Is Dask Finance safe?

Business

License

Is Dask Finance Safe or Scam?

Introduction

Dask Finance is a relatively new player in the forex market, positioning itself as an online broker offering a wide range of trading instruments, including currency pairs, cryptocurrencies, and commodities. As the forex market continues to grow, it attracts a diverse array of brokers, some of which may not adhere to the highest standards of regulation and transparency. This makes it crucial for traders to carefully evaluate the legitimacy and safety of any forex broker before committing their funds. In this article, we will investigate whether Dask Finance is a safe trading option or if there are potential red flags that traders should be wary of. Our analysis will be based on a comprehensive review of Dask Finance's regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. Dask Finance claims to operate under a regulatory license from the National Futures Association (NFA) in the United States. However, upon further examination, it has been revealed that Dask Finance is not listed as a member of the NFA, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0547768 | United States | Not Verified |

The lack of valid regulatory oversight is alarming, as it implies that Dask Finance operates without the stringent checks and balances that come with being regulated by a reputable authority. This absence of regulation can expose traders to a higher risk of fraud, mismanagement, and inadequate customer support. Furthermore, the suspicious nature of Dask Finance's claimed regulatory status suggests that it may not be fully compliant with industry standards. Traders should exercise extreme caution when dealing with unregulated brokers, as they often lack the accountability required to safeguard clients' interests.

Company Background Investigation

Dask Finance Limited was established in the United Kingdom, but specific details about its founding and ownership structure remain vague. The company appears to have been operational for only 1-2 years, which may not provide enough historical data for potential clients to assess its reliability. The lack of transparency regarding the company's management team and their professional backgrounds is concerning. A reputable broker typically discloses information about its leadership, including their qualifications and experience in the financial sector.

Moreover, the absence of clear information about the company's operations and the limited availability of customer support contact details raise questions about its commitment to transparency and client service. A well-established broker usually provides comprehensive information about its operations, including a clear outline of its services, fees, and trading conditions. In contrast, Dask Finance's lack of clarity may indicate an attempt to obscure critical information from potential clients.

Trading Conditions Analysis

When evaluating whether Dask Finance is safe, it is essential to consider the trading conditions it offers. Dask Finance imposes a relatively high minimum deposit requirement of $1,000, which can be a significant barrier for many traders, especially beginners. This is notably higher than the industry average, where many brokers require deposits ranging from $100 to $200.

| Fee Type | Dask Finance | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.0 pips | 1-2 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

While Dask Finance advertises spreads starting from 0.0 pips, the lack of clarity regarding its commission structure and overnight interest rates raises concerns. Traders should be cautious of brokers that do not provide transparent information about their fees, as hidden costs can significantly impact trading profitability. The absence of a well-defined fee structure may indicate potential issues with the broker's practices, further questioning whether Dask Finance is safe for trading.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Dask Finance claims to implement certain security measures; however, specific details about fund segregation, investor protection, and negative balance protection policies are not readily available. A reputable broker typically segregates client funds from its operational funds to ensure that clients' money is safeguarded in the event of insolvency.

Furthermore, the lack of information regarding any historical security issues or disputes raises alarms. Traders should be wary of brokers that do not have a clear track record of protecting client funds, as this could indicate potential vulnerabilities in their operational framework. The absence of robust security measures can expose traders to risks, making it imperative for potential clients to thoroughly investigate Dask Finance's practices before proceeding.

