Regarding the legitimacy of FFS Group forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is FFS Group safe?

Business

License

Is FFS Group markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FTX AUSTRALIA PTY LTD

Effective Date:

2008-07-01Email Address of Licensed Institution:

chris.chen@ftx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 6, 228 Pitt Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

90483838Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Forex Financial Services Pacific Ltd

Effective Date:

2016-12-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FFS Group Safe or Scam?

Introduction

FFS Group is a forex broker that has gained attention in the trading community since its establishment in 2017. Positioned as an Australian broker, it offers a range of trading instruments, including forex, commodities, and indices. However, the integrity and reliability of FFS Group have come under scrutiny, prompting traders to evaluate its legitimacy carefully. As the forex market is rife with both reputable and dubious brokers, it is essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective assessment of FFS Group by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on data collected from various credible sources, including user reviews and regulatory information.

Regulatory and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety and legitimacy. FFS Group has faced significant challenges regarding its regulatory compliance. Initially, it was registered with the Financial Service Providers Register (FSPR) in New Zealand, but this license has since been revoked. Additionally, although FFS Group claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC), there are serious concerns about the validity of these claims, with suggestions that they may be clones or unverified registrations.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FSPR | 530907 | New Zealand | Revoked |

| ASIC | 323193 | Australia | Unverified |

| VFSC | 14838 | Vanuatu | Suspicious Clone |

The revocation of the FSPR license raises red flags about FFS Group's compliance with industry standards. Operating without a valid regulatory framework exposes traders to potential risks, including fraud and mismanagement of funds. Furthermore, the lack of oversight from recognized regulatory bodies means that traders have limited recourse in case of disputes or financial loss. In light of these factors, the question remains: Is FFS Group safe? The evidence suggests that traders should approach this broker with caution.

Company Background Investigation

FFS Group was founded in 2017, and while it has been operational for several years, its history and ownership structure are not well-documented. The company's lack of transparency regarding its management team and operational practices raises concerns about its credibility. Investigations into the backgrounds of key personnel have revealed limited information, which is troubling for potential investors seeking to understand the broker's governance.

Moreover, the absence of a physical office location that corresponds with its claimed address in Australia adds to the skepticism surrounding FFS Group. A field survey conducted by WikiFX confirmed that the address listed by the broker does not correspond to any identifiable office space, further questioning the legitimacy of its operations. Such discrepancies can be indicative of a broker that may not be fully committed to ethical practices.

In terms of information disclosure, FFS Group has been criticized for not providing sufficient details about its services, fees, and risk management policies. This lack of clarity can be detrimental for traders who need to make informed decisions. Given these factors, it is essential for traders to assess whether FFS Group is safe to trade with, considering its opaque operational history.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. FFS Group offers two types of trading accounts: STP (Straight Through Processing) and ECN (Electronic Communication Network). The minimum deposit for an STP account is $500, while the ECN account requires a minimum deposit of $5,000. The leverage offered is up to 1:400 for forex trading, which is relatively high and could amplify both profits and losses.

However, the fee structure of FFS Group has raised eyebrows. Traders have reported issues with withdrawal processes, and there are claims of hidden fees associated with trading and account maintenance. Such practices can significantly impact a trader's profitability and overall experience.

| Fee Type | FFS Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0-1.5 pips |

| Commission Model | Unclear | Varies widely |

| Overnight Interest Range | Not disclosed | 0.5%-1.5% |

The spreads offered by FFS Group are on the higher end compared to industry standards, which could deter cost-conscious traders. Additionally, the lack of clarity surrounding commissions and overnight fees raises concerns about potential hidden costs. Therefore, it is crucial for traders to carefully scrutinize these conditions to determine if FFS Group is safe for their trading activities.

Customer Fund Security

The safety of customer funds is paramount in the forex trading environment. FFS Group claims to implement measures for fund protection, including segregating client funds from the company's operational funds. However, the effectiveness of these measures remains questionable given the broker's regulatory challenges.

There is little information available regarding investor protection policies, such as negative balance protection, which is crucial for safeguarding traders from incurring debts beyond their initial investments. Historical complaints have surfaced, alleging that traders have faced difficulties withdrawing their funds, which is a significant concern for anyone considering trading with FFS Group.

In summary, while FFS Group may present some safety measures, the lack of regulatory oversight and transparency raises serious doubts about the security of client funds. Thus, potential traders must weigh these risks carefully when assessing whether FFS Group is safe for their investment.

Customer Experience and Complaints

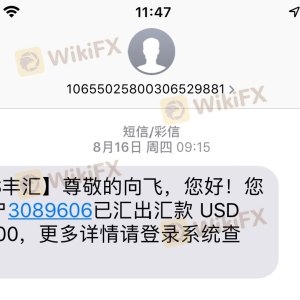

Customer feedback is a valuable resource for evaluating a broker's reliability. Reviews and complaints about FFS Group indicate a pattern of dissatisfaction among traders. A notable number of complaints have been filed regarding withdrawal issues, with many users reporting that their requests for fund withdrawals have gone unanswered or delayed for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Inadequate |

For instance, one trader reported that their withdrawal request was pending for several months, leading to frustration and distrust in the broker's operations. Another user mentioned that customer service was unresponsive, further compounding the issues faced by clients. Given these complaints, it is clear that the customer experience with FFS Group has been less than satisfactory, raising further questions about whether FFS Group is safe to engage with.

Platform and Execution

The trading platform provided by FFS Group is the widely used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust features. However, user experiences regarding platform stability and execution quality have been mixed. Reports of slippage and rejected orders have emerged, with some traders expressing concerns about potential platform manipulation.

The effectiveness of order execution is critical in the forex market, where timing can significantly impact profitability. Users have noted instances where orders were not executed at the expected prices, leading to losses that could have been avoided. Such execution issues raise alarms about the reliability of FFS Group's trading platform and whether it truly operates in the best interest of its clients.

In conclusion, while the MT4 platform is generally reputable, the execution quality and reported issues suggest that traders should approach FFS Group with caution when considering if FFS Group is safe for their trading needs.

Risk Assessment

Engaging with FFS Group carries several risks that potential traders should be aware of. The lack of regulatory oversight, combined with reported withdrawal issues and execution problems, contributes to a high-risk trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, potential fraud |

| Financial Risk | High | Difficulties in fund withdrawals |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with a small investment, and remain vigilant regarding their account activities. Additionally, utilizing demo accounts with other reputable brokers can help traders gain experience without risking real capital.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of FFS Group. The broker's lack of valid regulation, coupled with numerous complaints regarding withdrawal issues and poor customer service, suggests that traders should exercise extreme caution. There are clear indicators that FFS Group is not safe for trading, particularly for those who prioritize security and reliability.

For traders seeking a more secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers such as IG, OANDA, or Forex.com offer a more transparent and secure trading environment, making them suitable alternatives for traders looking to minimize their risks.

Is FFS Group a scam, or is it legit?

The latest exposure and evaluation content of FFS Group brokers.

FFS Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FFS Group latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.