Is Fancy Group Ltd safe?

Business

License

Is Fancy Group Ltd Safe or a Scam?

Introduction

Fancy Group Ltd is a relatively new entrant in the forex trading market, having been established in 2021. Operating primarily from the United Kingdom, it positions itself as a platform for retail traders looking to engage in forex and other financial instruments. However, the forex market is fraught with risks, and it is imperative for traders to conduct thorough due diligence before committing their funds to any broker. This article aims to evaluate whether Fancy Group Ltd is safe or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Our investigation draws on various online reviews and regulatory databases, focusing on the broker's compliance with industry standards and feedback from actual users. By analyzing these factors, we seek to provide a comprehensive assessment of Fancy Group Ltd, allowing traders to make informed decisions.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect clients' funds and interests. Unfortunately, Fancy Group Ltd operates without proper regulatory oversight, which raises significant concerns regarding its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation from reputable authorities like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the U.S. suggests that Fancy Group Ltd may not meet the stringent requirements typically expected of forex brokers. This lack of oversight can expose traders to various risks, including the potential for fraud or mismanagement of funds. Moreover, the designation of Fancy Group Ltd as a "suspicious clone" by some regulatory bodies indicates that it may not be operating in good faith, further questioning its legitimacy.

Company Background Investigation

Fancy Group Ltd's company history is short and somewhat obscure. Founded in 2021, the broker has not established a long track record in the financial services industry. The ownership structure and management team remain largely unverified, making it difficult to assess their qualifications and expertise. A transparent company is usually more trustworthy, but Fancy Group Ltd has not provided sufficient information on its leadership or operational history.

Furthermore, the lack of transparency raises red flags regarding the broker's commitment to ethical practices. Companies with a solid foundation often disclose their ownership and management details, allowing potential clients to evaluate their credibility. In contrast, the vague information available about Fancy Group Ltd could be indicative of an attempt to obscure potential issues or risks associated with its operations.

Trading Conditions Analysis

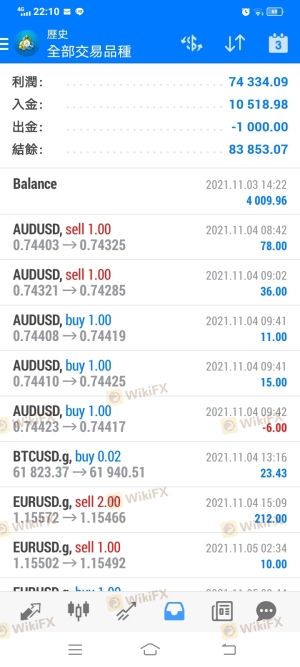

When evaluating whether Fancy Group Ltd is safe, it is essential to consider its trading conditions, including fees, spreads, and commissions. The broker advertises competitive trading conditions, but the absence of regulatory oversight raises questions about the validity of these claims.

| Fee Type | Fancy Group Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 - 2.0 pips |

| Commission Structure | $7 per round turn (Mini Account) | $5 - $10 per round turn |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by Fancy Group Ltd may appear attractive, the commission fees, particularly for the mini account, suggest that traders may incur higher costs than anticipated. Additionally, the broker's lack of regulation means that there are no guarantees regarding the transparency of these fees. Traders should be cautious of any hidden charges or unfavorable trading conditions that could erode their profits.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard traders' investments. However, it is unclear what specific measures Fancy Group Ltd has in place to protect client funds.

Traders should be particularly wary of brokers that do not clearly outline their fund safety protocols. The absence of such information can indicate a lack of commitment to safeguarding clients' interests. Furthermore, any historical issues related to fund security can significantly impact a broker's reputation. Unfortunately, there have been numerous complaints regarding withdrawal issues and difficulties in accessing funds with Fancy Group Ltd, which raises serious concerns about the safety of client funds.

Customer Experience and Complaints

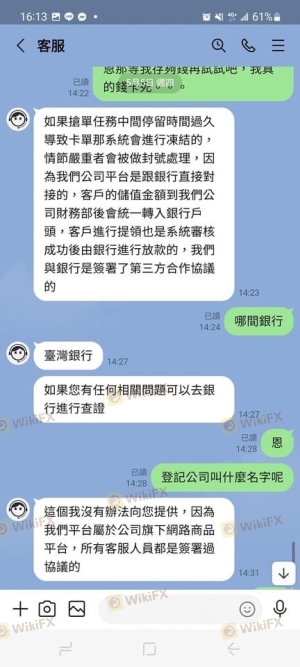

Customer feedback is a crucial indicator of a broker's reliability. A review of online forums and complaint databases reveals a troubling pattern of dissatisfaction among users of Fancy Group Ltd. Many traders have reported issues related to account withdrawals, lack of customer support, and difficulties in resolving disputes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Access | Medium | Poor |

| Transparency Concerns | High | Poor |

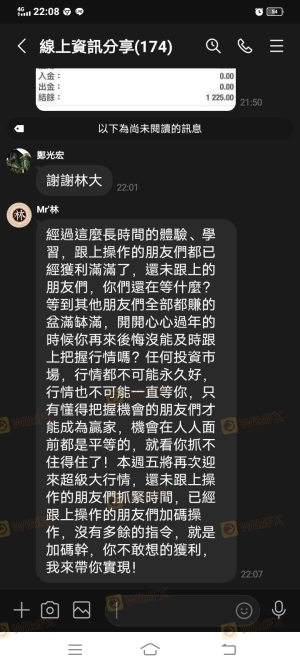

Several users have shared experiences of being unable to withdraw their funds, often citing vague excuses from the broker. Such complaints are particularly alarming as they can indicate potential fraudulent practices. The company's lack of responsiveness to customer inquiries further exacerbates these issues, leading to a loss of trust among traders.

Platform and Trade Execution

The performance of a trading platform is vital for a smooth trading experience. Fancy Group Ltd utilizes the popular MetaTrader 4 platform, known for its user-friendly interface and robust features. However, user experiences suggest that the platform may suffer from issues related to stability and execution quality.

Traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes. Such issues may indicate that the broker could be manipulating trade execution, a serious concern for any trader. The lack of transparency regarding platform performance metrics further complicates the assessment of whether Fancy Group Ltd is safe for trading.

Risk Assessment

Given the findings from our investigation, it is essential to evaluate the overall risk associated with trading with Fancy Group Ltd. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Complaints about withdrawal issues. |

| Transparency Risk | Medium | Lack of information about company structure. |

| Customer Support Risk | High | Poor response to complaints. |

To mitigate these risks, traders are advised to proceed with caution. It is essential to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fancy Group Ltd is not a safe option for traders. The lack of regulatory oversight, combined with numerous complaints regarding fund safety and customer service, raises significant red flags. Traders should exercise extreme caution and consider alternative brokers that offer better regulatory protection and a proven track record of reliability.

For those seeking to engage in forex trading, we recommend exploring brokers that are regulated by top-tier authorities, such as the FCA or ASIC, which provide a safer trading environment. By prioritizing safety and transparency, traders can better protect their investments and enhance their overall trading experience.

Is Fancy Group Ltd a scam, or is it legit?

The latest exposure and evaluation content of Fancy Group Ltd brokers.

Fancy Group Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fancy Group Ltd latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.