Is CF safe?

Business

License

Is CF Safe or Scam?

Introduction

CF, a prominent player in the forex trading market, has garnered attention for its wide range of trading services and user-friendly platforms. As the forex market continues to expand, the need for traders to carefully evaluate their brokers has never been more critical. With numerous reports of scams and fraudulent activities in the industry, ensuring that your broker is legitimate and trustworthy is paramount. This article aims to investigate whether CF is a safe trading option or a potential scam. To achieve this, we will analyze CF's regulatory status, company background, trading conditions, customer fund safety, and user experiences, supported by data from credible sources.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial services industry, particularly in forex trading. A well-regulated broker is typically subject to stringent oversight, ensuring they adhere to the highest standards of financial conduct. In the case of CF, it is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is recognized as one of the most stringent regulatory bodies globally.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AGD 005 | Hong Kong | Verified |

The SFC's oversight means that CF must maintain sufficient capital reserves, keep client funds segregated from its operational funds, and provide transparent updates regarding client accounts. This regulatory framework is designed to protect traders from potential fraud and mismanagement. However, while CF is regulated by a reputable authority, it is essential to note that not all regulatory bodies are created equal. Traders should remain vigilant and ensure that their broker complies with all regulatory requirements.

Company Background Investigation

CF has been operational since 2005, establishing itself as a reputable broker in the forex trading landscape. The company is registered in Hong Kong and has a history of providing various financial services, including forex, commodities, and CFDs. Despite its longevity, there have been concerns about transparency regarding the company's ownership structure and management team.

The management team at CF consists of professionals with extensive experience in the financial industry, yet specific details about their backgrounds and qualifications remain limited. This lack of transparency can raise questions about the company's accountability and trustworthiness. A reputable broker typically provides comprehensive information about its leadership and operational history to build trust with potential clients.

In terms of information disclosure, CF maintains a relatively open communication channel with its clients, providing essential updates and insights. However, further improvements in transparency could enhance its reputation and instill greater confidence among traders regarding its legitimacy.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall value proposition. CF claims to offer competitive trading fees, but a closer examination reveals a more complex picture. The broker's fee structure includes spreads, commissions, and overnight interest rates, which can significantly impact a trader's profitability.

| Fee Type | CF | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.5 pips | 1-2 pips |

| Commission Model | Variable | $5 - $10 per lot |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1% |

While CF's spreads appear competitive, the variability in commissions can lead to unexpected costs for traders. Additionally, the overnight interest rates are on the higher side compared to industry averages, which could deter cost-sensitive traders. The complexity of the fee structure necessitates that traders conduct thorough research to understand the potential costs associated with trading on CF's platform.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. CF claims to implement robust measures to protect client assets, including segregated accounts and investor protection schemes. The SFC's regulatory framework mandates that client funds be kept separate from the broker's operational funds, providing an added layer of security.

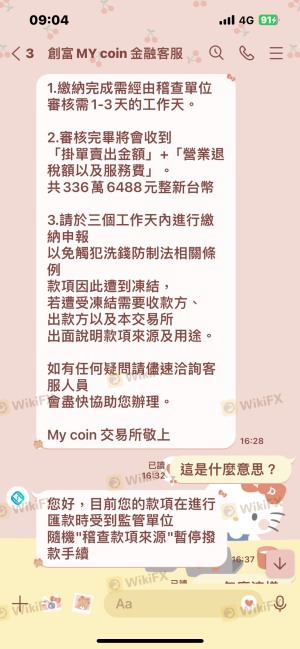

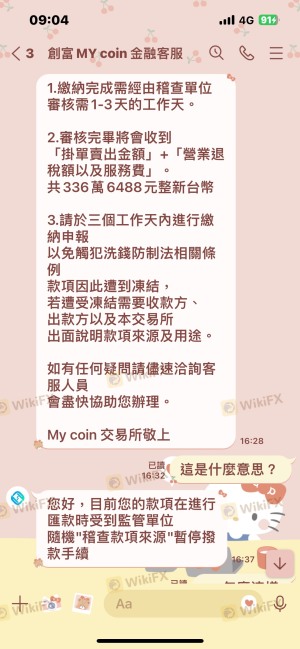

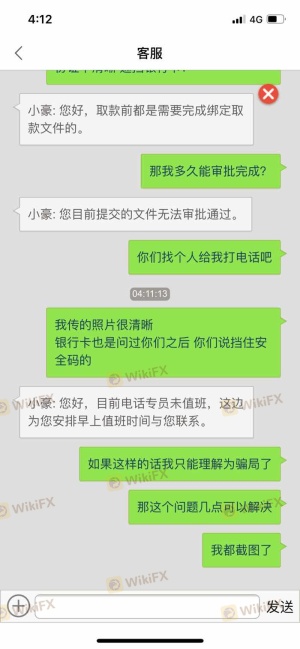

However, there have been reports of withdrawal difficulties and issues related to fund safety in the past. Some traders have expressed concerns about their ability to access funds, raising red flags about the broker's financial practices. While CF appears to have measures in place to protect client funds, the historical complaints regarding fund access highlight the need for caution when considering this broker.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's reliability. A review of user experiences with CF reveals a mixed bag of interactions. While some users report positive experiences and effective customer support, common complaints include withdrawal delays and communication issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Lack of Communication | Medium | Poor |

Numerous users have reported being unable to withdraw their funds, with some alleging that the broker employs tactics to delay or deny withdrawal requests. This pattern of complaints raises significant concerns about CF's commitment to prioritizing client interests. While the broker has made efforts to address these issues, the recurring nature of the complaints suggests that potential clients should exercise caution.

Platform and Trade Execution

The trading platform is a vital aspect of a broker's service offering. CF utilizes a proprietary trading platform that is generally user-friendly but has faced criticism regarding stability and execution quality. Users have reported instances of slippage and order rejections, which can severely impact trading performance.

Concerns about potential platform manipulation have also been raised, with some users claiming that the broker provides misleading information about their trading results. These issues further complicate the assessment of CF's reliability as a trading platform and warrant careful consideration from potential traders.

Risk Assessment

Engaging with CF presents various risks that traders should be aware of. The lack of transparency in certain areas, combined with historical complaints about fund access and withdrawal difficulties, contributes to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with mixed reviews |

| Financial Risk | High | Reports of withdrawal issues |

| Execution Risk | Medium | Issues with trade execution |

To mitigate these risks, it is advisable for traders to conduct thorough research, consider starting with a demo account, and maintain cautious trading practices. Engaging with a broker that has a solid reputation and transparent practices can significantly reduce the risk of encountering issues.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that while CF is regulated by a reputable authority, there are several red flags that indicate it may not be a completely safe trading platform. The lack of transparency, historical complaints regarding fund access, and mixed user experiences raise concerns about its reliability.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by top-tier authorities such as the FCA or ASIC provide a safer trading environment and better protection for client funds. Ultimately, traders should prioritize safety and due diligence when selecting a broker to ensure the security of their investments.

Is CF a scam, or is it legit?

The latest exposure and evaluation content of CF brokers.

CF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CF latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.