Is cbimful safe?

Business

License

Is cbimful A Scam?

Introduction

In the ever-evolving world of forex trading, brokers play a pivotal role in facilitating trades and providing traders with the necessary tools to succeed. One such broker is cbimful, which has emerged as a player in the forex market. However, with the increasing number of scams and fraudulent activities in the trading industry, traders must exercise caution when selecting a broker. This article aims to objectively analyze whether cbimful is a safe and legitimate broker or if it raises red flags that warrant concern. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when evaluating its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, cbimful lacks valid regulatory information, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

This absence of regulation means that cbimful operates without the oversight typically provided by reputable financial authorities. The lack of regulatory compliance is a major red flag, as it could expose traders to higher risks, including potential fraud or mismanagement of funds. Furthermore, the broker's operational scope has been described as suspicious, with warnings from various sources indicating a high potential risk associated with trading through cbimful.

Company Background Investigation

Understanding the company behind a forex broker is essential for assessing its credibility. cbimful reportedly operates out of China and has been in business for approximately two to five years. However, the lack of transparency regarding its ownership structure and management team raises concerns.

The absence of detailed information about the company's history and the qualifications of its management team further exacerbates the uncertainty surrounding cbimful. A reputable broker typically provides clear information about its founders, management experience, and operational history, which is crucial for building trust with potential clients. The lack of such information about cbimful suggests a need for caution, as it may indicate a lack of accountability and transparency.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. cbimful's fee structure and trading policies are essential components of this analysis. Reports indicate that the broker has an unclear fee structure, which can often hide additional costs that traders may not be aware of.

| Fee Type | cbimful | Industry Average |

|---|---|---|

| Spread on Major Pairs | Unspecified | Varies |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unspecified | Varies |

The lack of specific information regarding spreads, commissions, and overnight interest rates makes it challenging for traders to assess the overall cost of trading with cbimful. This ambiguity can lead to unexpected expenses, which could ultimately impact a trader's profitability. Moreover, if a broker's fees are not in line with industry standards, it may indicate potential exploitation of traders.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Traders must ensure that their investments are protected through adequate measures. Unfortunately, cbimful does not provide clear information regarding its fund safety protocols.

Without proper fund segregation and investor protection policies, traders may face significant risks. The absence of information about negative balance protection and investor compensation schemes raises concerns about the potential loss of funds. Additionally, any historical incidents related to fund security or disputes would further highlight the risks associated with trading with cbimful.

Customer Experience and Complaints

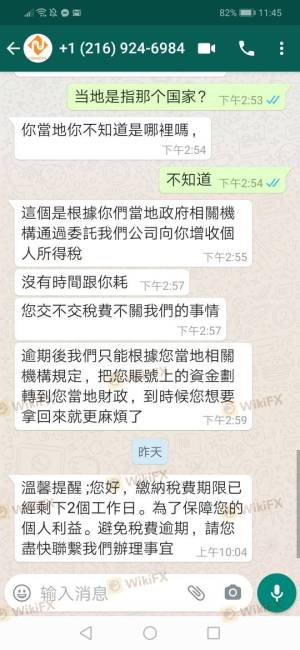

Customer feedback is a valuable resource for assessing a broker's reputation. Reviews and complaints can provide insight into the experiences of other traders and highlight potential issues. In the case of cbimful, there are indications of dissatisfaction among users, with common complaints revolving around withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Delays | Medium | Slow Response |

The severity of complaints related to withdrawal issues is particularly concerning, as it can indicate deeper operational problems within the broker. If traders are unable to access their funds, it raises serious questions about the broker's reliability and trustworthiness. Additionally, the company's slow response to customer inquiries further exacerbates the situation, suggesting a lack of commitment to customer satisfaction.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. Traders need a stable and efficient platform to execute their trades effectively. While specific details about cbimful's trading platform are limited, reports suggest that users have experienced issues with order execution, including slippage and rejected orders.

These execution problems can significantly impact a trader's ability to capitalize on market opportunities. If a broker's platform consistently fails to execute trades as intended, it can lead to frustration and financial losses for traders. Additionally, any signs of potential platform manipulation should be thoroughly investigated, as they can indicate unethical practices.

Risk Assessment

When considering whether cbimful is a safe broker, it's essential to evaluate the overall risk associated with trading through this platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Operational Risk | Medium | Lack of transparency |

| Customer Service Risk | High | Poor response to complaints |

The high regulatory risk associated with cbimful is a significant concern, as it indicates a lack of oversight that could expose traders to potential fraud. Furthermore, operational risks stemming from the broker's unclear policies and customer service issues further exacerbate the overall risk profile. Traders should approach cbimful with caution and consider alternative options to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that cbimful raises several red flags that warrant serious consideration. The lack of regulation, transparency, and poor customer feedback indicate potential risks for traders. While cbimful may offer trading services, the absence of oversight and the presence of unresolved complaints suggest that it may not be a safe choice for forex trading.

For traders seeking a reliable broker, it is advisable to explore alternatives that are well-regulated and have established a positive reputation in the industry. Brokers overseen by top-tier regulatory authorities, such as the FCA or ASIC, can provide a safer trading environment. Ultimately, conducting thorough research and due diligence is essential for ensuring the safety of investments in the forex market.

Is cbimful a scam, or is it legit?

The latest exposure and evaluation content of cbimful brokers.

cbimful Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

cbimful latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.