Is Forex-U safe?

Business

License

Is Forex U Safe or Scam?

Introduction

Forex U is a relatively new player in the foreign exchange market, established in 2020. As a broker based in China, it aims to provide traders with access to the global forex market using the MetaTrader 5 (MT5) platform. However, the emergence of numerous unregulated brokers in the forex industry has raised concerns among traders about the safety and legitimacy of their chosen platforms. This article seeks to objectively evaluate whether Forex U is a safe option for traders or if it exhibits characteristics typical of a scam. Our investigation is based on a thorough review of regulatory status, company background, trading conditions, customer experiences, and overall security measures.

Regulation and Legitimacy

The regulatory environment is crucial for determining the safety of a forex broker. A well-regulated broker is more likely to adhere to industry standards and protect trader interests. Forex U's regulatory status is ambiguous, as it lacks clear oversight from recognized financial authorities. The following table summarizes the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | China | Not Verified |

The absence of regulation raises significant red flags. Regulatory bodies like the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC) in the U.S. are essential for ensuring that brokers operate legally and ethically. Without such oversight, traders may face increased risks, including potential fraud or mismanagement of funds. Furthermore, Forex U has received a low score of 1.41 from WikiFX, indicating multiple exposures and a lack of trustworthiness. This lack of regulatory clarity and poor ratings contribute to the question: Is Forex U safe?

Company Background Investigation

Forex U was founded in 2020, which makes it a relatively new entrant in the forex market. The company's ownership structure is not transparently disclosed, which is another cause for concern. A well-established broker usually provides detailed information about its management team and ownership, allowing potential clients to assess their credibility. However, Forex U has not made this information readily available.

The management teams background and professional experience are critical factors in evaluating a broker's reliability. A team with extensive experience in finance and trading can enhance a broker's reputation. Unfortunately, there is scant information on Forex U's management, which diminishes transparency. Furthermore, the lack of comprehensive information on the company's history and its operational practices raises questions about its legitimacy. Given these factors, traders should be cautious when considering whether Forex U is a safe option.

Trading Conditions Analysis

Understanding the trading conditions offered by Forex U is essential for evaluating its overall safety. A broker's fee structure can significantly impact a trader's profitability. Forex U claims to provide competitive trading conditions, but the specifics of its fee structure are not well-documented. The following table summarizes the core trading costs associated with Forex U:

| Fee Type | Forex U | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding fees can be alarming. Traders should be wary of brokers that do not clearly outline their fee structures, as hidden fees can lead to unexpected losses. Additionally, Forex U does not provide information regarding its commission model or overnight interest rates, further complicating the decision-making process for potential clients. This ambiguity raises concerns about whether Forex U is truly a safe trading environment.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading environment. Forex U's measures for ensuring fund safety are unclear. A reputable broker typically segregates client funds from its operating capital, providing an additional layer of security. Furthermore, brokers regulated by established authorities often offer investor protection schemes, which can safeguard traders in case of broker insolvency.

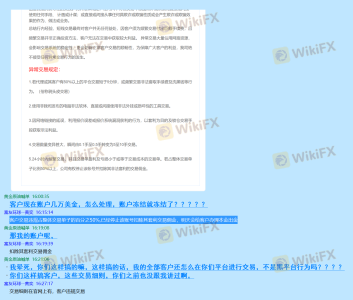

Unfortunately, Forex U does not appear to offer such protections. The absence of information regarding fund segregation and negative balance protection policies raises serious concerns about the safety of customer deposits. Historical issues related to fund security, such as delayed withdrawals or account freezes, have also been reported by users. These issues further exacerbate the question: Is Forex U safe for your trading capital?

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Forex U has received mixed reviews from users, with several complaints highlighting issues related to withdrawal delays and account management. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Freezes | High | No resolution |

| Poor Customer Support | Medium | Inconsistent |

Several users have reported that their accounts were frozen without clear justification, leading to frustration and distrust. Furthermore, the company's response to these complaints has been slow and inadequate, which is a significant red flag for potential traders. When evaluating whether Forex U is a scam, these complaints and the company's handling of them are critical factors to consider.

Platform and Execution

The trading platform's performance and execution quality are vital for a positive trading experience. Forex U utilizes the MT5 platform, which is known for its advanced features and user-friendly interface. However, user reports indicate that the platform may suffer from stability issues, including slippage and order rejections. These problems can hinder a trader's ability to execute trades effectively, raising further concerns about the broker's reliability.

Moreover, the absence of robust customer support for platform-related issues can exacerbate traders' frustrations. If traders encounter technical difficulties and cannot receive timely assistance, it can lead to significant financial losses. Thus, the question remains: Is Forex U safe for executing trades effectively?

Risk Assessment

Evaluating the overall risk associated with using Forex U is essential for potential traders. The following risk assessment summarizes key risk categories:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation and oversight |

| Fund Safety Risk | High | Unclear fund protection measures |

| Execution Risk | Medium | Reports of slippage and order issues |

| Customer Service Risk | High | Poor response to complaints |

Given these risks, traders should proceed with caution. To mitigate these risks, it is advisable to conduct thorough research, start with a demo account, and only deposit funds that one can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Forex U presents several red flags that potential traders should carefully consider. The lack of regulation, ambiguous fee structures, and numerous customer complaints indicate that Forex U may not be the safest option for trading. Therefore, traders should exercise caution and consider alternative, well-regulated brokers to ensure their funds and trading activities are secure.

For those seeking reliable alternatives, we recommend considering brokers that are regulated by recognized authorities, such as Forex.com or OANDA, which offer transparent fee structures and robust customer support. Ultimately, the question remains: Is Forex U safe? Based on the available evidence, the answer leans towards skepticism.

Is Forex-U a scam, or is it legit?

The latest exposure and evaluation content of Forex-U brokers.

Forex-U Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex-U latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.