Is FTM Global safe?

Business

License

Is FTM Global Safe or a Scam?

Introduction

FTM Global is a forex brokerage that has emerged in the trading landscape, positioning itself as a platform for both novice and experienced traders. However, as with any financial service provider, it is crucial for traders to conduct thorough research to ensure they are engaging with a trustworthy entity. The forex market is rife with scams, and the consequences of falling victim can be severe, leading to significant financial losses. Therefore, evaluating the legitimacy of brokers like FTM Global is essential. This article aims to provide a comprehensive analysis of FTM Global, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple credible sources, including regulatory databases, customer reviews, and market analysis platforms.

Regulatory and Legitimacy

When it comes to assessing whether FTM Global is safe, the first aspect to consider is its regulatory status. Regulation acts as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Unfortunately, FTM Global operates without any recognized regulatory oversight. This lack of regulation poses a significant risk to traders, as unregulated brokers are not held accountable for their actions.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license means that FTM Global is not subject to the scrutiny and compliance requirements that regulated brokers must adhere to. This raises red flags about the safety of funds and the integrity of trading practices. Many unregulated brokers have been known to engage in deceptive practices, including the manipulation of prices and the refusal of withdrawal requests. Therefore, the lack of regulation is a strong indicator that FTM Global may not be a safe option for traders.

Company Background Investigation

FTM Global's history and ownership structure further complicate its credibility. The company claims to have been established in 2020, but there is little verifiable information available regarding its founders or management team. This opacity raises concerns about the company's transparency and accountability. A reputable brokerage typically provides information about its leadership and their professional backgrounds. The absence of such information can be a warning sign for potential clients.

Moreover, the company's website lacks detailed information about its operations, which is another indicator of potential issues. A trustworthy broker should provide clear information about its services, trading conditions, and company history. Without this transparency, it becomes challenging for traders to assess the legitimacy of FTM Global.

Trading Conditions Analysis

Examining the trading conditions offered by FTM Global is crucial in determining whether it is safe for traders. The broker advertises high leverage options of up to 1:500, which is significantly above the limits set by many regulatory bodies. High leverage can amplify both profits and losses, making it a double-edged sword. While it may attract traders looking for high-risk, high-reward opportunities, it also increases the likelihood of significant financial losses.

| Fee Type | FTM Global | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable | 1.0 - 1.5 pips |

| Commission Structure | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | 0.5% - 2% |

The spread rates and commission structures at FTM Global appear to be unclear, with no specific details provided on its website. This lack of clarity can lead to unexpected costs for traders, further complicating their trading experience. Additionally, the absence of a transparent fee structure can be a red flag, indicating that the broker may not be operating in good faith.

Customer Fund Safety

The safety of customer funds is a paramount concern when evaluating the legitimacy of any broker. FTM Global does not provide clear information regarding its fund protection measures. There are no indications that client funds are held in segregated accounts, which is a standard practice among regulated brokers to protect client assets in case of insolvency. Furthermore, the absence of investor protection schemes means that traders are at risk of losing their funds without any recourse.

Historically, unregulated brokers have been associated with numerous safety issues, including the misappropriation of funds and the inability to process withdrawal requests. This lack of security measures raises significant concerns about whether FTM Global is safe for traders looking to invest their hard-earned money.

Customer Experience and Complaints

Customer feedback is an essential element in assessing the overall experience with a broker. Reviews of FTM Global indicate a pattern of negative experiences, with several users reporting difficulties in withdrawing funds and receiving poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Non-responsive |

| Customer Service Quality | Medium | Unhelpful |

| Transparency Concerns | High | Ignored |

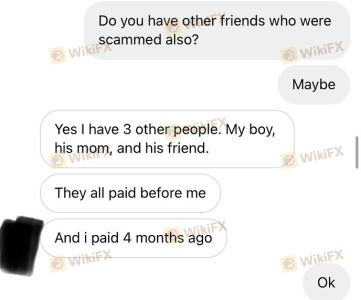

One notable case involved a trader who deposited funds but faced significant delays when attempting to withdraw. After multiple attempts to contact customer support, the trader reported that their requests were either ignored or met with vague responses. Such experiences are alarming and suggest that FTM Global may not prioritize customer satisfaction or transparency.

Platform and Trade Execution

The trading platform provided by FTM Global is another critical factor in determining its safety. While the broker claims to offer access to popular trading platforms, reviews indicate that users have experienced issues with platform stability and execution quality. Problems such as slippage and order rejections can severely impact trading performance, making it essential for traders to have confidence in their broker's technological capabilities.

Moreover, any signs of platform manipulation, such as sudden price spikes or unexplainable execution delays, can further erode trust in the broker. If traders feel that their trades are not being executed fairly, it raises questions about the broker's integrity.

Risk Assessment

Using FTM Global involves several inherent risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Financial Risk | High | High leverage increases potential losses. |

| Operational Risk | Medium | Platform stability issues reported. |

| Customer Support Risk | High | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders are advised to conduct extensive research before engaging with FTM Global, consider starting with a small investment, and be prepared to withdraw funds promptly if issues arise.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that FTM Global poses significant risks for traders. The lack of regulation, unclear trading conditions, and numerous customer complaints indicate that it may not be a safe option for those looking to invest in the forex market. Traders should exercise caution and consider alternative options with proven regulatory oversight and positive customer feedback.

For those seeking reliable brokers, it is advisable to explore options that are well-regulated, offer transparent trading conditions, and have a reputation for excellent customer service. Some recommended alternatives include established brokers like Plus500 and IG, which provide a safer trading environment.

In summary, while FTM Global may present itself as an attractive trading option, the associated risks and concerns highlight that it is essential for traders to prioritize safety and make informed decisions.

Is FTM Global a scam, or is it legit?

The latest exposure and evaluation content of FTM Global brokers.

FTM Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTM Global latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.