Is Etiq Markets safe?

Business

License

Is Etiq Markets Safe or a Scam?

Introduction

Etiq Markets is a relatively new player in the forex market, established in 2016, and has positioned itself as a global trading platform offering various financial instruments, including forex, indices, and commodities. As the trading landscape becomes increasingly crowded, it is crucial for traders to conduct thorough assessments of their brokers. The potential for scams in the forex market is significant, leading to the necessity for traders to exercise caution and diligence when selecting a broker. This article aims to provide a comprehensive evaluation of Etiq Markets, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple credible sources and data points, employing a structured framework to analyze the broker's trustworthiness.

Regulation and Legitimacy

The regulatory framework within which a broker operates is one of the most critical factors in determining its safety and legitimacy. Brokers that are regulated by reputable authorities are typically subject to stringent oversight, which can provide a level of assurance to traders regarding the safety of their funds and the integrity of the trading environment.

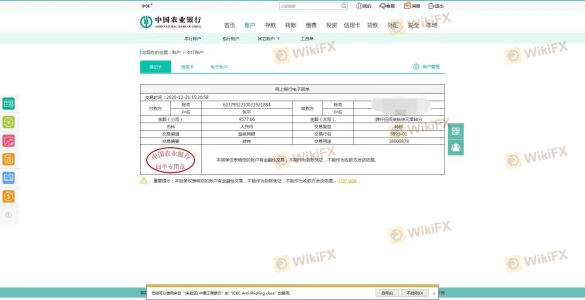

Etiq Markets claims to be regulated by the Canadian Financial Transactions and Reports Analysis Centre (FINTRAC) as a Money Services Business (MSB). However, it is essential to note that this type of regulation does not provide the same level of investor protection as that offered by more stringent financial authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINTRAC | M20312814 | Canada | Verified |

While FINTRAC registration indicates that Etiq Markets is recognized as a legitimate business entity, it lacks the robustness of oversight provided by top-tier regulators such as the FCA (UK) or ASIC (Australia). The absence of a more stringent regulatory framework raises questions about the safety of trading with Etiq Markets. Furthermore, the lack of historical compliance information and any notable regulatory actions against the broker adds to the uncertainty surrounding its legitimacy.

Company Background Investigation

Etiq Markets is owned by Etiq Global Markets Limited, a company that has been operating for approximately five to ten years. The company's headquarters is located in Kingston, Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. The management team behind Etiq Markets consists of professionals with varying backgrounds in finance and trading; however, detailed information regarding their qualifications and experience is not readily available.

The overall transparency of the company is somewhat limited. While it provides basic information about its services and operations, there is a noticeable lack of detailed disclosures regarding its ownership structure and the professional backgrounds of its key personnel. This opacity can be a red flag for potential traders, as it may indicate an unwillingness to provide the level of transparency expected from reputable brokers.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the fee structure and any potential hidden costs that could impact a trader's profitability. Etiq Markets offers a range of trading accounts with varying minimum deposit requirements. The trading costs associated with these accounts can significantly influence a trader's overall experience.

| Cost Type | Etiq Markets | Industry Average |

|---|---|---|

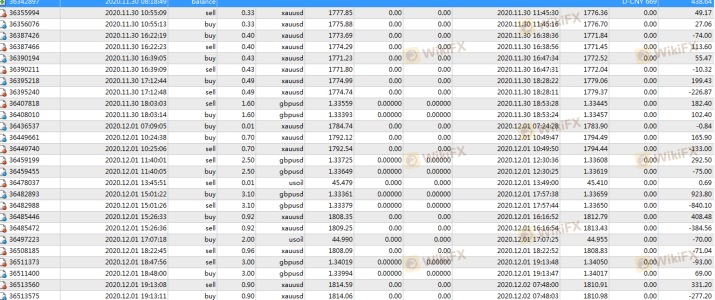

| Spread on Major Currency Pairs | 10 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The spreads offered by Etiq Markets are notably higher than the industry average, which could deter cost-sensitive traders. Additionally, the lack of clarity regarding any overnight interest rates or additional charges may lead to unexpected costs for traders. This lack of transparency in fees is a common concern among users and may be indicative of a less-than-ideal trading environment.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Etiq Markets claims to implement various security measures to protect client funds, including segregated accounts. However, the specifics of these measures are not extensively detailed on their website.

