making them worthy alternatives for traders looking to enter the forex market safely.

Is FUNRATS a scam, or is it legit?

The latest exposure and evaluation content of FUNRATS brokers.

FUNRATS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FUNRATS latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.