Is FRTC.NET LIMITED safe?

Business

License

Is FRTC Net Limited Safe or Scam?

Introduction

FRTC Net Limited has emerged as a player in the forex market, claiming to provide a platform for trading various financial instruments, including currencies and commodities. However, with the rise of online trading platforms, traders must exercise caution and thoroughly evaluate the legitimacy of brokers before committing their funds. The forex market is fraught with risks, and the presence of unregulated or fraudulent brokers can lead to significant financial losses. This article aims to investigate whether FRTC Net Limited is a safe trading option or a potential scam. Our assessment combines a review of regulatory compliance, company background, trading conditions, customer feedback, and risk factors to provide a comprehensive overview of this broker.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its safety and reliability. Brokers that operate without proper licensing can expose traders to various risks, including fraud and mismanagement of funds. FRTC Net Limited claims to be regulated; however, investigations reveal a lack of valid regulatory information. Below is a summary of the broker's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a legitimate regulatory framework raises significant concerns about the broker's practices. Regulatory bodies are essential in ensuring that brokers adhere to strict operational guidelines, which protect clients' funds and enhance transparency. The lack of oversight from recognized authorities suggests that FRTC Net Limited may not be a trustworthy option for traders. Furthermore, warnings from organizations such as the Ontario Securities Commission indicate that FRTC Net Limited is not registered to engage in trading activities, further questioning its legitimacy.

Company Background Investigation

FRTC Net Limited was incorporated on December 28, 2018, and is reportedly based in China. However, details regarding its ownership structure and history remain vague. The company's website is often inaccessible, limiting the availability of information about its management team and operational practices. Transparency is a critical factor in assessing a broker's reliability, and FRTC Net Limited's lack of disclosure raises red flags.

The absence of a clear management team with proven expertise in the financial sector further complicates matters. Investors are advised to be wary of brokers that do not provide information about their leadership or operational history, as this could indicate a lack of accountability. Overall, the limited information available about FRTC Net Limited's background suggests that potential clients should proceed with caution.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. FRTC Net Limited claims to offer competitive trading fees; however, the specifics of its fee structure remain unclear. Below is a comparison of core trading costs associated with FRTC Net Limited against industry averages:

| Fee Type | FRTC Net Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of detailed information on spreads, commissions, and overnight interest rates makes it challenging to assess the overall cost-effectiveness of trading with FRTC Net Limited. Furthermore, reports indicate that clients have faced unexpected fees, which could suggest a lack of transparency in the broker's pricing model. Traders should be cautious of brokers with unclear fee structures, as this can lead to hidden costs that undermine profitability.

Client Fund Security

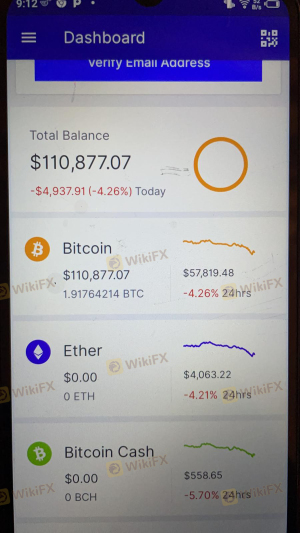

The safety of client funds is a paramount concern when selecting a forex broker. FRTC Net Limited's website does not provide sufficient information about its fund security measures. It is essential for brokers to implement robust security protocols, including the segregation of client funds, investor protection schemes, and negative balance protection policies. Unfortunately, FRTC Net Limited has not disclosed any such information, raising concerns about the safety of clients' investments.

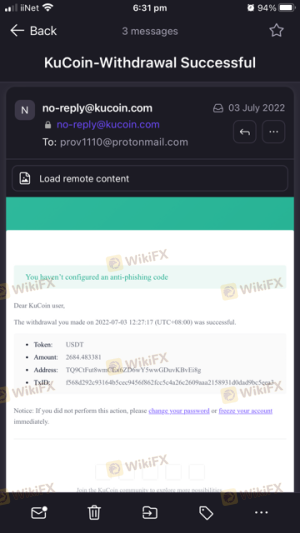

Historically, there have been reports of clients experiencing difficulties when attempting to withdraw funds, which is a common warning sign of potential scams. The absence of clear policies regarding fund security and withdrawal processes further compounds the risks associated with trading with FRTC Net Limited.

Customer Experience and Complaints

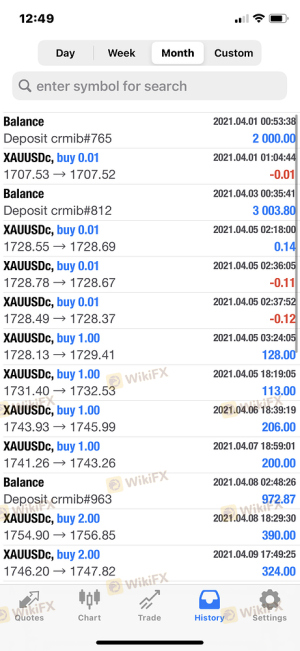

Customer feedback can provide valuable insights into a broker's reliability and service quality. Reviews and complaints regarding FRTC Net Limited have surfaced on various platforms, indicating a pattern of dissatisfaction among clients. Common complaints include difficulties with fund withdrawals and unresponsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | Poor |

Several clients have reported being asked to pay additional fees before their withdrawal requests could be processed, a tactic commonly associated with fraud. For instance, one user detailed a situation where they were required to pay a "risk fee" to access their funds. These complaints suggest that FRTC Net Limited may not prioritize customer service or ethical business practices, further casting doubt on its legitimacy.

Platform and Trade Execution

The trading platform's performance is another critical aspect to consider. FRTC Net Limited advertises the use of the popular MetaTrader 5 platform, which is known for its reliability. However, user experiences suggest that there may be issues with order execution, including slippage and rejected orders. Traders have expressed concerns about the stability of the platform, which can significantly impact trading outcomes.

Signs of potential platform manipulation have also been noted, with some users reporting unusual trading behavior that raises suspicions. A reliable broker should provide a stable and transparent trading environment, and any indication of manipulation should be taken seriously.

Risk Assessment

Engaging with FRTC Net Limited comes with various risks, primarily due to its unregulated status and poor customer feedback. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of transparency in fund management |

| Customer Service | Medium | Numerous complaints and poor responsiveness |

| Trading Conditions | High | Unclear fee structures and withdrawal issues |

Traders considering FRTC Net Limited should be aware of these risks and take necessary precautions to protect their investments. It is advisable to conduct thorough research and consider alternative brokers with proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that FRTC Net Limited raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, poor customer feedback, and unclear trading conditions indicate that this broker may not be a reliable option for traders. As such, it is recommended that traders exercise extreme caution and consider alternative, well-regulated brokers for their trading needs.

For those who prioritize safety and transparency, brokers with established reputations and regulatory backing are advisable. Always ensure that you conduct thorough research before committing your funds to any trading platform. In light of the findings, it is prudent to conclude that FRTC Net Limited is not safe for trading, and potential clients should be wary of engaging with this broker.

Is FRTC.NET LIMITED a scam, or is it legit?

The latest exposure and evaluation content of FRTC.NET LIMITED brokers.

FRTC.NET LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FRTC.NET LIMITED latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.