Customer Experience and Complaints

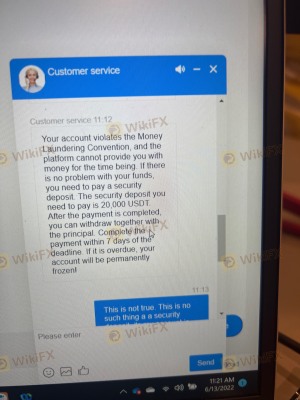

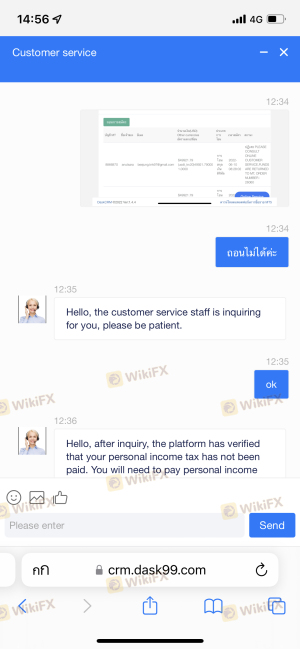

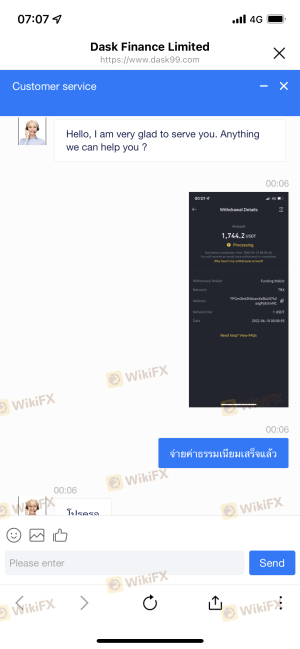

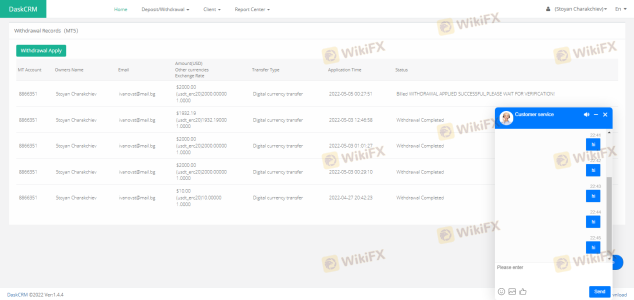

Analyzing customer feedback is crucial in determining whether Dask Finance is a reliable trading option. Reports from various sources indicate that clients have experienced significant issues with withdrawals, with some alleging that the broker has refused to process their requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| High Minimum Deposit Requirement | Medium | Neutral |

For instance, one trader reported that Dask Finance demanded an additional deposit before allowing a withdrawal, which raises serious concerns about the broker's ethical practices. Such complaints suggest a pattern of behavior that could be indicative of a scam, as legitimate brokers do not impose unreasonable demands on clients seeking to access their funds. The overall negative sentiment surrounding Dask Finance's customer service and responsiveness further reinforces the notion that potential clients should approach this broker with caution.

Platform and Trade Execution

The trading platform offered by Dask Finance is another critical aspect to consider. The broker provides access to the widely used MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, there are concerns regarding the platform's performance, stability, and overall user experience.

Traders have reported issues with order execution quality, including slippage and instances of rejected orders. These problems can significantly impact trading outcomes, particularly for those employing strategies that rely on precise execution. The potential for platform manipulation is another red flag, as brokers should provide a fair and transparent trading environment.

Risk Assessment

Overall, the risks associated with trading through Dask Finance appear to be elevated.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Numerous complaints about withdrawal issues. |

| Trading Conditions Risk | High | High minimum deposit and unclear fee structure. |

Given these risks, potential clients are advised to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the investigation into Dask Finance raises several concerns regarding its legitimacy and safety as a forex broker. The lack of regulatory oversight, vague company background, high minimum deposit requirements, and numerous customer complaints suggest that Dask Finance may not be a safe trading option. Traders should be particularly cautious of brokers that do not provide clear and transparent information about their operations and fees.

For those seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities, such as the FCA or ASIC, which offer better protection for client funds and a more transparent trading environment. Ultimately, the decision to engage with Dask Finance should be made with careful consideration of the potential risks involved.

Is Dask Finance a scam, or is it legit?

The latest exposure and evaluation content of Dask Finance brokers.

Dask Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Dask Finance latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.