The broker does not provide clear information about investor protection schemes or negative balance protection policies, which are critical components in safeguarding traders' investments. The absence of these protections raises concerns about the potential risks involved in trading with Etiq Markets. Furthermore, there have been no reported incidents of fund misappropriation or security breaches, which is a positive sign, but the lack of a robust regulatory framework leaves clients exposed to risks that could be mitigated with better oversight.

Customer Experience and Complaints

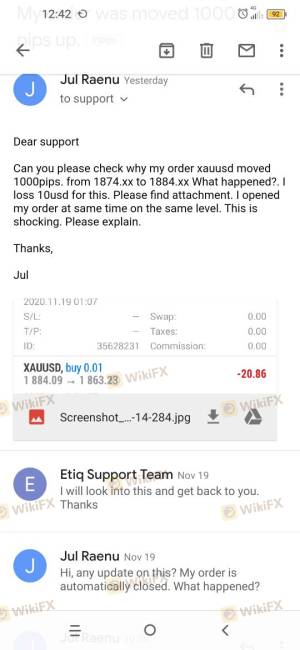

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of Etiq Markets reveal a mixed bag of experiences. Some users report satisfactory trading experiences, while others express concerns regarding the responsiveness of customer support and the withdrawal process.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Spreads | Medium | No acknowledgment |

| Poor Customer Support | High | Inconsistent |

Common complaints include delays in processing withdrawals and high spreads, which have led to frustration among traders. In some instances, users have reported difficulty in reaching customer support, indicating a potential area for improvement. These issues could suggest that while Etiq Markets may not be a scam, it may not provide the level of service that traders expect or deserve.

Platform and Trade Execution

The trading platform offered by Etiq Markets is primarily MetaTrader 4 (MT4), a widely recognized platform among traders for its user-friendly interface and robust features. However, the performance of the platform can vary, with some users reporting issues related to stability and execution quality.

Order execution quality is critical for traders, especially in a volatile market. While there have been no widespread reports of slippage or rejections, the high spreads could impact the overall trading experience. Traders should be cautious and ensure that they are comfortable with the execution quality before committing significant capital.

Risk Assessment

Using Etiq Markets carries several risks that potential traders should consider. The lack of stringent regulation, combined with high spreads and limited transparency, contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited oversight from weak regulators |

| Financial Risk | Medium | High spreads and unclear fees |

| Operational Risk | Medium | Potential issues with platform stability |

To mitigate these risks, it is advisable for traders to start with a demo account or a minimal investment to gauge the platform's reliability and customer service before committing larger sums of money.

Conclusion and Recommendations

In conclusion, while Etiq Markets does not appear to be a scam based on the available evidence, several factors warrant caution. The broker's regulatory status is less than ideal, with limited oversight and transparency. Additionally, high trading costs and customer service issues raise concerns about the overall trading experience.

For traders considering Etiq Markets, it is essential to weigh these factors carefully. If you prioritize regulatory safety and low trading costs, you may want to explore alternative brokers with stronger regulatory backing and better customer feedback. Some reputable alternatives include brokers regulated by top-tier authorities like ASIC or FCA, which typically offer more robust protections for traders.

In summary, is Etiq Markets safe? The answer is nuanced; while it may not be a scam, potential traders should approach with caution and conduct thorough research before engaging with the platform.

Is Etiq Markets a scam, or is it legit?

The latest exposure and evaluation content of Etiq Markets brokers.

Etiq Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Etiq Markets latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.