Regarding the legitimacy of BitDelta Pro forex brokers, it provides FSC and WikiBit, .

Is BitDelta Pro safe?

Software Index

Risk Control

Is BitDelta Pro markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

BitDelta Limited

Effective Date:

2024-05-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

6th Floor, The Core Ebene, Mauritius / 6th Floor, The Core Ebene, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is BitDelta Pro A Scam?

Introduction

BitDelta Pro is a relatively new player in the forex market, established in 2023, and operates under the company name Bit Delta Fintech Limited, based in Vanuatu. As the forex trading landscape becomes increasingly crowded, traders must exercise caution when selecting a broker. The potential for scams and unregulated entities is high, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective assessment of BitDelta Pro's credibility, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk. Our investigation is based on a comprehensive review of available information, including regulatory filings, user testimonials, and industry analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. For traders, regulation serves as a safety net, ensuring that the broker adheres to certain standards of conduct and offers a level of protection for client funds. Unfortunately, BitDelta Pro lacks regulation from recognized financial authorities. The broker claims to be regulated by the Financial Services Commission (FSC) in Mauritius; however, a search of the FSC's records reveals no evidence of such a license.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB24202926 | Mauritius | Not Found |

The absence of valid regulatory oversight raises significant concerns about the broker's legitimacy. Unregulated brokers are not subject to the same stringent requirements as their regulated counterparts, which can lead to issues such as fraud, market manipulation, and lack of transparency. This lack of oversight is alarming, especially for traders who may be unaware of the risks involved.

Company Background Investigation

BitDelta Pro is operated by Bit Delta Fintech Limited, which is incorporated in Vanuatu. The company is relatively new, having been founded in 2023, and there is limited information available regarding its ownership structure and management team. The lack of transparency surrounding the company's leadership and operational history adds another layer of concern for potential clients.

The management teams background is crucial in assessing the broker's reliability. However, there is minimal public information available about their professional experience or qualifications in the financial industry. This lack of insight into the team's expertise can be a red flag for traders looking for a trustworthy broker. Furthermore, the company's information disclosure practices appear to be lacking, making it difficult for potential clients to assess the broker's credibility.

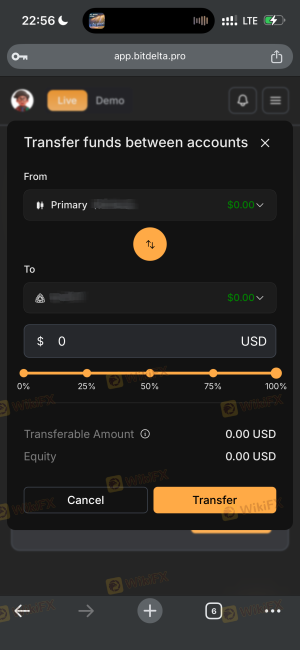

Trading Conditions Analysis

The trading conditions offered by BitDelta Pro include a variety of account types and a dynamic leverage of up to 1:500, which is attractive to many traders. However, the overall fee structure raises concerns.

| Fee Type | BitDelta Pro | Industry Average |

|---|---|---|

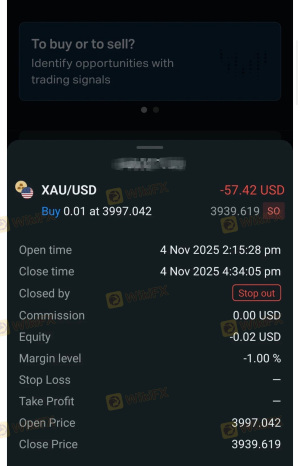

| Major Currency Pair Spread | 20 pips (Forex) | 1-2 pips |

| Commission Structure | Variable | Typically fixed |

| Overnight Interest Range | High | Moderate |

The spreads offered by BitDelta Pro are significantly higher than the industry average, which could eat into traders' profits, especially for those engaging in frequent trading. Additionally, the variable commission structure can be confusing and may not be favorable for all account types. Traders should be wary of any unusual fees that could arise, as they can impact overall profitability.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. BitDelta Pro claims to implement several security measures, including the use of advanced encryption and the separation of client funds from company assets. However, the lack of regulatory oversight means that these claims cannot be independently verified.

Traders should be aware of the risks associated with unregulated brokers, as they often lack investor protection mechanisms. For instance, if a broker goes bankrupt or engages in fraudulent activities, clients may have limited recourse to recover their funds. Moreover, there have been no reported incidents of fund security breaches or disputes, but the absence of a regulatory body raises questions about the broker's accountability.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any broker. A review of user experiences with BitDelta Pro reveals a mixed bag. Some users praise the platform's user-friendly interface and comprehensive customer support, while others express frustration over high spreads and slow withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow responses |

| High Spreads | Medium | No resolution |

| Lack of Transparency | High | No clear communication |

Common complaints include long wait times for withdrawals and a perceived lack of transparency regarding fees. While some users report satisfactory experiences with customer support, the overall sentiment suggests that the broker may need to improve its responsiveness and clarity regarding its policies.

Platform and Trade Execution

The trading platform provided by BitDelta Pro is based on the widely used MetaTrader 5 (MT5), known for its robust features and analytical tools. However, the execution quality and order fulfillment rates are critical aspects that need careful evaluation.

Users have reported varying experiences regarding order execution, with some experiencing slippage during volatile market conditions. The absence of any reported manipulation signs is reassuring, but traders should remain vigilant and monitor their trade executions closely.

Risk Assessment

Using BitDelta Pro comes with inherent risks, primarily due to its unregulated status and high trading costs.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | High spreads and commissions |

| Operational Risk | Medium | Limited company transparency |

To mitigate risks, traders should consider diversifying their investments and employing risk management strategies, such as setting stop-loss orders and limiting exposure to any single trade.

Conclusion and Recommendations

In conclusion, while BitDelta Pro presents itself as a versatile trading platform with a wide range of assets, the lack of regulation and transparency raises significant concerns about its legitimacy. The high trading costs and mixed customer feedback further complicate the decision for potential clients.

Traders should exercise caution and consider alternative, well-regulated brokers that offer similar trading conditions with greater security and reliability. If you are considering using BitDelta Pro, it is advisable to conduct thorough research and possibly seek out more established options in the forex market.

Is BitDelta Pro a scam, or is it legit?

The latest exposure and evaluation content of BitDelta Pro brokers.

BitDelta Pro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BitDelta Pro latest industry rating score is 4.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.