Is ECN PRO safe?

Business

License

Is ECN Pro A Scam?

Introduction

ECN Pro positions itself as a forex brokerage firm that caters to both retail traders and financial institutions, claiming to offer low spreads and a wide range of trading instruments. However, in the ever-evolving landscape of forex trading, traders must exercise caution when selecting a broker. The potential for scams and unreliable brokers is high, making it essential to conduct thorough research before committing any funds. This article aims to provide an objective analysis of ECN Pro, focusing on its regulatory status, company background, trading conditions, customer feedback, and overall safety. The findings are based on a comprehensive review of various sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. ECN Pro claims to operate from the United Kingdom; however, it lacks valid regulatory oversight from reputable authorities. This absence of regulation raises significant concerns regarding the safety of client funds and the operational transparency of the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight is a substantial red flag. Regulated brokers are required to adhere to strict guidelines that protect traders, such as maintaining segregated accounts for client funds and providing negative balance protection. ECN Pro's unregulated status means it is not subject to such protections, leaving traders vulnerable to potential losses without recourse. Furthermore, past reports have highlighted issues related to fund withdrawals, which further exacerbate concerns about the broker's reliability.

Company Background Investigation

ECN Pro was founded in 2009 and claims to provide a variety of trading services, including access to forex, stocks, and commodities. However, the companys ownership structure and management team remain largely opaque. There is minimal publicly available information regarding the backgrounds of its executives, which is concerning for potential clients seeking a transparent trading environment.

The company's website presents a professional image, but the lack of detailed disclosures regarding its operational history and management raises questions about its credibility. Transparency in a broker's operations is crucial, as it builds trust and assures clients that their funds are being managed responsibly. Without this transparency, traders may find themselves in a precarious position, particularly if they encounter issues with their accounts or withdrawals.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. ECN Pro advertises low spreads and a commission-free trading environment; however, the lack of verifiable data raises skepticism about these claims. Traders should be particularly cautious about any hidden fees that could significantly impact profitability.

| Fee Type | ECN Pro | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | <1 pip | 1.0 - 2.0 pips |

| Commission Model | None | $3 - $7 per lot |

| Overnight Interest Range | N/A | Varies by broker |

The above table indicates that while ECN Pro claims to offer competitive trading conditions, the absence of reliable information makes it difficult to assess the actual costs involved. Moreover, the possibility of hidden fees or unfavorable trading conditions could lead to unexpected losses for traders, emphasizing the importance of choosing a broker with a transparent fee structure.

Customer Funds Security

The security of customer funds is paramount in the forex trading landscape. ECN Pro does not provide adequate information regarding its fund protection measures. Without regulation, there are no guarantees that client funds are held in segregated accounts, which is a standard practice among reputable brokers.

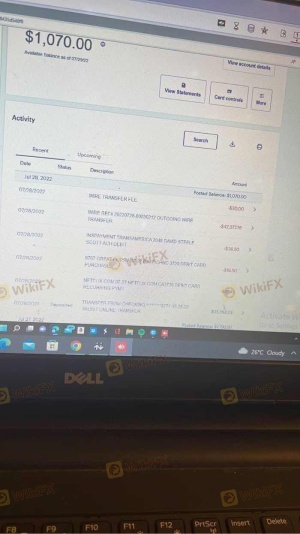

The absence of investor protection schemes further complicates the safety of funds. Traders need to be aware that in the event of the broker facing financial difficulties, their investments could be at risk. Additionally, there have been reports of withdrawal issues, with some users claiming that they were unable to access their funds after making deposits. These incidents raise serious concerns about the reliability of ECN Pro as a trading platform.

Customer Experience and Complaints

User feedback is a critical component of assessing a broker's reliability. In the case of ECN Pro, customer reviews are mixed, with several users reporting positive experiences regarding trade execution speeds and platform usability. However, a notable number of complaints focus on withdrawal issues and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Account Management | High | Inconsistent |

Typical complaints include difficulties in withdrawing funds, with some users alleging that their accounts were frozen or that they faced unreasonable delays. These issues are significant as they directly affect traders' ability to access their capital. The overall sentiment among users suggests that while the trading platform may function adequately, the lack of support during critical situations is a substantial drawback.

Platform and Trade Execution

The trading platform offered by ECN Pro is primarily MetaTrader 4, a widely recognized platform known for its user-friendly interface and extensive features. However, the platform's performance, stability, and execution quality are essential factors for traders, particularly those engaged in high-frequency trading strategies.

Reports indicate that while the platform generally performs well, there have been instances of slippage and order rejections during volatile market conditions. Such occurrences can significantly impact trading outcomes, particularly for scalpers and day traders who rely on precise execution. The absence of evidence pointing to platform manipulation is a positive aspect, but the reported issues with execution quality warrant caution.

Risk Assessment

Engaging with ECN Pro presents several risks that traders should carefully consider. The absence of regulation, coupled with the mixed reviews regarding customer service and withdrawal issues, paints a concerning picture of the broker's reliability.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight, increasing potential for fraud. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Reports of withdrawal difficulties. |

| Customer Service Risk | High | Slow response times to critical issues. |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. Additionally, it may be prudent to start with a smaller investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while ECN Pro presents itself as a competitive forex brokerage, the lack of regulation, transparency issues, and customer complaints indicate that it may not be a safe option for traders. The potential for withdrawal difficulties and inadequate customer support further exacerbates concerns about the broker's reliability.

Traders should exercise caution and consider alternative options that are well-regulated and have a proven track record of customer satisfaction. Some reputable alternatives include brokers like IC Markets, Pepperstone, and FXPro, which offer robust regulatory frameworks, transparent trading conditions, and reliable customer support.

In summary, if you are considering trading with ECN Pro, it is essential to weigh the risks carefully and remain vigilant about the potential for issues related to fund security and customer service. Always prioritize safety and transparency in your trading endeavors.

Is ECN PRO a scam, or is it legit?

The latest exposure and evaluation content of ECN PRO brokers.

ECN PRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ECN PRO latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.