Is FUNBODS safe?

Business

License

Is Funbods Safe or Scam?

Introduction

Funbods is a forex broker that has recently entered the market, aiming to attract traders with its promises of competitive trading conditions and user-friendly platforms. As the forex market continues to grow in popularity, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. The potential risks associated with trading, including scams and fraudulent practices, necessitate a careful approach when selecting a broker. This article aims to provide a comprehensive assessment of Funbods by examining its regulatory status, company background, trading conditions, customer feedback, and overall safety measures. The investigation draws on various sources, including user reviews and regulatory databases, to ensure a balanced and informed conclusion.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is essential for assessing its legitimacy. Funbods claims to be regulated by the Australian Securities and Investments Commission (ASIC), a reputable authority known for its stringent oversight of financial services. However, several reviews indicate that Funbods may be operating as a suspicious clone, raising concerns about its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not provided | Australia | Suspicious Clone |

The lack of a valid license number and the designation of Funbods as a "suspicious clone" by various sources suggest that the broker may not have the necessary regulatory oversight. This raises significant red flags as brokers operating without proper licensing often lack the accountability and investor protection mechanisms that regulated entities must adhere to. Moreover, historical compliance issues have been noted, with numerous complaints regarding withdrawal difficulties and unresponsive customer service. Therefore, it is imperative for traders to exercise caution and consider these factors when evaluating whether Funbods is safe for trading.

Company Background Investigation

Funbods, established in 2021, presents itself as a modern trading platform aimed at providing an accessible trading experience for both novice and experienced traders. However, the broker's short history raises questions about its long-term viability and the experience of its management team. The ownership structure of Funbods remains unclear, with limited information available regarding its founders and key personnel.

Transparency is a critical factor in determining a broker's reliability. Funbods has not provided sufficient details about its management team or their professional backgrounds, which is concerning for potential investors. A lack of information can indicate a lack of accountability and raises questions about the broker's commitment to ethical trading practices. Furthermore, the absence of clear information regarding the company's operational history and development trajectory adds to the uncertainty surrounding its legitimacy. As such, potential users must carefully consider whether Funbods is safe to engage with, given the opacity surrounding its corporate structure.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Funbods advertises competitive spreads and various trading instruments, but there are reports of hidden fees and unfavorable trading conditions that may not be immediately apparent to new users.

| Fee Type | Funbods | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Medium |

The absence of clear information regarding the commission structure is particularly concerning, as many brokers typically disclose their fees upfront. Additionally, reports of high overnight interest rates and unexpected charges have surfaced, which could significantly erode a trader's capital over time. This lack of transparency in fee structures raises questions about whether Funbods is safe for traders seeking a straightforward and fair trading environment.

Client Funds Security

The safety of client funds is paramount when evaluating a forex broker. Funbods claims to implement various security measures, including segregated accounts for client funds. However, the effectiveness of these measures is questionable given the broker's regulatory ambiguities and the numerous complaints regarding withdrawal issues.

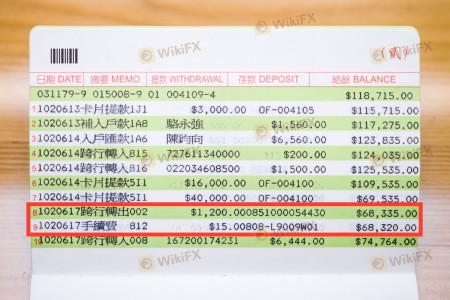

Traders should be aware of the importance of investor protection policies, such as negative balance protection, which ensures that clients cannot lose more than their deposited funds. Unfortunately, there is limited information available about Funbods' policies in this regard. Historical concerns about fund security, including reports of clients being unable to withdraw their funds and the lack of response from customer service, further exacerbate the situation. These factors collectively contribute to the perception that Funbods may not be safe, and traders should exercise extreme caution when considering depositing funds with this broker.

Customer Experience and Complaints

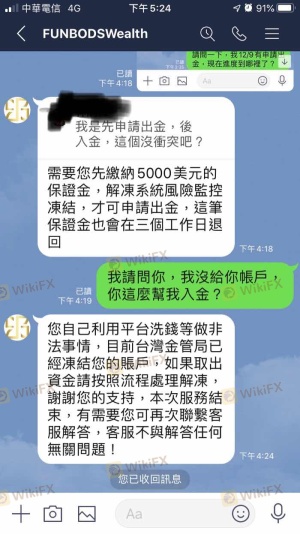

Customer feedback plays a vital role in assessing the reliability of a broker. Funbods has received numerous negative reviews highlighting issues such as withdrawal difficulties, unresponsive customer service, and aggressive sales tactics. Many users have reported that while initial withdrawals may be approved, subsequent requests are met with excuses and delays.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Responsiveness | High | Poor |

| Misleading Promotions | Medium | Inconsistent |

Typical case studies reveal that clients often find themselves trapped in a cycle of frustration when attempting to access their funds. One user reported a successful withdrawal of a small amount, only to face repeated denial for larger withdrawals due to alleged compliance issues. Another user described a threatening response from customer service when they inquired about their funds, indicating a troubling pattern of behavior.

These experiences raise significant concerns about the overall customer experience with Funbods, suggesting that the broker may not prioritize client satisfaction or transparency. Given the severity of these complaints, it is crucial for potential traders to consider whether Funbods is safe before committing their funds.

Platform and Execution

The trading platform offered by Funbods is designed to be user-friendly, but its reliability and execution quality remain under scrutiny. Users have reported instances of slippage and order rejections, which can severely impact trading outcomes, particularly in fast-moving markets.

The overall performance of the trading platform, including execution speed and stability, is critical for traders who rely on timely order placements. Reports of platform outages and slow execution times further contribute to concerns about the broker's operational integrity. Additionally, any signs of potential platform manipulation must be taken seriously, as they can indicate unethical practices.

Given the mixed reviews regarding platform performance, traders should approach Funbods with caution and consider the potential risks associated with trading on a platform that may not consistently deliver reliable execution. These factors further complicate the question of whether Funbods is safe for trading.

Risk Assessment

When evaluating the overall risk of engaging with Funbods, several key areas of concern emerge. The following risk assessment summarizes the primary risks associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation and clone status. |

| Financial Security Risk | High | Numerous complaints about withdrawal issues. |

| Operational Risk | Medium | Mixed reviews on platform stability and execution quality. |

| Customer Service Risk | High | Poor responsiveness and handling of complaints. |

To mitigate these risks, potential traders should conduct thorough research, consider trading with smaller amounts, and explore alternative brokers with stronger regulatory oversight and positive user experiences. It is essential to remain vigilant and informed to protect one's investments in the volatile forex market.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Funbods may not be a safe choice for forex trading. The lack of clear regulatory oversight, numerous customer complaints regarding withdrawal issues, and the opacity surrounding the company's background raise significant concerns. Traders should be particularly cautious, as the broker's practices appear to align more closely with those of a scam than a reputable trading entity.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have established positive reputations in the industry. Brokers regulated by top-tier authorities, such as the FCA or ASIC, and those with transparent fee structures and responsive customer service should be prioritized.

Ultimately, the question of whether Funbods is safe can be answered with caution: potential traders should be wary of engaging with this broker and consider safer alternatives to protect their investments.

Is FUNBODS a scam, or is it legit?

The latest exposure and evaluation content of FUNBODS brokers.

FUNBODS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FUNBODS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.